- A person, who jointly owns a single house property, to file his/her return of income in ITR-1 or ITR-4 Form, as may be applicable, if he/she meets the other conditions.

- A person who is required to file a return due to the fulfillment of one or more conditions specified in the seventh proviso to section 139(1) of the Act, to file his/her return in ITR-1 Form.

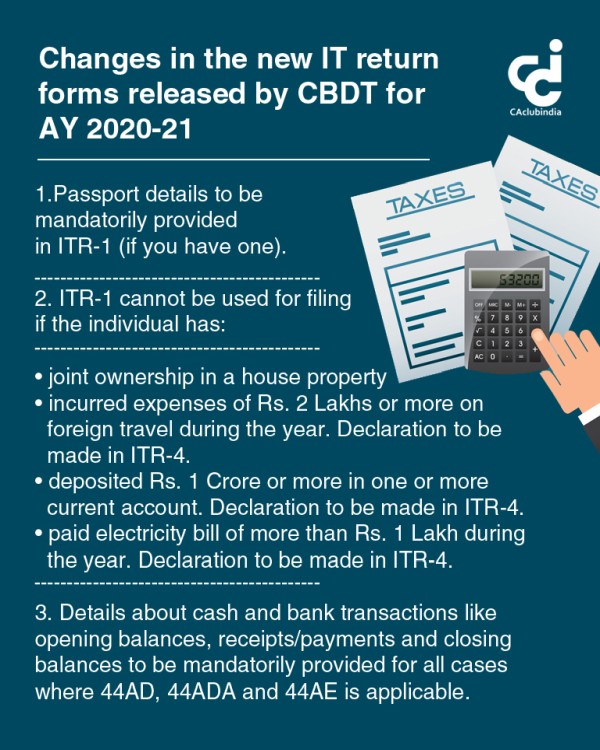

The Central Board of Direct Taxes (CBDT) has notified Income Tax forms - ITR 1 and ITR 4 for A.Y. 2020-2021 well in advance. The said forms will be applicable for filing income tax returns for the period April 1, 2019 to March 31, 2020.

Following changes have been made In the forms as compared to previous year's forms:

1. Passport details to be mandatorily provided in ITR-1 (if you have one).

2. ITR-1 cannot be used for filing in the following cases:

• if an individual has joint ownership in a house property

• if an individual has incurred expenses of Rs. 2 Lakhs or more on foreign travel during the year

• if an individual has deposited Rs. 1 Crore or more in one or more current account

• if an individual has paid electricity bill of more than Rs. 1 Lakh during the year

3. Details about cash and bank transactions like opening balances, receipts/payments and closing balances to be mandatorily provided for all cases where 44AD, 44ADA and 44AE is applicable.

4. Declaration to be made in ITR-4 if the aggregate amount of cash deposit in one or more current account exceeds Rs. 1 Crore. Exact amount of deposit to be mentioned.

5. Declaration to be made in ITR-4 if the aggregate amount exceeding Rs. 2 Lakhs is spent on foreign travel. Exact amount of expenditure to be mentioned.

6. Declaration to be made in ITR-4 if the aggregate amount exceeding Rs. 1 Lakh is spent on the consumption of electricity. Exact amount of expenditure to be mentioned.

To download the new ITRs: Click Here

Courtesy: Juhin Ajmera

CAclubindia

CAclubindia