DEFINITION

The world Business Council for Sustainable Development has proposed a definition of CSR as :

Corporate Social Responsibility is the continuing commitment by business to behave ethically and contribute to the economic development while improving the quality of life of the workforce and their families as well as of the local community and the society at large.

CORPORATE SOCIAL RESPONSIBILITY IN INDIA

Corporate Social Responsibility Voluntary Guidelines, 2009 is the first initiative taken in India regarding corporate social responsibility. As per this guidelines CSR is recommendatory and the CSR policy should cover the following core elements such as:

1. Care for all Stakeholders

2. Respect for Environment

3. Respect for workers Rights and welfare

4. Activities for Social and Inclusive Development

SECTION 135 OF THE COMPANIES ACT 2013

The Companies Act 2013 introduces and mandates the concept of Corporate Social Responsibility vide section 135. This provision in the Companies Act, 2013 will make India the only country which mandates CSR in the world which turns from voluntary to mandatory. This new mantra of CSR means that organizations should have moral, ethical and philanthropic responsibilities in addition to their responsibilities towards investors and compliance of law.

The Ministry of Corporate Affairs (MCA) vide notifications dated 27th February 2014 has notified the Section 135 of the Companies Act, 2013 and Companies (Corporate Social Responsibility Policy) Rules 2014 (CSR Rules) applicable w.e.f 01st April, 2014.

“CSR should bring smile to people” – Shri.Sachin Pilot., Hon’ble Minister of Corporate Affairs

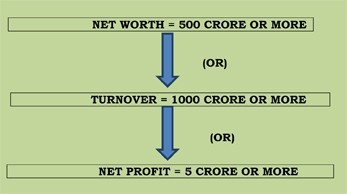

Is CSR applicable for all Companies?

CSR Applicable only for the following companies irrespective of whether Listed, unlisted, private, public etc and having

If CSR applicable, Companies needs to form a CSR Committee

Constitution of CSR committee

a. The company which is coming under any of the above mentioned criteria during any financial year shall constitute a Corporate Social Responsibility committee of the board consisting of 3 or more directors, out of which 1 director shall be an independent director.

b. an unlisted public company or a private company shall have its CSR Committee without independent director

c. a private company having only 2 directors on its board shall constitute CSR committee with two such directors

d. in case of foreign company there shall be atleast two persons of which one shall be as specified under clause (d) of subsection (1) of section 380 of the Act and another person shall be nominated by the foreign company

What is the Role of CSR Committee?

a. formulate and recommend to the Board, a Corporate Social Responsibility Policy which shall indicate the activities to be undertaken by the company as specified in Schedule VII;

b. recommend the amount of expenditure to be incurred on the activities referred to in clause (a); and

c. monitor the Corporate Social Responsibility Policy of the company from time to time.

d. The CSR committee shall institute a transparent monitoring mechanism for implementation of the CSR projects or programs or activities undertaken by the company

What are all the activities covered under CSR

(i) Eradicating hunger, poverty and malnutrition, promoting preventive health care and sanitation and making available safe drinking water

(ii) Promoting education, including special education and employment enhancing vocation skills especially among children, women, elderly, and the differently abled and livelihood enhancement projects

iii) Promoting gender equality, empowering women, setting up homes and hostels for women and orphans, setting up old homes, day care centres and such other facilities for senior citizens and measures for reducing inequalities faced by socially and economically backward groups

iv) Ensuring environmental sustainability, ecological balance, protection of flora and fauna, animal welfare, agro forestry, conservation of natural resources and maintaining quality of soil, air and water

v) Protection of national heritage, art and culture including restoration of buildings and sites of historical importance and works of art, setting up public libraries, promotion and development of traditional arts and handicrafts

vi) Measures for the benefit of armed forces veterans, war widows and their dependents

vii). Training to promote rural sports, nationally recognised sports, paralympic sports and olympic sports

viii) Contribution to the prime ministers national relief fund or any other fund set up by the central government for socio-economic development and relief and welfare of the scheduled castes, the scheduled tribes, other backward classes, minorities and women

ix) Contributions or funds provided to technology incubators located within academic institutions which are approved by the central government

x) Rural development projects

What are all the activities not covered under CSR

a. The CSR projects or programs or activities undertaken in India only shall amount to CSR expenditure

b. Contribution to political party either directly or indirectly shall not be considered as CSR activity

c. The projects or programs or activities that benefit only the employees and families shall not be considered as CSR activities

How much to Spend?

Every financial year, at least 2 percent of the average net profits of the company made during the immediately preceding 3 financial years.

Net profit

Net profit means the net profit of the company as per its financial statement prepared in accordance with the applicable provisions of the Act but shall not include the following ;

i). Any profit arising from any overseas branch or branches of the company whether operated as a separate company or otherwise and

ii). Any dividend received from other companies in India which are covered under and complying with the provisions of section 135 of the Act

Average net profit shall be calculated in accordance with the provisions of section 198 of companies Act 2013.

If Company has made CSR spend of 3% of average net profits in present financial year, can it make CSR Spend of only 1% of average net profits in next financial year?

There is no provision for set- off of excess spend in one year against shortfall spend in the next financial year. Neither the act nor the rules specified about Set Off.

Will CSR Obligations apply if company has been in existence for less than 3 financial years preceeding the financial year?

In this case, we have to take the stand of ICAI regarding Applicability of CARO – Internal Audit for unlisted company. The CARO does not apply unless the company is having three year operation. On the same analogy, it can be opined that a company covered by Section 135(1) will not be required to comply with mandatory corporate spends obligations. It is desirable for MCA to clarify this aspect.

What is the Consequences if the Company fails to spend?

If the company fails to spend such amount, the board should specify the reasons for not spending the amount in its Board report.

“If they do not spend and if they do not report (reasons for non spending), then there is trouble for the company” – Shri. Sachin Pilot, Minister of Corporate Affairs.

What are all the duties of the Directors in respect of CSR?

1. To Constitute CSR Committee

2. After taking in to account the recommendations made by the CSR committee, approve the CSR policy for the company and disclose contents of such policy in Board Report and also in Companies Website

3. To ensure that the activities as are included in CSR

4. Shall ensure that the company spends in every financial year, at least 2 percent of the average net profits of the company made during the immediately preceding 3 financial years, in respect of its CSR policy

5. The company shall give preference to the Local area and areas around it where it operates, for spending the amount earmarked for CSR activities

6. If the company fails to spend such amount, the board should specify the reasons for not spending the amount in its Board report

7. The Composition of Corporate Social Responsibility Committee shall be disclosed in the Board’s report under subsection (3) of section 134 of companies Act 2013.

8. The board of directors of the company shall, after taking in to account the recommendations of CSR committee, approve the CSR policy for the company and disclose contents of such policy in its report and the same shall be displayed on the company website.

Is CSR can be spent jointly with somebody?

The board may undertake its activities through a registered trust or a registered society or a company established by the company or its holding or subsidiary or associate company under section 8 of the Act or otherwise Provided that

i). If such trust, society or company is not established by the company or its holding or subsidiary or associate company, it shall have an established track record of three years in undertaking similar programs or projects

ii).The company has specified the project or programs to be undertaken through these entities the modalities of utilization of funds on such projects and programs and the monitoring and reporting mechanism. The company may also collaborate with other companies for undertaking projects or programs

Companies may build CSR capacities of their own personnel as well as those of their implementing agencies through institutions with established track record of atleast 3 financial years but such expenditure shall not exceed 5 percent of total CSR expenditure in 1 financial year

What is the Content of CSR Policy?

1.The CSR policy of the company shall include the following;

a) a list of CSR projects or programs which a company plans to undertake falling within the purview of the schedule VII of the Act, specifying modalities of execution of such project or programs and implementation of schedule for the same and

b) monitoring process of such projects or programs

The board shall ensure those activities shall not farm part of normal course of business and it is included in schedule VII of the Act

2. The CSR policy of the company shall specify that the surplus arising out of the CSR projects or programs or activities shall not form part of the business profit of a company

Grey Areas?

1. The CSR applicable to foreign companies with branches or project offices in India. Foreign companies are governed by the provisions of respective countries charter. Implementation of the norms to foreign companies are also likely to result in several practical hurdles as the corresponding sections of CA 2013 for computation of financial accounts of foreign companies are yet to be notified.

2. CSR Rules are applicable to every company including its holding / subsidiary company. It is not clear whether respective companies are individually considered or group.

Conclusion:

A Former President Mr.Abdul Kalam rightly pointed out "CSR if it is implemented with sustainability as a focus, then it enhances business sustainability, provides new opportunities, develops customer loyalty and improves stakeholder relationship”

“CSR IS A NEW EMERGING MANTHRA FOR CORPORATES”

Prepared by

CS.P.Eswaramoorthy, B.Sc., FCS.,

Company Secretary in Practice & Registered Trade Mark Agent,

Director – Viesva Corpserv Private Ltd

60A, Krishnsamy Nagar, School Road, Ramanathapuram,

Coimbatore - 641045

E.Mail: eswarfcs@gmail.com

Thanks to my Team:

Ms S.Vidhya. B.Com., ACS, Company Secretary

Mr M S Sivakumar, Manager –Compliance

Ms V.Priyadharsini, Manager –Compliance

Mr K Karthik, Officer-Accounts

Mr Sanjay, Trainee

Mr S Ramkumar, Trainee

Disclaimer:

This Article has been prepared on the basis of Companies Act,2013, Rules, Notifications and personal observations. The users and readers are advised to cross check with the original Act & Rules before acting upon this document

CAclubindia

CAclubindia