GST IMPACT STUDY FOR JEWELLERY SECTOR

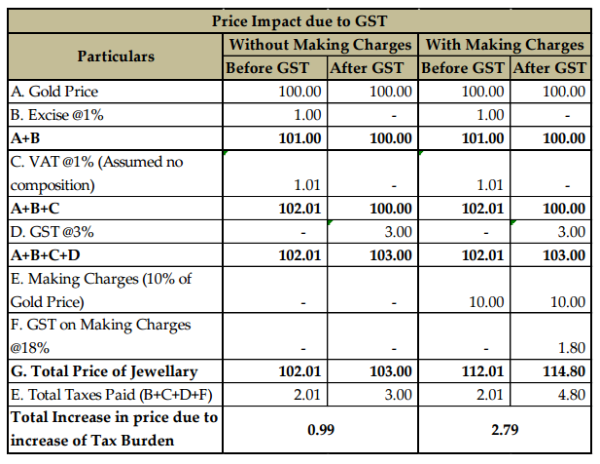

GST Council has decided 3% rate of GST on Gold under chapter 71. In the GST regime prices of Jewellery will be high as compared to in current scenario as the tax burden is more. We can understand the impact on price as under:

Due to GST the prices of jewellery will be increased by 0.99% or 2.79% without making charges or including making charges respectively.

In the excise, SSI exemption up to Rs. 6 crore is available but this limit will remain up to Rs. 20 lakh in the GST. Due to this more assesses will cover under the GST.

Transitional Provision

If the person is registered under earlier law shall be entitled for CENVAT credit furnished by him in the return for the period ending with the day immediately preceding the appointed day. We can understand the impact as under:

Example:

Q. Mr. A registered under excise furnishes the return for the period ending 30th June 2017 with the CENVAT credit carried forward for Rs. 1,00,000/- Whether Mr. A is entitled for input of Rs. 1,00,000/- under GST?

A. Jewellery is taxable in the excise and the same will be taxable in GST. Hence the CENVAT Credit in his return is carried forward in GST.

If the person is not registered under earlier law and duty paying invoice for Jewellery as on appointed day is available then the person is entitled to take credit of duty & taxes mentioned in invoice. Subject to Invoice were issued not earlier than 12 months immediately preceding the appointed day.

Example:

Q. Mr. A not registered under excise and has the invoice dated 2nd June, 2016 for Jewellery containing excise duty of Rs. 18,000/-. In GST, Mr.A is liable to registered and the jewellery is in stock as on Appointed Day. Whether Mr. A is entitled to take credit of Excise paid on Jewellery.

A. Yes, Mr. A is entitled to take credit of Rs. 18,000.

If the person is not registered under earlier law and duty paying invoice for Jewellery as on appointed day is not available then the person is entitled to take credit of 40% of CGST or 20% of SGST. For the purpose of the credit, supplies have been made and tax liability on supply has been paid.

Example:

Q. Mr. A not registered under excise and No invoice held for Jewellery in stock as on Appointed Day. In GST, Mr. A is liable to registered. Whether Mr. A is entitled to take credit of Excise paid on Jewellery.

A. Yes, Mr. A is entitled to take credit of 40% of CGST or 20% of IGST paid on Jewellery if supply of that stock is made and taxes CGST or IGST on such supply has been paid.

If person is registered as composition dealer in the earlier law and in the GST becomes as normal dealer, shall entitled to take the credit of eligible duties in respect of jewellery held in stock as on appointed day.

Example:

Q. Mr. A is composition dealer in excise and In GST he is registered as normal dealer. He has Jewellery in stock as on Appointed Day and also have invoice of duty paid on the same. Whether Mr. A is entitled to take credit of Excise paid on Jewellery.

A. Yes, Mr. A is entitled to take credit of Excise duty mentioned in Invoice.

JOB WORK FOR JEWELLARY SECTOR

In the current scenario, we can send the Gold for Job Work without paying any duty but the Jewellery shall be received back after completion of job work within 180 days of their being sent for Job work.

In GST, Jewellery can be removed for Job Work without paying any tax but prior intimation to commissioner is required. As per ITC rules, inputs shall be sent to Job Workers under the cover of challan issued by the principal and the detail of challan for Gold dispatched to the Job Worker shall be furnished in GSTR-1 for that period.

The Jewellery may be received back to the principal’s place without tax or to the customers’ premises on payment of taxes, within 1 year of their being sent for Job Work.

If Jewellery has not received back within 1 year then the date on which Gold sent for Job Work is date of supply of Gold and taxes with interest shall be paid accordingly.

Principal shall be liable to maintain the record of Gold sent for Job Work. For the purpose of this benefit Job Worker should be registered otherwise such place of Job Worker shall be declared as an additional place of business by the principal. [Section 143 of the IGST Act, 2017]

Example:

Q. Mr. P registered under Excise sent the Jewellery for Job Work to Mr. R on 15th March 2017.

I. Mr. R returned the Jewellery after completion of Job Work on 18th August 2017. Whether Mr. P or Mr. R is required to pay tax?

II. What If the Goods returned on 25th October 2017, Whether Mr. P or Mr. R is required to pay tax?

III. What If the Goods returned on 25th January 2018, Whether Mr. P or Mr. R is required to pay tax?

A. If the Jewellery received back before six month from the appointed day then there is no tax liability but the job worker and the manufacturer needs to file the detail of jewellery as on appointed day with the job worker.

I. No Tax Liability as Jewellery has been received back before six months from the appointed date.

II. No Tax Liability as Jewellery has been received back before six months from the appointed date.

III. In this case Jewellery has not received back within six month from the appointed day. Hence it is deemed that supply has been made on the date when jewellery sent for job work i.e. 15th March 2017. And Tax and interest shall be payable accordingly.

INPUT TAX CREDIT IN CASE OF JOB WORK [Section 19]

If the Jewellery received within one year after completion of Job Work then the Principal is entitled for ITC on inputs sent for Job Work.

If the inputs are directly sent to Job Workers then, the date shall be counted from the date of receipt of inputs by Job Worker.

TRANSITIONAL PROVISIONS FOR JOB WORK

If the Gold & inputs is sent for Job Work before the appointed date and the same is received back after completion of job work within six months from the appointed day or Jewellery removed directly from Job worker, after payment of tax in India or without payment of tax for export within six months from the appointed day, no tax shall be payable, only if the manufacturer or Job worker declare the details of the Gold or Jewellery held in stock by Job Worker on behalf of the manufacturer on the appointed day in the prescribed time, form and manner.

JEWELLARY SENT FOR APPROVAL

In the current regime, there is no tax and no time limits for Jewellery sent on Approval.

In the GST regime, if the Jewellery sent for approval then the same should be under cover of delivery challan.

Section 31(7) of CGST Act mandate that the invoice for Jewellery sent for approval shall be raised earliest of the following:-

- Time when it becomes known that supply has taken place.

- Six months from the date of removal.

JEWELLARY SENT FOR EXHIBITION OR FOR THE PURPOSE OF OTHER THAN SUPPLY

If the Jewellery sent for exhibition in the same state then the same shall be removed under cover of delivery challan.

If the Jewellery sent for exhibition in other state then the person is required to obtain registration in such other state as causal taxable person (CTP).

For the purpose of obtaining registration as Causal taxable Person, the application shall be made at least 5 days prior to the commencement of business and estimated liability of tax shall be paid in advance. The amount so paid can be used for paying his liability of tax at the time of supplies made.

Example:

Mr. A registered person in Rajasthan is sending Jewellery of Rs. 1 crore to Gujarat for exhibition.

Q 1: Whether Mr. A is required to take registration in Gujarat?

Q 2: Whether Mr. A is required to pay tax on Rs. 1 crore?

Q 3: Whether Mr. A is required to pay tax on estimated supply?

Q 4: Assume exhibition is on 20th September 2017 when Mr. A shall apply for registration?

Q 5: What shall be charged by Mr. A in his invoice?

A. 1: Yes, Mr. A is required to obtain a registration in Gujarat as Casual Taxable Person.

A. 2: No, Mr. A is not required to pay tax on Rs. 1 crore, the Jewellery will be removed under cover of challan.

A. 3: Yes, at the time of registration of Casual Taxable Person, Mr. A is required to pay estimated tax liability.

A. 4: Mr. A shall apply for registration 5 days prior to the exhibition i.e. before 15th September 2017.

A. 5: In this case place of supply is Gujarat and Mr. A is required to charge IGST on the supply.

GST Tariff

|

Tariff Item |

Description of goods |

Rate |

|

|

(1) |

(2) |

(3) |

|

|

I. NATURAL OR CULTURED PEARLS AND PRECIOUS OR SEMI-PRECIOUS STONES |

|||

|

7101 7101 10 7101 10 10 7101 10 20 7101 21 00 7101 22 00 |

- --- --- - -- -- |

Pearls, natural or cultured, whether or not worked or graded but not strung, mounted or set; natural or cultured, temporarily strung for convenience of transport Natural pearl: Unworked Worked Cultured pearls: Unworked Worked |

3%: 7101 Pearls, natural or cultured, whether or not worked or graded but not strung, mounted or set; Pearls, natural or culture, temporarily strung for convenience of transport. |

|

7102 7102 10 00 7102 21 7102 21 10 7102 21 20 7102 29 7102 29 10 7102 29 90 |

- - -- --- --- -- --- --- |

Diamonds, whether or not worked, but not mounted or set Unsorted Industrial: Unworked or simply sawan, cleaved or bruted: Sorted Unsorted Other Crushed Other |

0.25% Rough diamond [7102] 3%: 7102 Diamonds, whether or not worked, but not mounted or set [other than rough diamond] |

|

7102 31 00 7102 39 7102 39 10 7102 39 90 |

- -- -- --- --- |

Non-industrial: Unworked or simply sawn, cleaved or bruted Others: Diamond, cut or otherwise worked but not mounted or set Others |

|

|

7103 7103 10 7103 10 11 7103 10 12 7103 10 19 7103 10 21 7103 10 22 7103 10 23 7103 10 24 7103 10 29 7103 91 00 7103 99 7103 99 10 7103 99 20 7103 99 30 7103 99 40 7103 99 90 |

- --- ---- ---- ---- --- ---- ---- ---- ---- ---- - -- -- --- --- --- --- --- |

Precious stones (other than diamonds) and semi-precious stones, whether or not worked or graded but not strung, mounted or set; ungraded precious stones (other than diamonds) and semiprecious stones, temporarily strung for convenience of transport Unworked or simply sawn or roughly shaped: Precious stones: Emerald Ruby and sapphire Other Semi-precious stones: Feldspar (Moon stone) Garnet Agate Green aventurine Other Otherwise worked: Ruby, sapphire and emeralds Other: Feldspar (Moon stone) Garnet Agate Chalcedony Other |

3% : 7103 Precious stones (other than diamonds) and semi-precious stones, whether or not worked or graded but not strung, mounted or set; ungraded precious stones (other than diamonds) and semi-precious stones, temporarily strung for convenience transport |

|

7104 7104 10 00 7104 20 00 |

- - |

Synthetic or reconstructed precious or semi-precious stones, whether or not worked or graded but not strung, mounted or set; ungraded synthetic or reconstructed precious or semi-precious stones, temporarily strung for convenience of transport Piezo-electric quartz Other, unworked or simply sawn or roughly shaped |

3%: 7104 Synthetic or reconstructed precious or semi-precious stones, whether or not worked or graded but not strung, mounted or set; Ungraded synthetic or reconstructed precious stoned, temporarily strung for convenience of transport. |

|

7104 90 7104 90 10 7104 90 90 |

- --- --- |

Other: Laboratory-created or laboratory grown or manmade or cultured or synthetic diamonds Other |

|

|

7105 7105 10 00 7105 90 00 |

- - |

Dust and powder of natural or synthetic precious or semi-precious stones Of diamond Other |

3%: 7105 Dust and powder of natural or synthetic precious or semi-precious stones. |

|

II. PRECIOUS METALS AND METALS CLAD WITH PRECIOUS METAL |

|||

|

7106 7106 10 00 7106 91 00 7106 92 7106 92 10 7106 92 90 |

- - -- -- --- --- |

Silver (including silver plated with gold or platinum), unwrought or in semi-manufactured forms, or in powder form Powder Other: Unwrought Semi-Manufactured: Sheets, plates, strips, tubes and pipes Other |

|

|

7107 00 00 |

Base metals clad with silver, not further worked than semi-manufactured |

3% : 7107 Base metals clad with silver, not further worked than semi-manufactured. |

|

|

7108 7108 11 00 7108 12 00 7108 13 00 7108 20 00 |

- -- -- -- - |

Gold (including gold plated with platinum) unwrought or in semi- manufactured forms, or in powder form Non-Monetary: Powder Other unwrought form Other semi-manufactured forms Monetary |

3%: 7108 Gold (including gold plated with platinum) Unwrought or in semi-manufactured forms, or in powder form. |

|

7109 00 00 |

Base metals or silver, clad with gold, not further worked than semi-manufactured |

3%: 7109 Base metals or silver, clad with gold, not further worked than semi- manufactured. |

|

|

7110 7110 11 7110 11 10 7110 11 20 7110 19 00 7110 21 00 7110 29 00 |

- -- --- --- -- - -- -- |

Platinum, unwrought or in semi- manufactured form, or in powder form Platinum: Unwrought or in powder form Unwrought form In powder form Other Palladium: Unwrought or in powder form Other |

3%: 7110 Platinum, unwrought or in semi- manufactured form, or in powder form. |

|

7110 31 00 7110 39 00 7110 41 00 7110 49 00 |

- -- -- - -- -- |

Rhodium: Unwrought or in powder form Other Iridium, osmium and ruthenium: Unwrought or in powder form Other |

|

|

7111 00 00 |

Base metals, silver or gold, clad with platinum, not further worked than semi-manufactured |

3%: 7111 Base metal, silver or gold clad with platinum, not further worked than semi-manufactured. |

|

|

7112 7112 30 00 7112 91 00 7112 92 00 7112 99 7112 99 10 7112 99 20 7112 99 90 |

- - -- -- -- -- --- --- |

Waste and scrap of precious metal or of metal clad with precious metal; other waste and scrap containing precious metal or precious metal compounds, of a kind used principally for the recovery of precious metal Ash containing precious metal or precious metal compounds Other: Of gold, including metal clad with gold but excluding sweepings containing other precious metals Of platinum, including metal clad with platinum but excluding sweepings containing other precious metals Other: Of silver, including metal clad with silver but excluding sweepings containing other precious metals Sweepings containing gold or silver Other |

3%: 7112 Waste and scrap of precious metals, of metal clad with precious metal. |

|

III. JEWELLERY, GOLDSMITHS' AND SILVERSMITHS' WARES AND OTHER ARTICLES |

|||

|

7113 7113 11 7113 11 10 7113 11 20 7113 11 30 7113 11 90 |

- -- --- --- --- --- |

Articles of jewellery and parts thereof, of precious metal or of metal clad with precious metal Of precious metal whether or not plated or clad with precious metal: Of silver, whether or not plated or clad with other precious metal: Jewellery with filigree work Jewellery studded with gems Other articles of jewellery Parts |

3%: 7113 Articles of jewellery and parts thereof, of precious metal or of metal clad with precious metal. |

|

7113 19 7113 19 10 7113 19 20 7113 19 30 7113 19 40 7113 19 50 7113 19 60 7113 19 90 7113 20 00 |

-- --- --- --- --- --- --- --- - |

Of other precious metal, whether or not plated or clad with precious metal; Of gold, unstudded Of gold, set with pearls Of gold, set with diamonds Of gold, set with other precious and semi-precious stones Of platinum, unstudded Pares Other Of base metal clad with precious metal |

|

|

7114 7114 11 7114 11 10 7114 11 20 711419 7114 19 10 7114 19 20 7114 19 30 7114 20 7114 20 10 711420 20 711420 30 |

- -- --- --- -- --- --- --- - --- --- --- |

Articles of goldsmiths or silversmiths wares and pares thereof, of precious metal or metal clad with precious metal Of precious metal, whether or not plated or clad with precious metal: of silver, whether or not plated or clad with precious metal; Articles Pares of other precious metal, or not plated or with precious metal: Articles of gold Articles of platinum Parts Of base metal clad with precious metal: Articles clad with gold Other articles Parts |

3%: 7114 Articles of goldsmiths or silversmiths wares and pares thereof, of precious metal or of metal clad with precious metal. |

|

7115 7115 10 00 7115 90 7115 90 10 7115 90 20 7115 90 90 |

- - --- --- --- |

Other articles of precious metal or of metal clad with precious metal Catalysts in the form of wire cloth or grill, of platinum Other: Laboratory and industrial articles of precious metal Spinneret's made mainly of gold Other |

3%: 7115 Other articles of precious metal or of metal clad wit precious metal. |

|

7116 7116 10 00 |

- |

Articles of natural or cultured pearls, precious or semi-precious stones (natural, synthetic or reconstructed) Of natural or cultured pearls |

3%: 7116 Articles of natural or cultured pearls, precious or semi-precious stones (natural, synthetic or re- constructed.) |

|

7116 20 00 |

- |

Of precious or semi-precious stones (natural, synthetic or reconstructed) |

|

|

7117 7117 11 00 7117 19 7117 19 10 7117 19 20 7117 19 90 7117 90 7117 90 10 7117 90 90 |

- -- -- --- --- --- - --- --- |

Imitation jewellery Of base metal, whether or not plated with precious metal: Cuff-links and studs Other: Bangles German silver jewellery Other Other: Jewellery studded with imitation pearls or imitation or synthetic stones Other |

3% : 7118 Coins. |

|

7118 7118 10 00 7118 90 00 |

- - |

Coin Coin (Other than gold coin), not being legal tender) Other |

3% : 7118 Coins. |

CAclubindia

CAclubindia