The launch of GST 2.0 on September 22, 2025, simplified India's indirect tax system with revised rates and easier compliance. However, it did not alter the registration thresholds. The requirement to register still applies to businesses in regular states with an annual turnover above ₹40 lakh (for goods) or ₹20 lakh (for services).

Key Changes Under GST 2.0

- Reduced Tax Slabs: Consolidation into two main rates (5% and 18%), with a new top tier of 40% for specific luxury and sin goods.

- Streamlined Compliance: System-wide process improvements such as faster refunds, pre-filled returns, and a simplified registration process to benefit smaller enterprises.

- Faster Registration: A new three-working-day registration timeline for qualified "low-risk" businesses to encourage market entry.

GST Registration Threshold in 2025

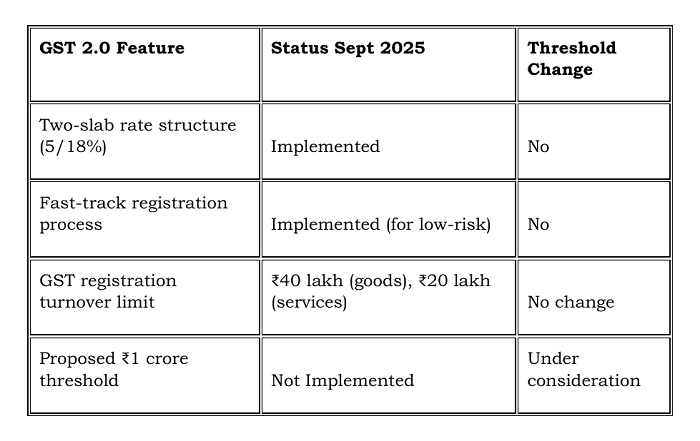

The government has retained the original GST registration thresholds as of the September 2025 reforms, choosing not to implement recommendations to raise the limit-such as the proposed ₹1 crore for merchants. The prevailing requirements are:

- A ₹40 lakh annual turnover for suppliers of goods in regular states.

- A ₹20 lakh limit for providers of services in regular states.

- Significantly lower thresholds (typically ranging from ₹10-20 lakh) continue to apply to special category states.

Practical Impact for Businesses

The GST 2.0 reforms have not modified the threshold criteria for mandatory registration. Businesses exceeding the prescribed turnover limit continue to be obligated to register, file returns, and fulfil all GST compliance duties.

The reforms are primarily concentrated on enhancing the ease of compliance and streamlining the tax rate structure.

Summary Table

FAQs

How will GST 2.0 change registration thresholds for small businesses?

GST 2.0 does not change the registration thresholds for small businesses-turnover limits remain at ₹40 lakh for goods and ₹20 lakh for services in regular states and ₹20 lakh/₹10 lakh for goods/services in special category states-though proposals to increase these to ₹1 crore and ₹50 lakh respectively are under discussion but have not been implemented as of September 2025.

Which goods moved to the new 5%, 18% and 40% slabs?

Reduced to 5% (from 12%/18%): Daily essentials like hair oil, shampoo, toothpaste, soaps, biscuits, chocolates, dairy products (butter, ghee, cheese), pre-packaged snacks, and kitchen utensils. This category also now includes key agricultural inputs like tractors, farm machinery, tyres, bio-pesticides, and drip irrigation systems.

Reduced to 18% (from 28%): A wide range of goods including electronics, small cars (petrol ≤1200cc, diesel ≤1500cc), motorcycles (up to 350cc), three-wheelers, household appliances (ACs, TVs >32", refrigerators, dishwashers), cement, and auto components.

New 40% "Sin/Luxury" Slab: Replacing the previous 28% + cess, this new top rate applies to luxury and demerit goods such as luxury cars, premium motorcycles (above 350cc), aerated/caffeinated beverages, pan masala, and other high-value luxury items.

How do pre-filled returns and faster refunds work under GST 2.0?

Under GST 2.0, pre-filled returns are auto-populated from supplieruploaded invoices and e-invoice feeds, significantly reducing manual data entry and minimising errors; taxpayers still review, reconcile, and can edit this data before final submission, shifting focus to timely dispute resolution and data accuracy.

Faster refunds are enabled by an automated, risk-based system processing valid refund claims within seven days for select sectors like textiles, chemicals, and pharmaceuticals, improving business liquidity and reducing bureaucratic delays. These reforms together aim to simplify compliance, improve cash flow, and reduce administrative burden for taxpayers under GST 2.0.

How will GST 2.0 affect input tax credit for MSMEs?

GST 2.0 simplifies Input Tax Credit (ITC) for MSMEs by consolidating tax slabs to 5% and 18%, streamlining calculations. Faster, automated refunds improve cash flow. The reforms also clarify ITC rules for post-sale discounts and encourage MSMEs to utilize credits before certain supplies become exempt, helping them optimize liquidity and support growth.

CAclubindia

CAclubindia