"This is unacceptable. States are on the frontline battling the pandemic despite severe fund crunch. Instead of providing them additional funds, even legitimate dues are denied by the Centre," [1]

Tweeted. CPI(M) General Secretary Sitaram Yechury

The Corona Effect

'When your weakest opponent raises his voice, it is time to rethink the Strategies'

The Central government reportedly owes around Rs 30,000-34,000 crore to states as the GST compensation for December 2019 and January 2020. The compensation for December-January was supposed to be released by the second week of February. Many attribute the delay to the Centre's fund crunch due to the economic slowdown.

West Bengal too has been vocal about it. Even Tamil Nadu, ruled by the NDA ally AIADMK, has stressed the need for the Centre to release the money to states as it's in dire need of funds due to the COVID-19 pandemic.

It will be interesting to see as to whether the said delay in compensation to the States is due to the lockdown resulting into the Economy slow down or there is a flipside to this story.

As the Country headed for a lockdown, everything came to a standstill. The Industries, the manufacturing units, the big and small businesses, the PSU, the MSME, the IT Parks / hubs, the Auto sector, the Textile sector, the Service sector, Travel/tourism, you name it, it is shut and closed. No Businesses whatsoever. It's an unprecedented, complete Economic lockdown which the country never even dreamed.No one is sure of when this all will end. Before one could look deep into the situation and its pros and cons, Lockdown 2.0 was imposed. No one is able to commit that when things will come back to its normal routine. Nor the Government is committal neither a common man knows: What is in store for the future?

However one thing is for sure- we are entering the biggest Economic Crisis the country has ever witnessed since Independence.A direct impact can be seen on GST Collections and this is just the beginning.

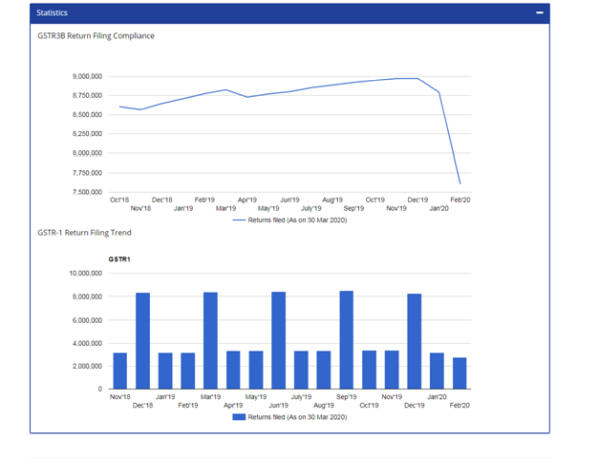

The GST collection has nose-dived, according to PIB release dated 1st April 2020 (Release ID: 1609919),the GST revenues during the month of March, 2020 from domestic transactions has shown a negative growth of 4% over the revenue during the month of March, 2019. During this month, the GST on import of goods has shown a negative growth of (-) 23% as compared to March, 2019.

It is pertinent to note that in March we had lost almost a week, however, the entire month of April 2020 is lost as far as the businesses are concerned and thus the revenue will be almost hitting the bottom of the graph.

The Centre has, so far, released about Rs 2.45 lakh crore as GST compensation to states since the implementation of GST on July 1, 2017. Under GST law, states were guaranteed to be paid for any loss of revenue in the first five years of the GST implementation, which came into force from July 1, 2017. The shortfall is calculated assuming a 14 per cent annual growth in GST collections by states over the base year of 2015-16.

During July 2017-March 2018, Rs 48,785 crore was released, while between April 2018-March 2019, Rs 81,141 crore was paid to states. For April-May and June-July last year, Rs 17,789 crore and Rs 27,956 crore were released. Further, Rs 35,298 crore was paid to states as compensation for August-September and Rs 34,053 crore for October-November 2019.

Source: https://www.business-standard.com/ :

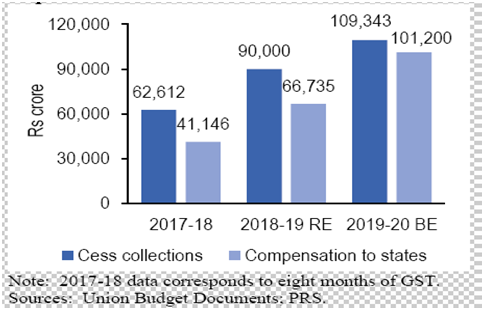

Interestingly, till date, the GST Cess collection has been able to take care of the GST compensation to the states. However, in days to come, the scenario may change as the revenue dips. Approximately, the GST cess collection from July2017 to March 2020 (direct, excluding that from imports) is Rs. 2.31914 Lakh Crores only, which is less than which is already released to the states. Furthermore, Compensation for the states for the months of December2019, January 2020, February 2020, and March 2020 still seems to be pending. Looking to the revenue trends, it will be approximately to the range to 65000 to 70,000 Crores.The situation may worsen as 2020 will progress. The indications could be seen in the past few GST council meetings. The voice of descent whispered in the meeting. Delay in compensation has been a regular feature since almost a year now. The states have started feeling the pinch. As Covid-19 lockdowns and restrictions of business continues, it will start hitting the revenues of the States as well as the Centre and the Voice decibel will go higher. The volume of the voice will increase along with the quality of the argument. The states may demand compensation beyond 5 years.

FLASHBACK1.0

1st GST Council Meeting (22nd and 23rd September 2016) had an agenda for Modalities for GST Compensation and draft Compensation Law. The issue was discussed in detail and initially,the proposal was bit different, but the Government was under pressure, as the time was running for implementation of GST.

[2] The Hon'ble Chairperson brought to the notice of the Hon'ble Members that GST was to be implemented in the next few months. He added that if consensus could not be arrived at, then the country could miss the deadline of 1st April 2017 for rollout of GST, but under no circumstances could the deadline of 16 September 2017 be breached. So he exhorted that the House should work in a spirit of statesmanship and decide the issues after comprehensive discussion and by avoiding voting.

Thus, under obvious pressure, the government agreed to 14% year on year growth keeping the base year as 2015-16. Though factually it was seen that majority of the states never had a history of 14% Growth in revenue on Year on Year basis consistently. This one decision seems to be a blunder as it may become the core reason for disputes between the Centre and states in time to come. The issue needs an immediate action.

IS THE CENTRE OVER-COMPENSATING THE STATES?

Let's first understand the basics lawsof this compensation [3] to states.

Section 3. The projected nominal growth rate of revenue subsumed for a State during the transition period shall be fourteen per cent. per annum

Section 2(q) 'transition date' shall mean, in respect of any State, the date on which the State Goods and Services Tax Act of the concerned State comes into force;

Section 2(r) 'transition period' means a period of five years from the transition date; and

Section 6. The projected revenue for any year in a State shall be calculated by applying the projected growth rate over the base year revenue of that State.

Illustration.- If the base year revenue for 2015-16 for a concerned State, calculated as per section 5 is one hundred rupees, then the projected revenue for the financial year 2018-19 shall be as follows- Projected Revenue for 2018-19=100 (1+14/100)3

In other words148% as per the Projected Revenue formula for 2018-19=100 (1+14/100)3

Similarly,

• 169 %as per Projected Revenue formula for 2019-20=100 (1+14/100)4

• 192% as per Projected Revenue formula for 2020-21 =100 (1+14/100)5

• 220 %as per Projected Revenue formula for 2021-22=100 (1+14/100)6

This is guaranteed for the States for the transition period, a period of five years from 1.7.2017.We all are aware that right from the inception, the states have been constantly proposing to lower the GST rates for many Goods and services. The originally proposed GST rates, which were calculated as per RNR(revenue neutral rates) have time and again been reduced. Eventually, the expected revenue was never achieved. This coupled with the GSTN flaws and glitches, resulted into much lower revenue figures if compared to the original estimates. In fact, till date, 100%return filing has neverbeen achievedand thus the revenue shortfall.

Now, with this revenue shortfall, the Centre is obliged to compensate the states if there is a shortfall in comparison to the Projected Revenue Figures.

Interestingly,till date, almost all states have claimed compensation, as none has outperformed since GST is implemented. All are underperforming. From the above, it is evident that the states are guaranteed 192 % and 220%of their basic revenue ( 2015-16)for the FY 2020-2021 and FY2021-22. Thus the States will get more than double the revenue as compared to their base year 2015-16, irrespective of the Rates of GST or GST Compliance. This sounds absurd.

Now one wonders, incase the 14% YOY for five years was not agreed upon under pressure, things would have been comfortable for the Centre.

The Centre is actually Over Compensating the States in as much as none of the states are in fact losing any revenue, even when the GST rates are slashed. They are compensated for these losses at the cost of the Centre.

INSTITUTE FOR POLICY RESEARCH STUDIES

An Interesting observation was made by the Institute for Policy Research Studies in December 2019

GST compensation requirements increasing: GST compensation requirements of states are increasing at faster rates than the compensation cess collections which finance them. This could lead to a scenario in the future when cess collections may not be sufficient to provide compensation to states. In 2019-20, cess collections have so far seen a growth of 1.5% during the seven-month period April to October 2019, which is much lower than the 21% growth budgeted for the year. Also, states have been guaranteed compensation only for a period of five years, which will end in 2022.

After 2022, states receiving compensation will have a revenue gap as they will not get these funds. States have roughly 2.5 years to bridge this gap with other sources to avoid any potential loss in revenue and the compensation provided to states vis-à-vis cess collections during the period 2017-18 to 2019-20. In 2019-20, while cess collections are estimated to increase by 21% over the previous year, compensation requirement of states is estimated to increase at a much faster rate of 52%. Such difference in growth rates could lead to a scenario in the future where the cess collections may not be sufficient for the compensation requirements of states. [4]

FLASHBACK 2.0

During the course of the 1st GST COUNCIL MEETING held on 22nd / 23rd September 2016 one of the members pointed out that during the introduction of VAT, there was no provision of 100% compensation for 5 years.

35. It was pointed out by the Hon'ble Minister from Assam that the VAT formula could not be completely replicated because States had got a better deal for compensation under the GST as compared to VAT. During the introduction of VAT, there was no provision of 100% compensation for 5 years. While it was agreed then for best 3 out of 5 years' growth rate, it was linked to diminishing amount of compensation for 3 years, namely 100% for year one, 75% for year two and 50% for year three. Therefore, it might be inappropriate to adopt only part of the formula. [5]

Today, one imagines, if this formula was adopted, things would have been totally different.

GST (COMPENSATION TO STATES) AMENDMENT ACT, 2018

There were strong indications of Global Slow down much before the Corona Pandemic hit the Globe. The said act was thus amended in 2018 August; however, the effective date was 1.02.19.

AS per GST (Compensation to States) amendment Act, 2018, which was made effective from 1.02.2019,

In section 10 of the principal Act, after sub-section (3), the following sub-section shall be inserted, namely:- -

"(3A) Notwithstanding anything contained in sub-section (3), fifty per cent. Of such amount, as may be recommended by the Council, which remains unutilized in the Fund, at any point of time in any financial year during the transition period shall be transferred to the Consolidated Fund of India as the share of Centre, and the balance fifty per cent. shall be distributed amongst the States in the ratio of their base year revenue determined in accordance with the provisions of section 5:

Provided that in case of shortfall in the amount collected in the Fund against the requirement of compensation to be released under section 7 for any two months 'period, fifty per cent. of the same, but not exceeding the total amount transferred tothe Centre and the States as recommended by the Council, shall be recovered from the Centre and the balance fifty per cent. from the States in the ratio of their base year revenue determined in accordance with the provisions of section 5.".

CENTRE NEEDS TO INTROSPECT IN THIS HOUR OF CRISIS

This new section 3A made a way for certain adjustments in case of shortfall in revenue, however, there is no provision, to compensate the states of shortfall, in case, there is a shortfall in the 'Fund'. In other words, in case of an economic depression, as the GST revenues may fall, so will the GST Cess.

It is evident that the states are guaranteed 192 % and 220%of their basic revenue (2015-16)for the FY 2020-2021 and FY2021-22. Thus in the Fifth year, the States will get more than double the revenue as compared to their base year 2015-16, irrespective of the Rates of GST or GST Compliance. This sounds absurd.

i. What happens if, in future, the State revenue shortfall surpasses the total Cess Fund collection?

ii. Is there any provision in GST law to compensate the said shortfall of the State's revenue from sources other than the 'Fund'?

iii. In absence of any such specific provision, how are the States going to Claim the Compensation?

iv. How are the States going to run their day to day affairs, with are venue shortage?

v. States have been guaranteed compensation only for a period of five years, which is going to end in 2022. In other words post 2022, states receiving compensation will have a huge revenue gap as they will not get these funds, which in total will run into a couple of lakh crores.

vi. Will the States insist for extension of this period?

vii. Will the GST Council discuss to change the definition of Transition Period? Will 5 years be extended by another 2 years?

viii. Will the unrealistic formula adopted for 14% YOY increment need to change?

ix. Will the Centre use its Veto power vested in it as per the weighted voting mechanism?

The questions are endless; the Challenge is how the Centre plans to address these issues, more so, in light of this Pandemic. The much hyped Cooperative Federalism will be there in letter and spirit or we will witness fault-lines in between. The final Call will have tobe taken by the onewho is at the helm of all affairs and He is known for taking tough Calls.

On25.01.2012,our Hon' PM Shri Narendrabhai Modi ji, (who was CM, Gujaratin 2012) wrote in one of his blogs, and I quote :

It Is High Time The Centre Realizes That Giving To The States What Rightfully Belongs To Them Will Not Weaken The Centre.

The States Must Co-Ordinate With The Union Government And Not Remain Subservient To It.

Co-Operative And Not Coercive Federalism Must Be The Norm In Our Country [6]

Leaving you with these thoughts to ponder upon ........

[1] @SitaramYechury tweeted on 12.04.2020

[2] 1st GST Council Meeting (22nd and 23 rd September 2016)

[3] The Goods And Services Tax (Compensation To States) Act, 2017

[4] Institute for Policy Research Studies in December 2019 Source: https://www.prsindia.org/

[5] 1st GST COUNCIL MEETING held on 22nd / 23rd September 2016

[6] https://www.narendramodi.in

CAclubindia

CAclubindia