As proposed in the union budget 2020, In the Income-tax Act, the following section shall be inserted with effect from the 1st day of April, 2021.

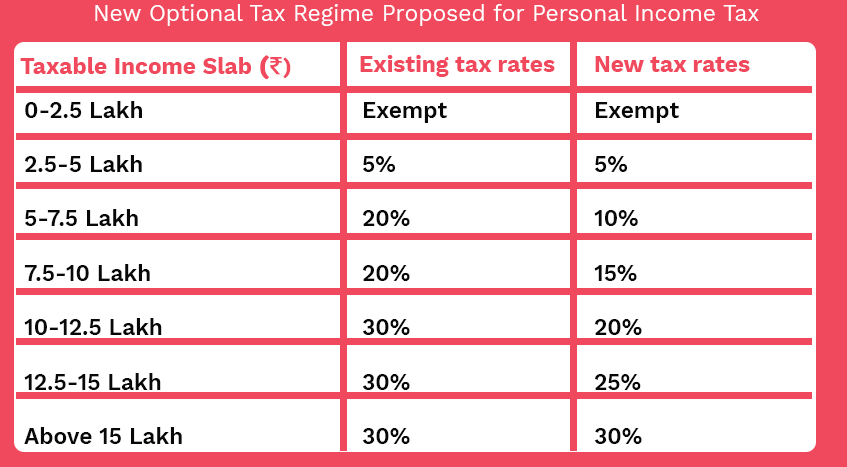

115BAC. (1) Notwithstanding anything contained in this Act but subject to the provisions of this Chapter, the income-tax payable in respect of the total income of a person, being an individual or a Hindu undivided family, for any previous year relevant to the assessment year beginning on or after the 1st day of April, 2021, shall, at the option of such person, be computed at the rate of tax given in the following Table, if the conditions contained in sub-section (2) are satisfied.

Key factors of section 115BAC:

1. Most important section 115BAC is optional

2. Option must be exercised in the prescribed manner by the person,

a. Having business income: on or before due date specified under section 139 (1) for furnishing the returns of income. [Such option once exercised shall apply to subsequent assessment years. However, option can be withdrawn only once for previous year other than the year in which it is exercised and thereafter such businessman cannot opt for this section, so choose wisely]

b. Having no business income along with the return of income to be furnished u/s 139(1)

3. Following deductions/exemptions shall not be available for taxpayer opting for this section:

(i) List of deductions and exemptions:

|

LTA 10(5) |

Allowances 10(14) |

Allowances 10(32) |

|

HRA 10 (13A) |

Allowances 10(17) |

Standard Deduction |

|

Professional Tax |

Entertainment Allowances |

Home Loan interest |

|

Deduction 32AD,33AB,33ABA, 35AD, 35CCC |

Additional Depreciation 32(1)(iia) |

|

|

Deduction from family pension u/s 57(iia) |

Exemption for Sez unit u/s 10AA |

|

|

Donations and expenses on scientific research u/s 35 |

||

|

Any deduction under chapter VIA except under section 80CCD (2) and 80JJAA E.g. LIC, Tuition fees, Donations, Mediclaim, rent, PPF, PF etc. |

||

(ii) Set off of any loss :

-

(a) carried forward or depreciation from any earlier assessment year, if such loss or depreciation is attributable to any of the deductions referred to in clause (i);

- (b) under the head “Income from house property” with any other head of income;

(iii) The depreciation, if any, under any provision of section 32, except clause (iia) of sub-section (1) of the said section, determined in such manner as may be prescribed; and

(iv) Any exemption or deduction for allowances or perquisite, by whatever name called, provided under any other law for the time being in force.

4. Person holding Units in (IFSC) International Financial Services Centre us/s 80LA (1A) shall be allowed deductions u/s 80LA.

Conclusion: section 115BAC is optional, it is taxpayers’ choice and professionals’ advice whether to opt for this or not.

CAclubindia

CAclubindia