There is so much hullabaloo about the applicability of Goods and Service Tax on freight charges paid to the Goods Transport Agency (GTA). Is chargeability of tax on the freight charges a new concept? To my mind, certainly not. This service, i.e, 'the taxable services provided or agreed to be provided by a goods transport agency in respect of transportation of goods by road, where the person liable to pay freight' is the person liable to pay Service Tax on Reverse Charge Mechanism (for brevity, hereinafter referred to as RCM), was also prevalent in the erstwhile Service Tax Law. On the same grounds and on the same footings this service is also made taxable in the current regime, i.e, GST regime but widening the scope of its taxability. How, let us analyze.

The biggest change that has occurred in the current regime of GST with regard to the freight charges vis-à-vis the erstwhile Service Tax Law is that in the erstwhile law the Sole proprietors (For brevity, hereinafter referred to as SP), HUF and BOI were not liable to pay Service Tax on RCM basis on the freight expenses incurred by them, whether registered or not, provided they were not registered under the Excise Law.

But in the Current Regime, i.e, under the GST law, besides other specific entities, all such entities i.e, the SP, HUF and BOI, if registered under the GST regime and incur the Freight expenses to the GTA in their books of accounts are liable to pay GST to the Government by virtue of RCM under GST regime (Notification No. 13/2017-Central Tax Rate, Entry No. 1). Hence, the scope of taxability of GST on freight charges is expanded, broadened and widened, covering entirely the whole gamut of the GST registered persons.

Now, the question that needs to be answered is, are all freight charges incurred subject to tax under GST regime? Are there any exemptions to it? What is the rate of tax that needs to be paid? Can the Input Tax Credit for the tax so paid be claimed and so on?

Before answering to all such questions let us understand what the law speaks about the taxability of GST on the freight expenses incurred by the business persons.

Sec 9(3) of the CGST Act, 2017 and Sec 5(3) of the IGST Act, 2013 states that the Government may specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both.

There are two such notifications that has been notified by the Government on the recommendations of the Council so far, where in the GST is to be paid by the Recipient on the supply of such goods or services or both on which tax is to be paid on RCM basis.

a) Notification No. 4/2017-Central Tax Rate dated 28th June, 2017, which specifies the list of GOODS on which GST is to be paid by the recipient on purchase of such Goods.

b) Notification No. 13/2017-Central Tax Rate dated 28th June, 2017, specifies the list of such SERVICES on which GST is to be paid by the recipient on purchases of such Service.

Entry No. 1 of Notification No. 13/2017-Central Tax Rate dated 28th June, 2017 states that the whole of Central Tax leviable under sec 9 of the CGST Act, 2017 shall be paid on reverse charge basis by the recipient of the supply of service by a Goods Transport

Agency (GTA) in respect of transportation of Goods by road to:

(a) any factory registered under or governed by the Factories Act, 1948 (63 of 1948);

(b) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any other law for the time being in force in any part of India;

(c) any co-operative society established by or under any law;

(d) any person registered under the Central Goods and Services Tax Act or the Integrated Goods and Services Tax Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act; or

(e) any body corporate established, by or under any law; or

(f) any partnership firm whether registered or not under any law including association of persons;

(g) any casual taxable person

Further, Explanation (a) to the said notification states that the person who pays or is liable to pay freight for the transportation of goods by road in goods carriage, located in the taxable territory shall be treated as the person who receives the service for the purpose of this notification

Hence, it can be concluded that only all the above categories of recipients who pay freight to the GTA are subject to payment of GST on RCM basis on freight and all other categories are exempt from the provision of RCM on freight. Who are other recipients that are exempted? To my mind, such other recipients would be:

a) Unregistered SP, HUF and BOI

b) Non Resident Taxable Person.

In such cases it is the Goods Transport Agency who will be liable to pay GST on forward charge basis.

Now the question arises that are all freight expenses incurred to the GTA subject to charge on RCM basis. Let us further understand this concept.

The notification as aforementioned says that only the supply of service by a Goods Transport Agency (GTA) in respect of transportation of Goods by road is subject to payment of GST on RCM basis. Hence, it becomes very pertinent to understand who is a 'Goods Transport Agency'.

As per clause (ze) of Para 2 of the Service Exemption Notification No. 12/2017-Central Tax Rate,

'Goods Transport Agency means any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called'. (This definition is the same as earlier definition under Service Tax Law -Sec 65B(26) of Finance Act, 1994).

Thus essential requirement to pay the GST on RCM on freight charges incurred are:

a) Services must be in relation to transportation of goods by road,

b) Such Services must have been provided by a GTA AND

c) The GTA must have issued a consignment note, by whatever name called, for the supply of such service.

Hence, can it be inferred that only the person who issues a consignment note for the transportation of goods by road is a GTA. But why is consignment note such an integral part of the supply of service by GTA? Can we say that consignment note is nothing but a document of title to the goods? Whoever presents (the consignee) such document of title to the goods to the transport agency will be entitled to receive the goods from the GTA. Therefore, it becomes very pertinent for the GTA to issue a consignment note to entitle the consignee to receive the goods from him. Hence, this document gives the right to the legal owner of the goods to claim the goods from the GTA.

And henceforth, the contents of the consignment note is also prescribed by the law by virtue of sub rule (3) Rule 54 of the Central Goods and Service Tax Rules, 2017, which is produced verbatim as under:

'Where the supplier of taxable service is a goods transport agency supplying services in relation to transportation of goods by road in a goods carriage, the said supplier shall issue a tax invoice or any other document in lieu thereof, by whatever name called, containing the gross weight of the consignment, name of the consigner and the consignee, registration number of goods carriage in which the goods are transported, details of goods transported, details of place of origin and destination, Goods and Services Tax Identification Number of the person liable for paying tax whether as consigner, consignee or goods transport agency, and also containing other information as mentioned under rule 46'.

But still the ambiguity lies in the mind on how to differentiate between the GTA and other truck operators. In order to remove this ambiguity, let us en route to the provision of Sec 93 of the Motor Vehicles Act, 1988 wherein it is very clearly stated that

No person shall engage himself-

i. as an agent or a canvasser, in the sale of tickets for travel by public service vehicles or in otherwise soliciting custom for such vehicles, or

ii. as an agent in the business of collecting, forwarding or distributing goods carried by goods carriages, unless he has obtained a licence from such authority and subject to such conditions as may be prescribed by the State Government'.

Hence, it can be inferred that the concept of Goods Transport Agency has sourced from here. It can be deciphered that GTA is any person who wants to engage himself in the business of collecting, forwarding or distributing goods carried by goods carriages as an agent and such persons are required to get himself registered as Goods Transport Agent under sec 93 of the Motor Vehicles Act, 1988. (Are these registrations actually taking place, I wonder?)

Before proceeding further, it also becomes pertinent to understand the meaning of goods carriages, common carriers and goods receipt note.

As per sec 2(14) of the Motor Vehicles Act, 1988, Goods Carriage means any motor vehicle constructed or adapted for use solely for the carriage of goods, or any motor vehicle not so constructed or adapted when used for the carriage of goods;

As per sec 2(a) of The Carriage By Road Act, 2007, common carrier means a person engaged in the business of collecting, storing, forwarding or distributing goods to be carried by goods carriage under a goods receipt or transporting for hire of goods from place to place by motorized transport on road for all persons indiscriminatingly and includes a goods booking company, contractor, agent, broker and courier agency engaged in the door-to-door transportation of documents, goods or articles utilizing the services of a person, either directly or indirectly, to carry or accompany such documents, goods or articles, but does not include the government.

As per Sec 9 of The Carriage By Road Act, 2007, a common carrier is required to issue a goods receipt which shall be the prima facie evidence of the weight or measure and other particulars of the goods and the number of packages stated thereon. Such goods receipt note will determine the liability of the common carrier per se with respect to the goods held in custody by them.

Hence, from what is stated in the Motor Vehicles Act, 1988 read with The Carriage by Road Act, 2007 it can be deciphered that a Common Carrier would include all such persons who are engaged in the transportation of goods by a goods carriage being rickshaw, taxi, tempo, owner driven trucks or self-employed person driven trucks and would also include an agent. Such common carriers as per The Carriage By Road Act, 2007 are required to issue a goods receipt note (which determines their liability per se with respect to the goods held in custody by them) but does not mandate the common carrier to issue a Consignment Note(as required in the GST law).

But from the conjoint reading of what has been stated above and the definition of Goods Transport Agency as per clause (ze) para 2 of the Notification No. 12/2017-Central Tax Rate for the purpose of levy of GST on freight charges, it can be concluded that only that Common carrier who is transporting goods as a Goods Transport Agent AND issues a Consignment Note (as required by the provisions of GST law), would fall under the ambit of levy of GST on RCM basis and the rest of the Common Carriers who are not running their business as GTA (such as rickshaw, auto, tempo, taxi owners either self-driven or driven by self-employed persons) would be outside the ambit of GST on freight charges paid to them for transportation of goods by virtue of entry No. 18 of Services Exemption Notification No. 12/2017-Central Tax Rate dated 28th June, 2017.

Now, the next question to be pondered is whether all freight expenses incurred to the GTA are liable to GST on RCM mechanism. For this we need to route through the entry No. 21 of Service Exemption Notification No. 12/2017-Central Tax Rate which exempts the Services provided by a goods transport agency, by way of transport in a goods carriage of –

(a) agricultural produce;

(b) goods, where consideration charged for the transportation of goods on a consignment transported in a single carriage does not exceed one thousand five hundred rupees;

(c) goods, where consideration charged for transportation of all such goods for a single consignee does not exceed rupees seven hundred and fifty;

(d) milk, salt and food grain including flour, pulses and rice;

(e) organic manure;

(f) newspaper or magazines registered with the Registrar of Newspapers;

(g) relief materials meant for victims of natural or man-made disasters, calamities, accidents or mishap; or

(h) defence or military equipments.

Hence, to conclude it can be said that transportation expense incurred by

• any entity

• other than unregistered SP, HUF , BOI and Non Resident Taxable Person

• on service provided by a GTA for transportation of goods by road

• For consignment value exceeding Rs. 1500/- per consignment or Rs. 750/- per consignee

• For goods transported

• other than agricultural produce, milk, salt and food grain , organic manure, newspaper or magazines, relief materials for natural calamities affected place, defence or military equipments

is subject to levy of GST on freight charges paid by the freight paying party on RCM basis.

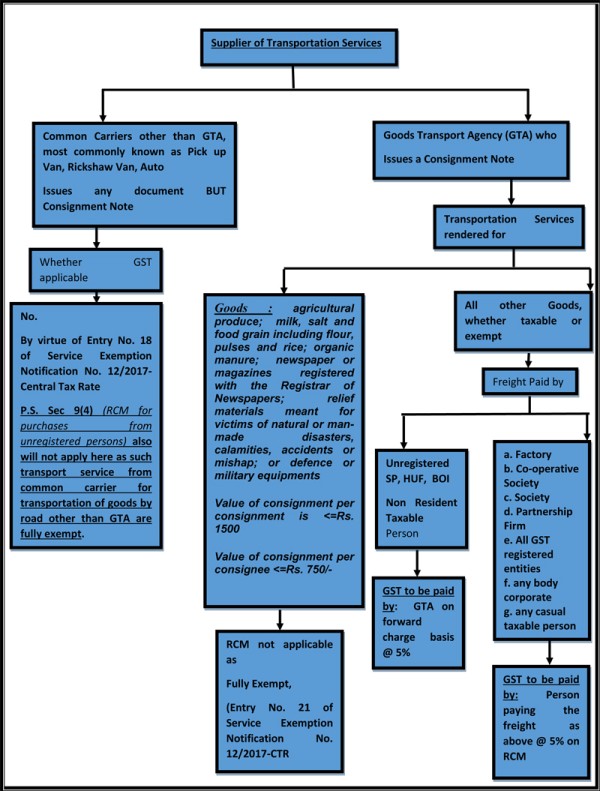

A pictorial presentation to summarize the applicability of the GST on freight Charges is presented as under:

Few cases to buttress that tax is not required to be paid on freight charges paid to individual truck owners:

a) M/s Parry Sugars Industries Ltd. versus Commissioner of Central Excise, Customs and Service Tax Visakhapatnam, 2013 (9) TMI 322 - CESTAT Bangalore

b) Carris Pipes & Tubes Pvt. Ltd. Versus Commissioner of Central Excise Coimbatore, 2013 (8) TMI 294 - CESTAT CHENNAI

Through this article of mine, I have endeavoured to cover only the taxability aspect of the GST on freight charges incurred on the Goods Transport Agency. The aspect of Input Tax Credit on GST paid on freight charges is not covered. The aspect of eligibility of Input Tax Credit along with the composite supply of services made by the Goods Transport Agency such as loading and unloading, packing etc. will be covered in my next article.

Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice or recommendation of author. Author never accepts any liabilities for any loss or damage of any kind arising out of any information in this document nor for any actions taken in reliance thereon.

Readers are advised to consult the professional for understanding and applicability of this article in the respective scenarios. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. No part of this document should be distributed or copied (except for personal, non-commercial use) without author’s written permission.

CAclubindia

CAclubindia