"The best place to defend is in the opposition penalty box."- Jock Stein

1. Learning the New Rules of the Game

In the game of football, your good performance and hard work of the entire game can go for a toss with just one wrong or foul move resulting in the award of a penalty shoot-out to your opponent. Sometimes, even an error of judgement by the Referee may also result in a penalty. Whether it's your foul play or the error of judgement by the Referee, once a penalty shoot is given to your opponent, then You are left with no other choice but to save your Goal. And for saving your goal, it is quintessential that you know the rules of penalty-shootout like how many defenders can remain in the inside circle etc., so that you may not give another penalty shoot-out opportunity to your opponent.

Like-wise, in the game of tax assessments, just one false or inaccurate particular of your income or sometimes even an error of judgement by the assessing authority can result in giving that penalty shoot-out to the assessing authority. Here also, in order to save your Goal (read levy of penalty), you ought to know the rules of the game.

In this Taxalogue, I am just trying to decode and explain the newly inserted rules of penalty shoot-out i.e. the newly legislated Faceless Penalty Scheme, 2021.

2. Faceless Penalty Scheme, 2021, Decoded

Well yes Friends, your income can't be faceless (read unexplained or concealed) anymore, as the assessing authorities have become faceless, nowadays.

Section 274 of the Income Tax Act provides for the procedure, for imposing penalty (for underreporting or misreporting of income u/s 270A) under Chapter XXI of the Act. In response to a showcause notice issued by the Assessing Officer (AO), assessee or his authorised representative was still required to visit the office of the Assessing Officer. With the advent of the Faceless Assessment Scheme, 2019 and in order to ensure that the reforms initiated by the Department to eliminate human interface from the system reaches the next level, it was imperative to launch a Faceless Penalty Scheme on the lines of Faceless Assessment Scheme, 2019.

Therefore, the Finance Act 2020 has inserted an enabling provision in the form of a new sub-section (2A) in section 274 of the Act so as to provide that the Central Government may notify an e-scheme for the purposes of imposing penalty so as to impart greater efficiency, transparency and accountability by—

- eliminating the interface between the Assessing Officer and the assessee in the course of proceedings to the extent technologically feasible;

- optimising utilisation of the resources through economies of scale and functional specialisation;

- introducing a mechanism for imposing of a penalty with dynamic jurisdiction in which penalty shall be imposed by one or more income-tax authorities.

3. Launch of Faceless Penalty Scheme, 2021

In exercise of the powers conferred by sub-section (2A) of section 274 of the Income-tax Act, 1961, the Central Government has notified the Faceless Penalty Scheme 2021, vide its gazetted Notification No. S.O. 117 (E), dated 12.1.2021 and for the purposes of giving effect to the Faceless Penalty Scheme, 2021, the Central Government vide its Gazetted Notification No. S.O. 118 (E) dated 12.1.2021, has issued Directions for the Implementation of the Faceless Penalty Scheme, 2021.

4. Difference between Conventional Penalty Proceedings & Faceless Penalty Proceedings under Faceless Penalty Scheme, 2021

The easiest way to understand the practicalities and nuances of any new/amended piece of legislation is to compare and analyse it with the existing provisions. So, for a better and clear understanding of the worthy readers, the points of distinction between the manner and mode of conducting of the conventional penalty proceedings and the new faceless penalty proceedings to be conducted under the Faceless Penalty Scheme, 2021, are being tabulated as under:

|

S. No. |

Particulars |

Conventional Penalty Proceedings |

Faceless Penalty Proceedings under Faceless Penalty Scheme, 2021 |

|

1. |

Applicability |

All Penalty Proceedings disposed of uptill 11.1.2021 |

All pending and new Penalty Proceedings w.e.f. 12.1.2021. |

|

2. |

Penalty Adjudicating Authority |

Jurisdictional AO |

Dynamic Jurisdiction comprised in any Penalty Unit in Regional Faceless Penalty Centre (RFPC) under the overall monitoring and supervision of National Faceless Penalty Centre (NFPC). |

|

3. |

Penalty Notice Issuing Authority |

Jurisdictional AO |

National Faceless Penalty Centre (NFPC) |

|

4. |

Assignment of Penalty Proceedings |

There was no assignment of penalty proceedings and the Jurisdictional AO was having a by-default and inherent right of initiating and adjudicating the penalty proceedings pursuant to the assessment order. |

The NFPC assigns the Penalty Proceedings to any Penalty Unit located in any one Regional Faceless Penalty Centre through an automated random allocation system. |

|

5. |

Inquiries/Adjudication during the course of penalty proceedings |

Jurisdictional AO used to issue Notices under section 274 read with 270A for want of further information/documents/records from the assessee. |

The NFPC may issue appropriate notice or requisition u/s 274 read with 270A, to the assessee or NFAC/AO, for obtaining any further information, documents or evidence, as required by the Penalty Unit in the Regional Faceless Penalty Centre, to which the penalty proceedings has been assigned by the NFPC. |

|

6. |

Provision of Draft Penalty Order |

There was no provision of passing a Draft Penalty Order. |

Draft Penalty Order is to be passed by the Penalty unit in the Regional Faceless Penalty Centre, to which the penalty proceedings have been assigned by NFPC. This Draft Penalty Order shall be examined by NFPC based on Risk Management Parameters and this draft Penalty Order may be sent by NFPC for Review to a Penalty Review Unit. |

|

7. |

Action on Draft Penalty Order |

Not Applicable |

The penalty review unit shall review the proposal of penalty unit, whereupon it may concur with, or suggest modification to, such proposal, for reasons to be recorded in writing, and intimate the National Faceless Penalty Centre. Where the penalty review unit concurs with the proposal of the penalty unit, the National Faceless Penalty Centre shall pass the Final Penalty Order. Where the penalty review unit suggests a modification, the National Faceless Penalty Centre shall assign the case to a specific penalty unit, other than the original penalty unit in any one of the Regional Faceless Penalty Centres through an automated allocation system. |

|

8. |

Final Penalty Order |

Passed by the Jurisdictional AO after considering the written and verbal submissions of the assessee. |

Where the case is assigned by NFPC to a new penalty unit, such penalty unit, after considering the material on record including suggestions for modification and reasons recorded by the penalty review unit, — (a) in a case where the modifications suggested by the penalty review unit are prejudicial to the interest of assessee, as compared to the draft penalty order of the original penalty, shall follow the same procedure as laid down in point no.7 above and prepare a revised draft order for imposition of penalty; or (b) in a case where the modification is not prejudicial to the interest of assessee, shall prepare a revised draft order for imposition of penalty; or (c) may propose non-imposition of penalty, for reasons to be recorded in writing, and send such order or reasons to the National Faceless Penalty Centre; Upon receipt of revised draft order from the penalty unit, the National Faceless Penalty Centre shall pass the penalty order as per such draft and serve a copy thereof upon the assessee or not impose a penalty under intimation to the assessee. Where in a case, as referred to in sub-clause (a) or (b) of clause (i), the National Faceless Penalty Centre has passed a penalty order, or not initiated or imposed penalty, as the case may be, it shall send a copy of such order or reasons for not initiating or imposing a penalty to the jurisdictional AO or the National Faceless Assessment Centre, as the case may be, for such action as may be required under the Act. |

|

9. |

Mode of Interface between the Assessee and the Penalty Adjudicating Authority |

The mode of interface and communication between the assessee and the penalty adjudicating authority i.e. the jurisdictional AO was a combination of electronic & manual mode. |

All the communication between the assessee and the NFPC is to be done exclusively through Electronic Mode via the 'e-Proceedings' functionality in the ITBA Module. The assessee or his authorised representative, as the case may be, may request for personal hearing so as to make his oral submissions or present his case before the penalty unit under this Scheme. The Chief Commissioner or the Director General, in charge of the Regional Faceless Penalty Centre, under which the concerned appeal unit is set up, may approve the request for personal hearing, if he is of the opinion that the request is covered by the circumstances as may be notified by CBDT. Where the request for personal hearing has been approved by the Chief Commissioner or the Director General, in charge of the Regional Faceless Penalty Centre, such hearing shall be conducted exclusively through video conferencing or video telephony, including use of any telecommunication application software which supports video conferencing or video telephony, in accordance with the procedure laid down by the Board. |

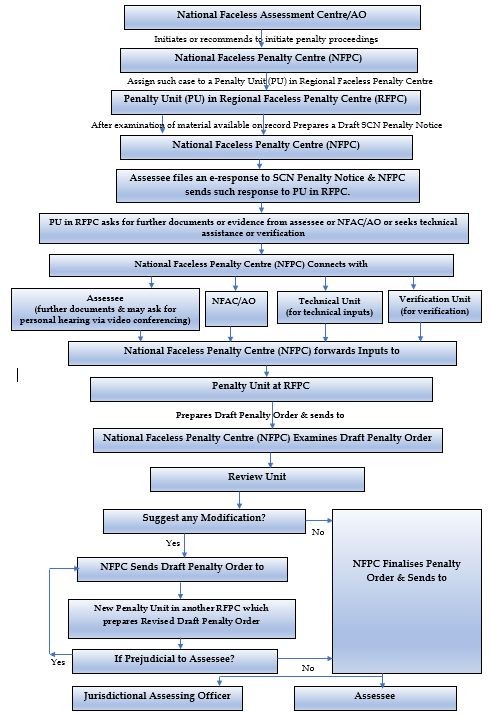

5. The New Faceless Penalty Proceedings Hierarchy

For the purpose of conducting of the penalty proceedings in a faceless manner, the CBDT is setting up:

(i) a National Faceless Penalty Centre to facilitate the conduct of faceless penalty proceedings in a centralised manner and vest it with the jurisdiction to impose a penalty in accordance with the provisions of this Scheme;

(ii) Regional Faceless Penalty Centres, as it may deem necessary, to facilitate the conduct of faceless penalty proceedings, which shall be vested with the jurisdiction to impose a penalty in accordance with the provisions of this Scheme;

(iii) Penalty Units, as it may deem necessary, to facilitate the conduct of faceless penalty proceedings, to perform the function of drafting penalty orders, which includes identification of points or issues for the imposition of penalty under the Act, seeking information or clarification on points or issues so identified, providing an opportunity of being heard to the assessee or any other person, analysis of the material furnished by the assessee or any other person, and such other functions as may be required for the purposes of imposing the penalty;

(iv) Penalty Review Units, as it may deem necessary, to facilitate the conduct of faceless penalty proceedings, to perform the functions of review of draft penalty order, which includes checking whether the relevant material evidence has been brought on record, whether the relevant points of fact and law have been duly incorporated in the draft order, whether the issues on which penalty is to be imposed have been discussed in the draft order, whether the applicable judicial decisions have been considered and dealt with in the draft order, checking arithmetical correctness of computation of penalty, if any, and such other functions as may be required for the purposes of review, and specify their respective jurisdiction.

6. Procedure of Penalty Proceedings under Faceless Penalty Scheme, 2021

7. Handy Practical Considerations in Faceless Penalty Regime

a. Currently there is one common response window for the faceless assessments, faceless appeals and the faceless penalty proceedings. In future, separate windows may be provided.

b. Only the scanned files in pdf format are to be uploaded as attachments. The resolution of the pdf file should be kept at 300dpi. The multiple pages in one submission should be uploaded as one pdf file only.

c. Currently the Video Conferencing (VC) functionalities are in the process of being built and soon the VC links will be available in the e-proceedings window of the e-filing portal.

d. UDINs are not required for e-filing of assessments and appeal submissions in the faceless regime.

e. The formats of State-wise Vakalatnamas with applicable stamp duty will also be available shortly in the e-filing portal.

f. The taxpayers should upload their current and accurate e-mail ids and mobile numbers in the e-filing portal so as to receive all the intimations and scrutiny & appeal notices from the department, in the e-filing portal and the e-mails.

8. Few Critical Suggestions to Make Faceless Penalty Scheme, 2021, Flawless

Faceless Penalty Scheme, 2021 is indeed a revolutionary and path-breaking initiative of the Government, aimed at reforming and overhauling the tax administration system and curbing the undesirable practices prevailing in the system, by eliminating the personal interface between the assessee and the assessing authority.

However, it is not uncommon for any new reform-oriented initiative to face some teething problems during the initial stages of its implementation and practice.

Accordingly, such critical areas where there is still scope of some improvement are discussed as under:

a. A By- Default Right of Personal Hearing via Video Telephony to the Assessee should be provided in the Faceless Penalty Scheme, 2021.

In the Faceless Penalty Scheme, 2021, the assessee is not having any 'by-default' right of personal hearing and he/she may only request for a personal hearing by way of video conferencing/telephony, so as to make his/her oral submissions or present his/her case before the penalty unit under this Scheme.

The Chief Commissioner or the Director General, in charge of the Regional Faceless Penalty Centre (RFPC), under which the concerned penalty unit is set up, may approve the request for personal hearing, if he/she is of the opinion that the request is covered by the circumstances as may be notified by CBDT.

The circumstances where the request of the assessee for personal hearing via video conferencing may be approved are yet to be notified by CBDT.

Thus, a suitable clarification concerning the specified circumstances wherein the request of personal hearing of the assessee may be approved by the CCIT RFPC is desirable.

This burning and litigative issue of lack of suitable opportunity of being heard in the new faceless regime resulting in violation of Principle of Natural Justice & Article 14 of the Constitution of India, has become more critical in view of the admission of the writ petition of the taxpayer by the Hon'ble Delhi High Court in the case of Lakshya Buddhiraja on 16.10.2020, on this very issue.

Levy of penalty in some provisions of Income Tax Law may also result in prosecution in addition to the monetary terms, so the grant of a suitable opportunity of being heard by way of video telephony or similar means, becomes all the more essential and necessary in the adjudication of penalty.

Thus, in order to reduce litigations and tussles, the CBDT may reconsider and review the provision of conditional grant of an opportunity of personal hearing via video telephony to the assessee, only in certain specified circumstances, and may consider the grant of such opportunity of personal hearing via video telephony to the assessee, in all cases, wherein the assessee asks for it in writing.

b. Provision of Alternative Mode of Uploading Files as Attachments along with e-Submissions, other than the Scanned Files.

In the existing 'schema' and 'semantics' of the 'e-Proceedings' functionality, the maximum number of attachments or files which can be attached along with a single 'response' to any penalty notice is 'TEN' (10) and the maximum 'size' of one attachment which can be attached along with a single 'e-response' is '10 MB' of data. Earlier the maximum size of one attachment which can be attached along with a single 'e-response' was 5 MB only. So, in the new faceless regime, the issue of space constraint has been resolved to some extent.

However, the assessee can attach scanned documents only in .pdf, .xls, .xlsx, .csv format. At times, the process of scanning of files or their conversion into pdf files for the purpose of uploading is a very cumbersome and tedious process and involves a lot of time. So, this file conversion becomes an irritant and hinders the smooth and uninterrupted uploading of supporting attachments to be attached `along with the response to any query to a notice.

The requirement of scanning of files or the conversion of files into pdf version to make them up-loadable should be done away with and instead of a standard file format like 'XML' in line with the International Best Practice of 'Standard Audit File for Tax' (SAF-T), should be adopted and implemented for uploading files and attachments, by aligning and integrating the 'e-proceedings' functionality of the ITBA module with that of the natural accounting systems of assessees.

9. Concluding Remarks

The concerned Legislative Authorities should immediately address the above-stated grey areas and litigative issues concerning this path-breaking and revolutionary initiative of faceless penalty so as to ensure their timely redressal and avoidance of opening up of the unnecessary pandora box of litigations.

The author is a Senior Partner in a Noida based established and reputed CA Firm, M/s S M Mohanka & Associates. He is the Founder Director in M/s TaxAaram India Pvt Ltd and has recently launched his unique Start-up Venture taxaaram.com, India's first digital platform offering painless, seamless and cost-effective professional e-services in relation to faceless assessments, appeals and other statutory e-compliances. He has 15+ years of rich and profound experience in the field of Taxation (Direct & Indirect), and Advisory. He makes Representations for a widely diversified cross-section of industries including Power Sector, Banking & Finance, Real Estate, Food Processing, Infrastructure, Manufacturing, Education and Information Technology, before Authority for Advance Rulings, ITAT, Education Boards and other appropriate forums. He has also authored 'Best Seller' Professional Books titled "Faceless Assessment Ready Reckoner with Real-Time Case Studies" & "Case Studies & Procedures under Direct Tax Vivad se Vishwas Act, 2020", with Taxmann Publications, and the Book 'SUPER 21', treasuring his real-life winning representations on Income Tax, GST, PF, ESI, IBC & Banking Regulation Act, in his professional practice.

CAclubindia

CAclubindia