Revision in format of Implementation of SA 700 (Revised) /SA 705/SA 706

A. EXTANT PROVISIONS UNDER COMPANIES ACT 1956

Appointment of Auditors:

Section 224 of the Companies Act 1956 mandates every company to appoint an auditor or auditors at each annual general meeting to hold office from the conclusion of that meeting until the conclusion of the next annual general meeting. The section further requires that the company needs to intimate the auditor so appointed within 7 days of the appointment and the auditor in turn needs to intimate the Registrar of Companies about his acceptance or refusal within 30 days of receipt of intimation of appointment from Company. The section also specifies the number of companies of which a person can act as Auditor at a given point of time.

Audit Report:

Section 227 of the Companies Act contains that an auditor has to make a report to the members of the company on the accounts examined by him and on every balance sheet and profit and loss account and on every other document declared by the Act to be part of or annexed to the balance sheet or profit and loss account, which are laid before the company in general meeting during his tenure of office.

The report shall state whether in the auditor’s opinion and to the best of his information and according to the explanations given to him, the accounts –

- give the information as required by the Act

- in the manner so required

- and give a true and fair view of the state of affairs of the company.

The auditor shall also state the following in his report:

• whether he has obtained all the information and explanations which to the best of his knowledge and belief were necessary for the purposes of his audit,

• whether, in his opinion, proper books of account as required by law have been kept by the company so far as appears from his examination of those books, and proper returns adequate for the purposes of his audit have been received from branches not visited by him,

• whether the report on the accounts of any branch office audited under section 228 by a person other than the company’ s auditor has been forwarded to him as required by clause (c) of sub- section (3) of that section and how he has dealt with the same in preparing the auditor’ s report;

• whether the company’ s balance sheet and profit and loss account dealt with by the report are in agreement with the books of account and returns,

• whether, in his opinion, the profit and loss account and balance sheet complied with the accounting standards referred to in sub-section (3C) of section 211,

• whether any director is disqualified from being appointed as director under clause (g) of sub-section (1) of section 274.

Observations/Remarks by Auditors in Audit Reports

Section 227 specifies that any observations or comments of the auditors which have any adverse effect on the functioning of the company need to be in thick type or in italics. Further if any point in the report is answered inthe negative or with a qualification, the auditor’s report shall also state the reason for the answer.

Additional reporting requirements in Auditor’s report

Sub-Section 4A of Section 227 contains that the Central Government may, by general or special order, direct that, in the case of such class or description of companies as may be specified in the order, the auditor’s report shall also include a statement on such matters as may be specified therein.

By virtue of the above, Manufacturing and Other Companies (Auditor’s Report) Order, 1988 were notified videNotification No. G. S. R. 909(E), dated 7th September, 1988. This order was later superseded by notification of “Companies (Auditor’s Report) Order, 2003” (CARO) notified on 12th June 2013 vide notification G.S.R. 480(E) and which came into force from 1St July 2003.

B. APPLICABILITY OF CARO –

It shall apply to every company including a foreign company as defined in section 591 of the Act, except the following:-

C. REVISION IN FORM AND CONTENT OF AUDITORS REPORT

APPLICABILITY OF SA 700 (Revised) /SA 705 / SA 706 AND ITS IMPLICATION

Standards on Auditing (SA) are issued by Auditing and Assurance Standards Board (AASB) under the authority of the Council of the ICAI. ICAI is one of the founder members of the International Federation of Accountants (IFAC). The Standards developed and promulgated by the AASB under the authority of the Council of the ICAI are needed to be in conformity with the corresponding International Standards issued by the International Auditing and Assurance Standards Board (IAASB), established by the IFAC.

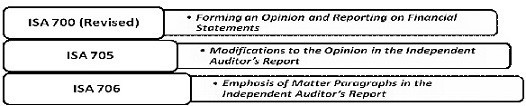

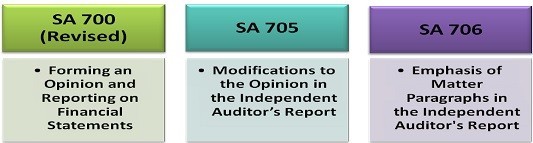

SA 700 was originally issued in the year 2003 by the ICAI and was then known as Auditing & Assurance Standard (AS) 28 corresponding to the International Standard on Auditing (ISA) 700. The 2008 crisis shook the confidence of the users of financial statements and brought to light, the need for greater transparency and information in the auditor’s report. Responding to the above needs, IASSB revised its ISA 700 and split it into three standards, namely –

Correspondingly, ICAI revised its SA 700 (AAS 28) in the year 2010 and issued three separate Standards on Auditing (SA) to deal with the form and content of an independent auditor’s report as also the various types of opinion that may be included in the auditor’s report corresponding to the aforementioned ISAs. The standards are:

Effective Date/Applicability –

These standards, when issued in 2010, were supposed to be effective for all audits relating to accounting periods beginning on or after April 1, 2011. However, the Council later decided that the effective date/applicability of these standards viz SA 700 (Revised), SA 705 and SA 706 be postponed by one year and consequently the said Standards are now effective/applicable for audits of financial statements for periods beginning on or after 1st April, 2012 (instead of audits of financial statements for periods beginning on or after 1st April, 2011 as was earlier decided).

Given below is a brief highlight of SA 700(Revised), SA 705 and SA 706 for easy understanding and reference. Readers are requested to refer to the complete text of the respective SAs to understand them in totality.

D. IMPLICATION ON SA 700 (REVISED) AUDITORS REPORT

SA 700 (REVISED) – FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS

SA 700 (Revised) deals with the auditor’s responsibility to form an opinion on the financial statements and also with the form and content of the auditor’s report issued as a result of an audit of financial statements. The main highlights of this SA are:

• The Auditors report shall be in writing – hard Copy or report using electronic format.

• It shall have a title that clearly indicates that it is the report of an independent auditor.

• The introductory paragraph of the report shall contain the name of the entity, name and period of each statement that comprises the financial statements, refer to the summary of significant accounting policies and other explanatory information and state that the financial statements have been audited.

• The auditor’s report shall include sections and headings as under:

Report on the Financial Statements (if other reporting responsibilities have been addressed)

- Management’s [or other appropriate term] Responsibility for the Financial Statements

- Auditor’s Responsibility

- Opinion

Report on Other Legal and Regulatory Requirements [or otherwise as appropriate] (wherever applicable)

The auditor’s report shall be signed and dated and shall also contain the place of signature along with membership number of the auditor signing the report and the FRN of the firm, as applicable.

An illustrative format of the Auditor’s Report as per SA 700(Revised) can be accessed from the following link:

http://220.227.161.86/17874sa700annx1.pdf

E. IMPLICATION ON SA 705 – MODIFIED AUDITORS REPORT

SA 705 – MODIFICATIONS TO THE OPINION IN THE INDEPENDENT AUDITOR’S REPORT

SA 705 deals with the auditor’s responsibility to issue an appropriate report in circumstances when, in forming an opinion in accordance with SA 700 (Revised), the auditor concludes that a modification to the auditor’s opinion on the financial statements is necessary.

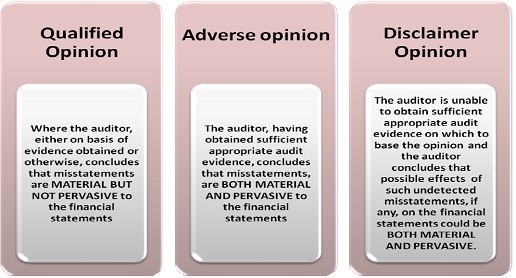

It establishes three types of modifications to the opinion, as discussed below.

Circumstances in which a modification is required

(a) The auditor concludes that, based on the audit evidence obtained, the financial statements as a whole are not free from material misstatement; or

(b) The auditor is unable to obtain sufficient appropriate audit evidence to conclude that the financial statements as a whole are free from material misstatement.

Types of Modifications:

Illustration on Types of Modified Opinion

The table below illustrates how the auditor’s judgment about the nature of the matter giving rise to the modification and the pervasiveness of its effects or possible effects on the financial statements, affects the type of opinion to be expressed:

| Nature of Matter Giving Rise to the Modification |

Auditor’s Judgment about the Pervasiveness of the Effects or Possible Effects on the Financial Statements |

|

|

Material but Not Pervasive |

Material and Pervasive |

|

| Financial statements are materially misstated |

Qualified opinion |

Adverse opinion |

| Inability to obtain sufficient appropriate audit evidence |

Qualified opinion |

Disclaimer of opinion |

Form and Content of the Auditor’s Report When the Opinion Is Modified

• When the auditor modifies the opinion on the financial statements, the auditor shall, in addition to the specific elements required by the SA 700 (Revised), include a paragraph in the auditor’s report that provides a description of the matter giving rise to the modification. The auditor shall place this paragraph immediately before the opinion paragraph in the auditor’s report and use the heading “Basis for Qualified Opinion”, “Basis for Adverse Opinion”, or “Basis for Disclaimer of Opinion”, as appropriate.

•When the auditor modifies the audit opinion, the auditor shall use the heading “Qualified Opinion”, “Adverse Opinion”, or “Disclaimer of Opinion”, as appropriate, for the opinion paragraph.

• The financial effect of the misstatement shall be quantified as far as practicable, else the auditor needs to specify that same in the report.

Further as required under Section 227(3)(e) of the Companies Act, 1956, the basis for qualification and the qualified opinion paragraphs should be in bold or italics.

F. IMPLICATION ON SA 706 – AUDITORS REPORT WITH EMPHASIS OF MATTER

SA 706 – EMPHASIS OF MATTER PARAGRAPHS AND OTHER MATTER PARAGRAPHS IN THE INDEPENDENT AUDITOR’S REPORT

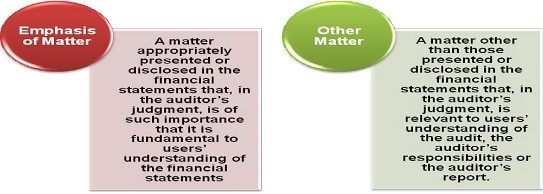

SA 706 deals with additional communication in the auditor’s report when the auditor considers it necessary to:

(a) Draw users’ attention to a matter or matters presented or disclosed in the financial statements that are of such importance that they are fundamental to users’ understanding of the financial statements; or

(b) Draw users’ attention to any matter or matters other than those presented or disclosed in the financial statements that are relevant to users’ understanding of the audit, the auditor’s responsibilities or the auditor’s report.

Meaning of “Emphasis of Matter” and “Other Matter”

Form and Content of the Auditor’s Report with “EMPHASIS OF MATTER” Paragraphs in the Auditor’s Report

• Emphasis of Matter paragraph shall be included in the auditor’s report immediately after the Opinion paragraph under the heading “Emphasis of Matter”, or other appropriate heading.

• A clear reference to the matter being emphasized and where the same can be found in the financial statements shall be given in the report.

• The Auditor shall indicate that auditor’s opinion is not modified in respect of the matter emphasized.

Form and Content of the Auditor’s Report with “OTHER MATTER” Paragraphs in the Auditor’s Report

Other Matter paragraph shall be included in the auditor’s report immediately after the Opinion paragraph and any Emphasis of Matter paragraph, or elsewhere in the auditor’s report if the content of the Other Matter paragraph is relevant to the Other Reporting Responsibilities section.

G. COMPARISON OF OLD AUDIT REPORT FORMAT WITH SA 700(REVISED) FORMAT

COMPARATIVE ILLUSTRATION OF FORMAT OF AUDITOR’S REPORT (NON-MODIFIED) BEFORE AND AFTER APPLICABILITY OF SA 700 (REVISED) – AUDIT OF FINANCIAL STATEMENTS PREPARED UNDER COMPANIES ACT, 1956

|

Illustrative format of Audit Report applicable till 31.03.2012

[Before application of SA 700 (revised)] |

Illustrative format of Audit Report applicable from 01.04.2012

[After application of SA 700 (Revised)] |

|

AUDITORS’ REPORT To the Members of ABC Company Limited

We have audited the attached balance sheet of ABC Company Limited (“the Company”) as at 31 March 20XX and the statement of profit and loss for the period ….. annexed thereto.

These financial statements are the responsibility of the Company’s management.

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in India. Those Standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.

An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements.

An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

We believe that our audit provides a reasonable basis for our opinion.

As required by the Companies (Auditor’s Report) Order, 2003, as amended, issued by the Central Government of India in terms of sub-section (4A) of Section 227 of the Companies Act, 1956, (“the Act”) we enclose in the Annexure a statement on the matters specified in paragraphs 4 and 5 of the said Order.

Further to our comments in the annexure referred to above, we report that:

(a) we have obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purpose of our audit;

(b) in our opinion proper books of account as required by law have been kept by the Company so far as appears from our examination of those books [and proper returns adequate for the purposes of our audit have been received from branches not visited by us];

(c) the Balance Sheet, Statement of Profit and Loss, and Cash Flow Statement dealt with by this Report are in agreement with the books of account [and with the returns received from branches not visited by us;

(d) in our opinion, the Balance Sheet, Statement of Profit and Loss, and Cash Flow Statement comply with the Accounting Standards referred to in subsection (3C) of section 211 of the Companies Act, 1956;

(e) on the basis of written representations received from the directors as on March 31, 20XX, and taken on record by the Board of Directors, none of the directors is disqualified as on March 31, 20XX, from being appointed as a director in terms of clause (g) of sub-section (1) of section 274 of the Companies Act, 1956.

(f) in our opinion and to the best of our information and according to the explanations given to us, the said accounts give the information required by the Act in the manner so required, and give a true and fair view, in conformity with the accounting principles generally accepted in India:

(a) in the case of the Balance Sheet, of the state of affairs of the Company as at March 31, 20XX;

(b) in the case of the Profit and Loss Account, of the profit/ loss for the year ended on that date; and

(c) in the case of the Cash Flow Statement, of the cash flows for the year ended on that date.

For XYZ and Co.

Chartered Accountants

Firm’s Registration Number

Signature

(Name of the Member Signing the Audit Report)

(Designation)

Membership Number

Place of Signature

Date |

INDEPENDENT AUDITOR’S REPORT To the Members of ABC Company Limited

Report on the Financial Statements

We have audited the accompanying financial statements of ABC Company Limited (“the Company”), which comprise the Balance Sheet as at March 31, 20XX, and the Statement of Profit and Loss and Cash Flow Statement for the year then ended, and a summary of significant accounting policies and other explanatory information.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation of these financial statements that give a true and fair view of the financial position, financial performance and cash flows of the Company in accordance with the Accounting Standards referred to in sub-section (3C) of section 211 of the Companies Act, 1956 (“the Act”). This responsibility includes the design, implementation and maintenance of internal control relevant to the preparation and presentation of the financial statements that give a true and fair view and are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with the Standards on Auditing issued by the Institute of Chartered Accountants of India. Those Standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Company’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of the accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion and to the best of our information and according to the explanations given to us, the financial statements give the information required by the Act in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in India:

(a) in the case of the Balance Sheet, of the state of affairs of the Company as at March 31, 20XX;

(b) in the case of the Profit and Loss Account, of the profit/ loss for the year ended on that date; and

(c) in the case of the Cash Flow Statement, of the cash flows for the year ended on that date.

Report on Other Legal and Regulatory Requirements

1. As required by the Companies (Auditor’s Report) Order, 2003 (“the Order”) issued by the Central Government of India in terms of sub-section (4A) of section 227 of the Act, we give in the Annexure a statement on the matters specified in paragraphs 4 and 5 of the Order.

2. As required by section 227(3) of the Act, we report that:

a. we have obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purpose of our audit;

b. in our opinion proper books of account as required by law have been kept by the Company so far as appears from our examination of those books [and proper returns adequate for the purposes of our audit have been received from branches not visited by us];

c. the Balance Sheet, Statement of Profit and Loss, and Cash Flow Statement dealt with by this Report are in agreement with the books of account [and with the returns received from branches not visited by us;

d. in our opinion, the Balance Sheet, Statement of Profit and Loss, and Cash Flow Statement comply with the Accounting Standards referred to in subsection (3C) of section 211 of the Companies Act, 1956;

e. on the basis of written representations received from the directors as on March 31, 20XX, and taken on record by the Board of Directors, none of the directors is disqualified as on March 31, 20XX, from being appointed as a director in terms of clause (g) of sub-section (1) of section 274 of the Companies Act, 1956.

For XYZ and Co.

Chartered Accountants

Firm’s Registration Number

Signature

(Name of the Member Signing the Audit Report)

(Designation)

Membership Number

Place of Signature

Date |

H. COMPARISION OF SA 700 FORMAT WITH SA 705 & SA 706 IMPLICATIONS

Comparative Illustration of Format of Auditor’s report as per SA 700 (Revised) and SA (Revised) with SA 705 and SA 706 - Audit of financial statements prepared under Companies Act, 1956

|

Illustrative format of Audit Report As per SA 700 (Revised) |

Illustrative format of Audit Report As per SA 700 (Revised), SA 705 & SA 706 |

|

INDEPENDENT AUDITOR’S REPORT To the Members of ABC Company Limited Report on the Financial Statements We have audited the accompanying financial statements of ABC Company Limited (“the Company”), which comprise the Balance Sheet as at March 31, 20XX, and the Statement of Profit and Loss and Cash Flow Statement for the year then ended, and a summary of significant accounting policies and other explanatory information. Management’s Responsibility for the Financial Statements Management is responsible for the preparation of these financial statements that give a true and fair view of the financial position, financial performance and cash flows of the Company in accordance with the Accounting Standards referred to in sub-section (3C) of section 211 of the Companies Act, 1956 (“the Act”). This responsibility includes the design, implementation and maintenance of internal control relevant to the preparation and presentation of the financial statements that give a true and fair view and are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with the Standards on Auditing issued by the Institute of Chartered Accountants of India. Those Standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Company’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of the accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion and to the best of our information and according to the explanations given to us, the financial statements give the information required by the Act in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in India: (a) in the case of the Balance Sheet, of the state of affairs of the Company as at March 31, 20XX; (b) in the case of the Profit and Loss Account, of the profit/ loss for the year ended on that date; and (c) in the case of the Cash Flow Statement, of the cash flows for the year ended on that date. Report on Other Legal and Regulatory Requirements 1. As required by the Companies (Auditor’s Report) Order, 2003 (“the Order”) issued by the Central Government of India in terms of sub-section (4A) of section 227 of the Act, we give in the Annexure a statement on the matters specified in paragraphs 4 and 5 of the Order. 2. As required by section 227(3) of the Act, we report that: a. we have obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purpose of our audit; b. in our opinion proper books of account as required by law have been kept by the Company so far as appears from our examination of those books [and proper returns adequate for the purposes of our audit have been received from branches not visited by us]; c. the Balance Sheet, Statement of Profit and Loss, and Cash Flow Statement dealt with by this Report are in agreement with the books of account [and with the returns received from branches not visited by us; d. in our opinion, the Balance Sheet, Statement of Profit and Loss, and Cash Flow Statement comply with the Accounting Standards referred to in subsection (3C) of section 211 of the Companies Act, 1956; e. on the basis of written representations received from the directors as on March 31, 20XX, and taken on record by the Board of Directors, none of the directors is disqualified as on March 31, 20XX, from being appointed as a director in terms of clause (g) of sub-section (1) of section 274 of the Companies Act, 1956. For XYZ and Co. Chartered Accountants Firm’s Registration Number Signature (Name of the Member Signing the Audit Report) (Designation) Membership Number Place of Signature Date |

INDEPENDENT AUDITOR’S REPORT To the Members of ABC Company Limited Report on the Financial Statements We have audited the accompanying financial statements of ABC Company Limited (“the Company”), which comprise the Balance Sheet as at March 31, 20XX, and the Statement of Profit and Loss and Cash Flow Statement for the year then ended, and a summary of significant accounting policies and other explanatory information. Management’s Responsibility for the Financial Statements Management is responsible for the preparation of these financial statements that give a true and fair view of the financial position, financial performance and cash flows of the Company in accordance with the Accounting Standards referred to in sub-section (3C) of section 211 of the Companies Act, 1956 (“the Act”). This responsibility includes the design, implementation and maintenance of internal control relevant to the preparation and presentation of the financial statements that give a true and fair view and are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with the Standards on Auditing issued by the Institute of Chartered Accountants of India. Those Standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Company’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of the accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. *Basis for Qualified Opinion The Company’s inventories are carried in the Balance Sheet at Rs. XXX. Management has not stated the inventories at the lower of cost and net realisable value but has stated them solely at cost, which constitutes a departure from the accounting standards referred to in sub-section (3C) of section 211 of the Act………………………………….

*Qualified Opinion In our opinion and to the best of our information and according to the explanations given to us, except for the effects of the matter described in the Basis for Qualified Opinion paragraph, the financial statements give the information required by the Act in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in India: (a) in the case of the Balance Sheet, of the state of affairs of the Company as at March 31, 20XX; (b) in the case of the Profit and Loss Account, of the profit/ loss for the year ended on that date; and (c) in the case of the Cash Flow Statement, of the cash flows for the year ended on that date. Emphasis of Matter

We draw attention to Note X to the financial statements which describe the uncertainty related to the outcome of the lawsuit filed against the Company by XYZ Company. Our opinion is not qualified in respect of this matter. Report on Other Legal and Regulatory Requirements 1. As required by the Companies (Auditor’s Report) Order, 2003 (“the Order”) issued by the Central Government of India in terms of sub-section (4A) of section 227 of the Act, we give in the Annexure a statement on the matters specified in paragraphs 4 and 5 of the Order. 2. As required by section 227(3) of the Act, we report that: a. we have obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purpose of our audit; b. in our opinion proper books of account as required by law have been kept by the Company so far as appears from our examination of those books [and proper returns adequate for the purposes of our audit have been received from branches not visited by us]; c. the Balance Sheet, Statement of Profit and Loss, and Cash Flow Statement dealt with by this Report are in agreement with the books of account [and with the returns received from branches not visited by us; *d. Except for the effects of the matter described in the Basis for Qualified Opinion paragraph, the Balance Sheet, Statement of Profit and Loss, and Cash Flow Statement comply with the Accounting Standards referred to in subsection (3C) of section 211 of the Companies Act, 1956; e. on the basis of written representations received from the directors as on March 31, 20XX, and taken on record by the Board of Directors, none of the directors is disqualified as on March 31, 20XX, from being appointed as a director in terms of clause (g) of sub-section (1) of section 274 of the Companies Act, 1956. For XYZ and Co. Chartered Accountants Firm’s Registration Number Signature (Name of the Member Signing the Audit Report) (Designation) Membership Number Place of Signature Date |

* “Basis for Qualified Opinion” and “Qualified Opinion” paragraphs are in italics as required under Sec. 227(3)(e) of the Companies Act.

Changes in the formats have been highlighted by means of underlining the text which has got modified (added/deleted)

Post your reflections to:

S Dhanpal & Associates

Practising Company Secretaries

CAclubindia

CAclubindia