The CBIC has recently introduced Form PMT-09 for shifting wrongly paid Input Tax Credit. This enables a registered taxpayer to transfer any amount of tax, interest, penalty, etc. that is available in the electronic cash ledger, to the appropriate tax or cess head under IGST, CGST and SGST in the electronic cash ledger.

Hence, if a taxpayer has wrongly paid IGST instead of CGST, he can now rectify the same using Form PMT-09 by reallocating the amount from the IGST head to the CGST head.

Key Points Form PMT-09

• The amount once utilized and removed from cash ledger cannot be reallocated.

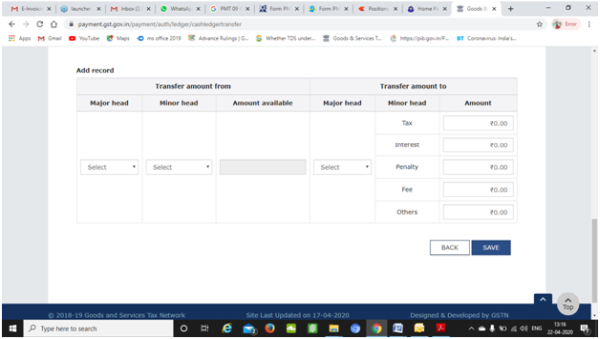

• Major head refers to- Integrated tax, Central tax, State/UT tax, and Cess.

• If the wrong tax has already been utilized for making any payment, then this challan is not useful. This challan only allows shifting of the amounts that are available in the electronic cash ledger.

The facility to use PMT-09 was made LIVE on the GST Portal on 21 April 2020.

Steps for PMT-09.

1) Log in to GST Portal

2) Click on Services

3) Click on Ledgers

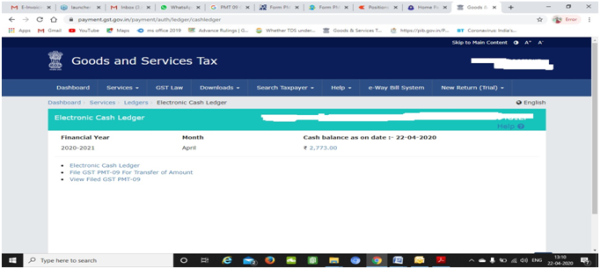

4) Click on Electronic Cash Ledger and below screen seen on GST Portal.

5) After that click on second option File GST PMT-09 for Transfer of Amount i.e. seen in 1st Screenshot.

Illustration:-

Mr. Vijay had to pay Rs.500 as Integrated tax under the major head and Rs.50 as interest under the minor head and he has wrongly paid Rs.50 under Integrated tax head and Rs.500 as interest under the minor head.

In this case, he can file PMT-09 to shift the amount from the minor head (i.e. interest) to the major head (i.e. integrated tax). This shifting of the amount can be done from major head to manor head as well.

An amount can also be transferred from one minor head to another minor head under the same major head.

For example, in the case of interchange of interest and penalty amount under State Tax can also be rectified by filing PMT-09.

CAclubindia

CAclubindia