The world was functioning normally as it used to be around 4 months back. But, all of a sudden everything changed! Earth closed down! Businesses were shut! People suffered! And in a snap of a finger, health was placed above all other things! All these were because of a small virus which could not even be seen with naked eyes, the CORONA virus or COVID-19. A pandemic that shook the world and made humans realise even the largest weapons or ammunitions cannot save from the nature's power.

Alike world, India also implemented lockdown and the businesses were shut for about 2 months due to pandemic situation. Businesses faced lots of problems which include losses, cash flow crunch, loss of assets and increase in liabilities due to its closure.

To add up, GST law also has some implications which has come to limelight in the present situation. One of such issues is blockage of Input Tax Credit ('ITC') on goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples.

There are certain businesses whose goods are perishable and due to lockdown, such goods may be deteriorated. The debate is that whether Section 17(5)(h)of the Central Goods and Services Tax Act, 2017 ('CGST Act') is a Bermuda Triangle which gulps the ITC on such goods? If so, whether the businesses which are already on the sinking ship be a prey to this Bermuda Triangle and vanish?

By this article, I will try to put up some light on certain aspects of Section 17(5)(h) of the CGST Act.It might not solve the mystery, but instead add up some points for discussion.

Facts:

The facts which led to panic are as follows:

1) The businesses were severely affected due to lockdown and the normal economic cycle was disturbed. The cash flow blockage was a major hit.

2) Due to sudden lockdown measures, businesses could not do the necessary packing to the goods which were delicate and fragile.

3) There were businesses who dealt with perishable goods such as food industry, textile and leather industries, pharmaceutical industry, fisheries, chemical industry, etc. Due to lockdown, they could neither issue such goods for further processing nor sell them; this led to expiry or obsolescence of such goods.

4) Businesses had to face losses as proportion of reusable goods was very less.

5) In addition to the above facts, provision in GST Law which is restricting ITC on goods which are destroyed or written off added to the woes of businesses.

Businesses are now completely broken down and struggling to get back to normal cycle.

The first 4 points are unavoidable, but what about the 5th point. Is there any chance to neutralise the provision and reduce the woes of businesses? To answer that we shall analyse the legal provision first.

Legal Provision:

The CGST Act provides for specific situations wherein ITC on specific goods or services are restricted even though used in the course or furtherance of business. Section 17 of the CGST Act deals with apportionment of credit and blocked credit. Extract of Clause (h) to Sub Section (5) of Section 17 is as follows:

'Notwithstanding anything contained in sub-section (1) of section 16 and Sub Section (1) of section 18, input tax credit shall not be available in respect of the following, namely:

………

(h) goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples; and

…….. "

Analysis of Legal Provision

On the plain reading of Sub Section (5) of Section 17 as extracted above, we can understand that this Sub Section restricts the ITC on the goods or services or both listed in the clauses followed. In order to understand the clause better, there are 5 very important phrases which needs to be analysed:

a) Non-Obstante Clause:

The said Sub Section, starts with 'Notwithstanding anything contained in'. We can understand the said Sub Section is a 'Non-Obstante Clause' which means this clause empowers the Sub Section to override the effects of any other legal provisions contrary to it. Meaning, Sub Section (5) of Section 17 overrides Sub Section (1) of section 16 and Sub Section (1) of section 18. So, we can concur upon the fact that ITC on such supplies will be restricted even though the supply of goods or services or both are used or intended to be used in the course or furtherance of business.

b) Available in respect of the following, namely:

The Sub Section ends with the wordings 'available in respect of the following'. The said expression was examined by Supreme Court in the case of State of Madras Vs M/s Swastik Tobacco Factory [AIR-1966 SC-1000] where it was held that the expression 'in respect of' would mean 'on the goods'. Thus, by this we can understand that the ITC has to be restricted only on the goods on which ITC has been availed. Further, the word 'namely' imports enumeration of what is comprised in the preceding clause. In other words, it ordinarily serves the purpose of equating what follows with the clause described before. Thus, no meaning other than that which is enumerated in the clauses can be assigned to the same.

c) Destroyed:

The very important term on which the whole idea of Bermuda Triangle lies upon is 'Destroy'. The terms, 'destroy' or 'destroyed' has not been defined in the CGST Act.In such case, the primary rule of Statutory Interpretations which is 'Literal Rule of Interpretation' is applied. As per the said rule, Courts interpret statutes in a literal and ordinary sense. They interpret the words of the statute in a way that is used commonly by all and use the grammatical meaning.

So, as per general understanding, the word 'destroy' means damage done to anything by means of external force due to which said thing becomes unusable or no longer exists. As per Oxford Dictionary, the term 'Destroy' is defined as 'to damage something so badly that it no longer exists, works, etc.' Thus, by plain reading of the definition, which says 'to damage', which concurs with the view thatan external force is required to do damage.

d) Written off:

Similarly, 'written off' is not defined in the act and the 'Literal Rule of Interpretation' shall be applied.

As per general understanding, the term 'write off' means to cancel or to derecognise an asset or liability with an intent to recognise loss or profit on the same. As per Oxford Dictionary, it means to cancel a debt; to recognize that something is a failure, has no value, etc.' Thus, it can be understood that, an asset or liability which has no value is written off.

e) Disposed of:

The clause (h) to Sub Section (5) of section 17 explicitly covers 2 means of disposal which are disposal by way of gift or free samples. All other forms of disposal are covered under clause (83) to section 2 which is definition of 'Outward Supply'.

Thus, by reading the whole analysis in a harmonious manner, it can be concurred that ITC on supply of the goods on which ITC has been availed which are destroyed or written off or disposed by way of gifts or free samples is blocked or restricted. There is no doubt regarding services as the clause specifically covers goods and not services. Thus, there is no need to reverse ITC on input services but only in case of input goods and capital goods. Further, let us try to apply the analysis on the facts.

Application of analysis on facts (Author's view)

As explained earlier, the terms destroy, written off and disposed are to be understood in true sense in order to come to a conclusion.

Destroy:

The term, 'destroy' as explained earlier in para (c) is through external means or forces. In other words, if destruction needs to be carried on, it has to be through some medium such as fire or water or explosion or even by breaking it. When goods are deteriorated or outdated by their internal composition or by their inherent nature, it cannot be held that such goods are destroyed. There is a very thin line of difference between destroy and deteriorate, yet they are not the same. The term 'deteriorate' is defined as per Oxford Dictionary as 'to become worse'.In the present scenario, goods which are blocked in godowns or factories or shops are deteriorated or outdated or expired due to the fact that such goods could not be either processed or sold but in my opinion are not destroyed per se.

Written off:

The unused inventory may be written off in the books of account. No doubt, the ITC on such goods are to be reversed back. But, in present case, doubt may arise whether ITC on inventory which has been written off partially or provision for writing off has been made, also needs to be reversed back. In erstwhile Rule 3(5B) of CENVAT Credit Rules, scope of 'write off' included full write-off, partial write-off and also provision to write off. However, no such explicit quotation is present in GST law. Further, as explained in para (b), only the ITC on goods which are written off fully is to be denied. In case of partial write off or provision to write off, it cannot be held that the goods are written off and thus ITC on such goods is to be allowed completely.

Further, it is also interesting to observe that terms destroy and disposal by way of gift or free samples are actions and write off is just a book entry. Write-offs typically happen when inventory becomes obsolete, spoils, damaged in transit, market price has fallen or is stolen or lost. Thus, write off is just recording of the action and not an action itself. Since the same clause contains specific actions such as lost, stolen, destroyed or disposed of by way of gifts or free samples, by applying the Rule of Harmonious Construction, it can be understood that write off on account of the said reasons may be considered. In other words, it may also be constructed that write off might not include writing off due to obsolescence or damage. Further, after write off, the inventory may even be disposed of as scrap or for lower value where ITC may be available. Thus, clarification on this aspect is awaited from the Government.

Disposed:

Further, the goods which are deteriorated can further be disposed of for no value or sold as scrap. There may be chances where such goods are sold to other businesses at lower price. As explained in para (e), disposal by any other means except gifts or free samples is qualified to be an outward supply and ITC cannot be denied on the same.Even though this Sub Sectionhas a overriding clause as explained in para (a), that arises only in case of contrary provisions. Clause (h) covers disposal by way of gifts or free samples and 'outward supply' as per section 2(83) is very clear on coverage of all types of disposals. Thus, the goods which are deteriorated can be disposed of by means other than gift or free samples and ITC cannot be denied by the department, since disposal is in the course or furtherance of business where ITC is available as per Section 16(1).

Government's view:

However, in some cases goods might have to be destroyed due to certain circumstances and ITC on such goods should be reversed back as the section explicitly provides for the same. Further, your attention is drawn to Circular No. 72/46/2018-GST, wherein Government has clarified the procedure to be followed in respect of return of time expired drugs or medicines. The Government has provided 2 options to the taxpayers.

• It can either be treated as reverse supply wherein the manufacturer who destroys the goods shall reverse the ITC on the reverse supply and not on manufacture of the same; or

• It can be returned though credit note wherein manufacturer who destroys shall reverse back the ITC attributable to manufacture of such goods.

As may be observed, Government has given 2 diverse views in the same clarification on reversal of ITC on manufacture of goods. These contrary views create confusion in the minds of taxpayers. These clarifications hold good even for other businesses as well where the manufacturer takes back the goods in case of expiry.

Further, as per the facts, there may be 2 situations:

i) A manufacturer purchases raw materials on which ITC has been claimed and manufactures finished goods.

ii) A trader purchases goods and has claimed ITC on such inward supplies.

Manufacturer of goods:

There may be situations where the manufacturer either manufactures perishable goods or buys perishable raw materials or both. We will try to draw an analogy of each combination.

|

Particulars |

Treatment |

|

Perishable Raw Materials |

Raw materials which are perished due to lockdown can either be disposed of or destroyed. If it is destroyed, then ITC shall be reversed but in any other case, ITC will be available. |

|

Perishable Finished Goods |

Finished goods which are perished can either be disposed of or destroyed. In either case, ITC shall be made available by virtue of para (b). The logical conclusion is that goods on which ITC has been claimed is not destroyed but the goods by using raw materials on which ITC has been claimed has been destroyed. |

Trader:

In case of a trader, full ITC claimed would be on respect of goods purchased. Hence, similar to perishable raw materials explained above, if goods are destroyed, then ITC shall be reversed and in any other case, ITC can be claimed.

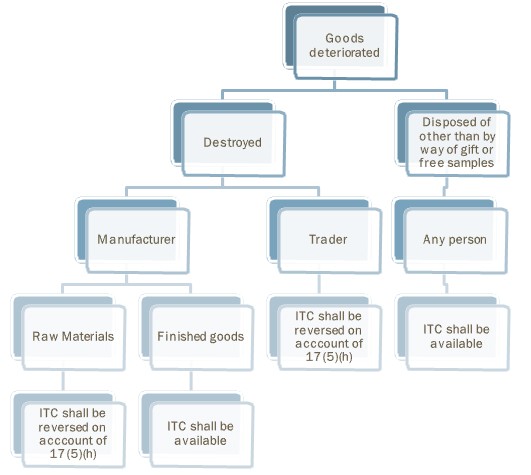

To summarize a decision tree may be depicted as follows:

Conclusion

The blockage of ITC depends on various factors. Infact, many businesses are facing the problem of deterioration of goods due to lockdown. ITC need not be reversed due to the single fact that the goods are deteriorated or expired but instead what will be the further process is the key factor. If such goods are disposed of other than by way of gifts or free samples, or sold as scrap, then reversal of ITC is not required. Further, in case of write off, clarity is required regarding write off on what account should be considered for reversal.GST Law has been subject to frequent changes since its inception and many issues continue to arise on account of varying interpretations on several of its provisions. There may be contrary decisions which arise due to changing circumstances or Governmental notifications on the same. However, the sword hangs on. These matters need to be settled by judicial decisions.

Businesses need to plan adequately on this aspect and treatment of such goods need to be optimised and thereby increase their chances of getting away from the clutches of Section 17(5)(h), the Bermuda Triangle. As crores of rupees are blocked in the said aspect, only time will answer whether section 17(5)(h) actually turns out be a Bermuda Triangle or whether an escape route is made available.

Disclaimer

All the views are based on judgement applied on the matters as on date. Clarification on the said aspect is awaited in near future as per the GST Council decision which would be held in the month of June 2020.The opinion expressed herein are purely author's view and understanding. The author is not responsible for any liability or damages arising out of adoption of the said opinion as ground for litigation by the taxpayers. Readers are advised to take due caution and expert's opinion before taking this ground.

CAclubindia

CAclubindia