Since we are not required to access E-Filing website as human we tend to forget its Login Information & Password. So let see how you can retrieve login details step by step.

First you need to know that there is no option to recover forgot password, only option is to recover the same by providing certain information of taxpayer.

First to reset password click on following link:

https://incometaxindiaefiling.gov.in/e-Filing/Services/ForgotPassword.html

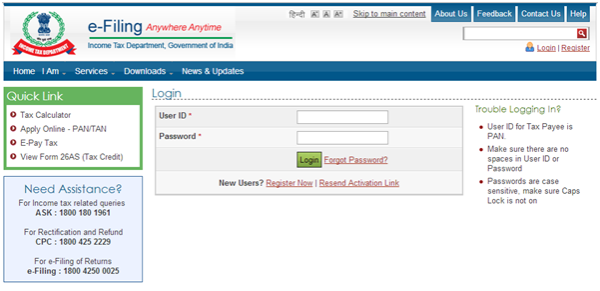

Also there is direct link below login button on main login page. By clicking on the same you will be directed to, see below screen shot:

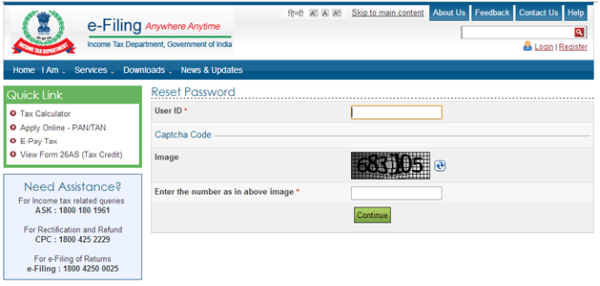

After you click there new window will get open as shown in below screen.

a. 1st in User ID mention your PAN

b. 2nd type number as mentioned in Capatcha

c. 3rd click on continue.

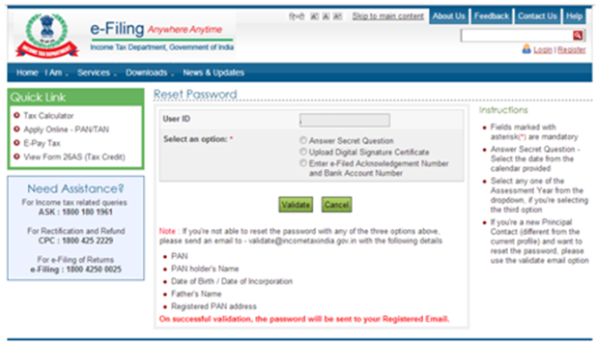

If your PAN is valid you will be taken to new window as shown in below screen. Mention again your PAN no. in User ID.

Now lets move forward for resting password.

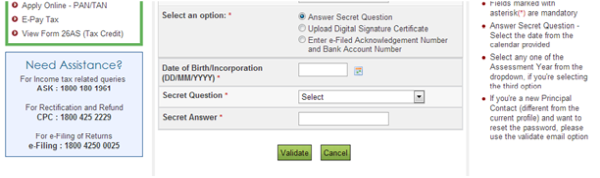

If you have never filed your E-Return before then you can reset password by selecting 1st option Answer Secret Question.

1. Select Answer Secret Question option

2. Mention date of birth

3. Select Your Secret Question

4. Mention Your Answer to secret Question

5. Click on validate button.

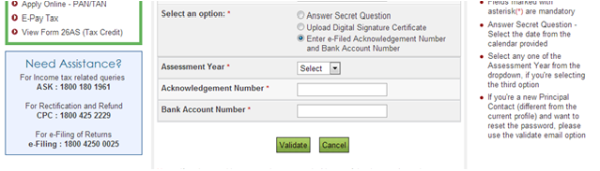

If you have forgot details of acknowledgement of last return file then you can reset password supplying relevant details as per screen shown below. You are required to provide following details:

1. Select Enter E-Filed acknowledgement number

2. Select Assessment year

3. Acknowledgement number

4. Bank A/c number mentioned in return filed

5. Click on validate button.

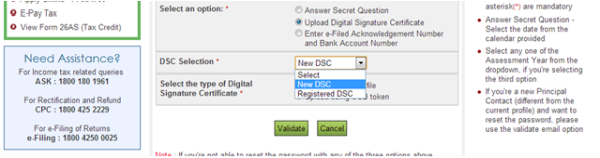

If you don’t remember secret Question & don’t have access to registered email ID then last option is to upload Digital Signature as shown below:

You have to select existing DSC or New DSC for registering new Digital Signature Certificate.

If you're not able to reset the password with any of the three options above,

Please send an email to - validate@incometaxindia.gov.in with the following details:

1. PAN

2. PAN holder's Name

3. Date of Birth / Date of Incorporation

4. Father's Name

5. Registered PAN address

Or you can call on call center:

For Income tax related queries

ASK: 1800 180 1961

For Rectification and Refund

CPC: 1800 425 2229

For e-Filing of Returns

e-Filing: 1800 4250 0025

Thanks//VaibhavJ

CAclubindia

CAclubindia