Background

The Goods and Services Tax constitutional amendment having been promulgated by the Govt of India, the rollout of the GST Bill will be a collective effort of the Central and State Governments, the tax payers and the IT platform provider i.e. GSTN, CBEC and State Tax Departments. Besides these main participants there are going to be other stakeholders e.g. Central and States tax authorities, RBI, the Banks, the tax professionals (tax return preparers, Chartered Accountants, Tax Advocates, STPs etc.), financial services providing companies like ERP companies and Tax Accounting Software Providers etc.

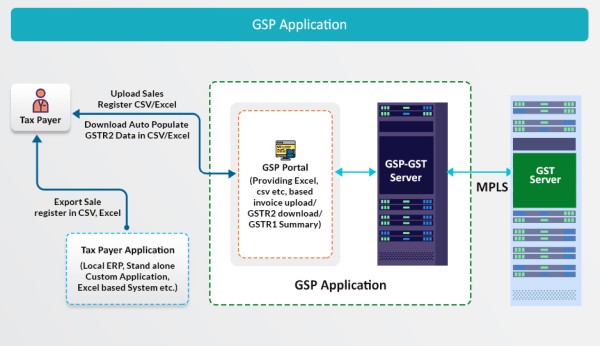

The GST System is going to have a G2B portal for taxpayers to access the GST Systems, however, that would not be the only way for interacting with the GST system as the taxpayer via his choice of third party applications, which will provide all user interfaces and convenience via desktop, mobile, other interfaces, will be able to interact with the GST system. The third party applications will connect with GST system via secure GST System APIs. All such applications are expected to be developed by third party service providers who have been given a generic name, GST Suvidha Provider or GSP. The GSPs are envisaged to provide innovative and convenient methods to taxpayers and other stakeholders in interacting with the GST Systems from registration of entity to uploading of invoice details to filing of returns. Thus there will be two sets of interactions, one between the App user and the GSP and the second between the GSP and the GST System. It is envisaged that App provider and GSP could be the same entity. Another version could where data in required format directly goes to GSP-GST Server. The diagram below gives the most generic case.

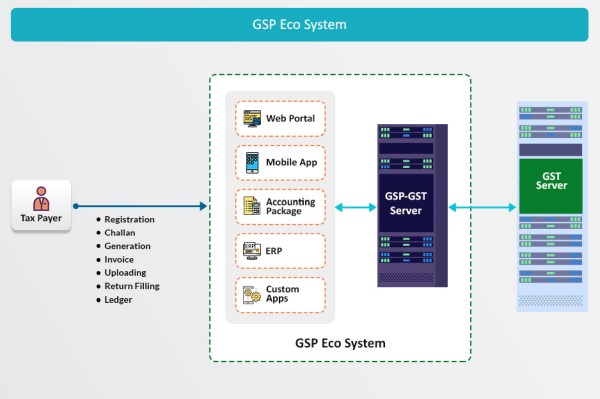

In the evolving environment of the new GST regime it is envisioned that the GST Suvidha Providers (GSP) concept is going to play a very important and strategic role. It is the endeavour of GSTN to build the GSP eco system, ensure its success by putting in place an open, transparent and participative framework for capable and motivated enterprises and entrepreneurs.

Concept

It is expected that the GSPs shall provide the tax payers with all services mentioned above in addition to maintaining their individual business ledgers (sales ledger and purchase ledger) and other value added services around the same. Another important service expected from GSPs is the automatic reconciliation of purchase made and entered in the purchase register and data downloaded in the form of GSTR-2 from the GST portal. In additional there will be sector-specific or trade specific needs which the GSPs are expected to fulfil. The conceptual diagram depicting the same is as given below.

While the GST System will have a G2B portal for taxpayers to access the GST System there will be a wide variety of tax payers (SME, Large Enterprise, Small retail vendor etc.) who will require different kind of facilities like converting their purchase/sales register data in GST compliant format, integration of their Accounting Packages/ERP with GST System. Similarly, the specific needs of an industry or trade could be met by GSP. In short, the GSP can help the taxpayers in GST compliance through their innovative solutions.

Design & Implementation Framework

Tax payer's convenience will be a key in success of GST regime. The tax payer should have a choice to use third party applications which can provide varied interfaces on desktops, laptops and mobiles and can connect with GST System. The GSP developed apps will connect with the GST system via secure GST system APIs. Majority of GST system functionalities related to taxpayer's GST compliance requirements shall be available to the GSP through APIs. GSPs may use GST APIs and enrich and enhance the tax payer's experience. (The APIs of GST System are RESTful, json-based and stateless). GST System will not be available over the Internet for security reasons.

The production API endpoints can only be consumed via MPLS lines. All APIs will be accessed over HTTPS protocol. The benefits of API based integration are:

- Consumption across technologies and platforms (mobile, tablets, desktops, etc.) based on individual requirements.

- Automated upload and download of data.

- Ability to adapt to changing taxation and other business rules and end-user usage models.

- Integration with customer software (ERP, Accounting systems) that taxpayers and others are already using for their day to day activities

The detail implementation framework can be perused on this website at GSP Implementation Framework

The selection process for applicants of GST Suvidha Providers (GSP) have been concluded in the three batches so far. GSTN has on-boarded these GSPs basis a selection process that involved evaluating their financial ability and IT capability to deliver the necessary services to tax payers for becoming GST compliant in the new GST regime. Businesses may avail of the services of the GSP as per their need.

The list of GST Suvidha Provider (GSP) already selected and enlisted by GSTN is given below. Taxpayers who need to avail of the services of GSPs may contact them.

Guidelines for GSPs and ISPs to Integrate with GST System

GSP will need to connect to GST System through telecom service providers (ISP). The GSP may choose and partner with one or more ISP to integrate with GST System. Please refer the guidelines and methodology for the integration document for further details.

Empanelled GSP: Click Here

Empanelment Process: 4th GSP Batch

The 4th Batch of GSPs shall be onboarded as per following steps.

1- Registration for the prospective applicants for GSP batch-4 will be available on the GSTN website till 11th Apr 2021.

2- Click here to know the Eligibility Criteria for GSP 4th Batch.

3- GSTN will scrutinise the financial criteria documents of the applicants based on the pre-qualification criteria published. The financial balance sheets and document verification of the shortlisted applicants shall be carried out internally and those who meet the criteria shall be called for technical evaluation.

4- The technical demonstrations and evaluations of the qualified applicants shall be scheduled by GSTN. A panel of members of GSTN shall evaluate the technical capability of applicants based on criteria and marks that are already published.

5- GSTN shall publish and declare the results of the selected GSPs on GSTN website, on completion of the evaluation.

6- Legal agreements will be signed between GSTN and all the applicants who are found to have qualified as GSPs.

After the legal agreements have been signed, the empanelled GSPs will be integrated with the GST System and also be provided API access to the e-Way bill system and the e-invoice system (IRP).

Please click here to register

"For further inquiries, questions or concerns, please feel free to contact us at ecosystem@gstn.org.in"

CAclubindia

CAclubindia