Income Tax return filing for FY 2024-25 has started. We all know that the new regime is the default regime for FY 2024-25. If any assessee wants to file the ITR in the old regime then he can file the same with the old regime.

In the old regime, assessee can claim deductions under the House Rent Allowance, interest on home loan in case of self-occupied and deductions under section 80C to 80U.

From FY 2024-25, the Income Tax Department wants to know the additional details in respect of all deductions claimed by the assessee for more clarity and curbing false deductions.

In this article, we will know the details required by the department with respect to each deduction.

1. HRA: House Rent Allowance under section 10

Details to be reported for claiming a deduction.

- Place of work

- Basic Salary

- Actual HRA received

- Rent Paid

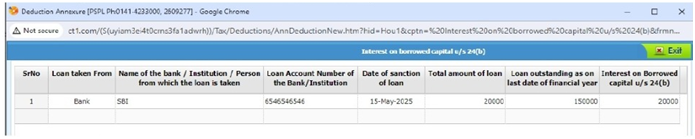

2. Interest on Borrowed Capital u/s 24(b)

In the above annexure, the following details are required to claim the deduction:

- Loan taken from: Select dropdown Bank/Other than Bank

- Name of Bank/Institution/Person from which the loan is taken

- Loan Account Number of Bank/Institution

- Date of Sanction of Loan

- Total Amount of Loan

- Loan Outstanding as on 31st March

- Interest on Borrowed Capital U/s 24(b)

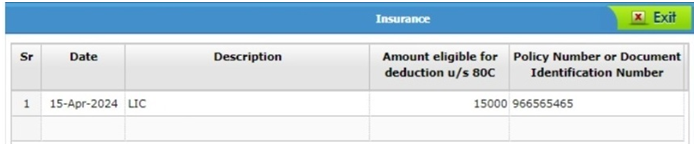

3. Deduction U/s 80C

In the above annexure, following detailes are requied to claim the deduction:

- Amount eligible for deduction u/s 80C

- Policy Number or Document Identification Number

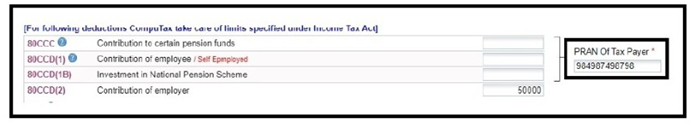

4. Details for Deduction U/s 80CCC, 80CCD(1), 80CCD(1B)

For claiming deduction under the following sections, the PRAN number is to be provided:

- 80CCC: Contribution to certain pension funds

- 80CCD (1): Contribution of employee / Self-employed

- 80CCD(1B): Investment in National Pension Scheme

- 80CCD (2): Contribution of employer

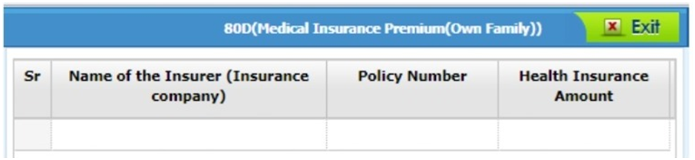

5. Details for Deduction U/s 80D

To claim deduction U/s 80D, the following information is required:

- Name of Insurance Company

- Policy Number

- Amount Paid

6. Details for Deduction U/s 80DD

To claim deduction U/s 80D, the following information is required:

- Nature of Disability (dependent) - select "Disability" / "Severe Disability"

- Type of disability

- Type of Dependent (self / spouse / children / parents)

- PAN & Aadhaar of Dependent

- Date & Ack. No. of Form 10-IA

- Ack. No. as per Rule 11A(2)(c) (if applicable)

- UDID No. (if available)

- Amount Claimed (u/s 80DD)

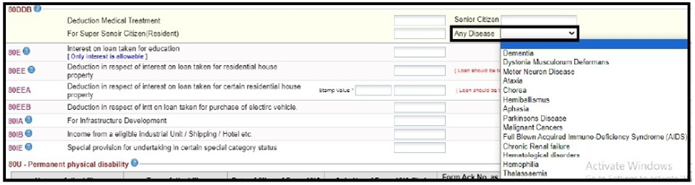

7. Details for Deduction U/s 80DDB

- Specified Disease (e.g., Cancer, Parkinson's, Thalassemia, HIV/AIDS, Chronic Renal Failure) - will be required to be select from the dropdown

- Amount Incurred

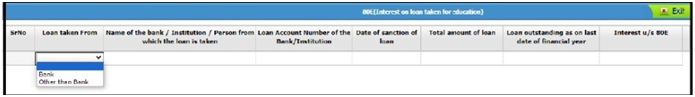

8. Details for Deduction U/s 80E : Interest on loan taken for higher education

- Loan Taken From ("Bank" / "Other than Bank")

- Name of Bank/Institution Name from which loan is taken

- Loan account number of bank

- Date of Sanction of loan

- Total Loan Amount

- Outstanding Balance (as on 31 Mar 2025)

- Interest Claimed (u/s 80E)

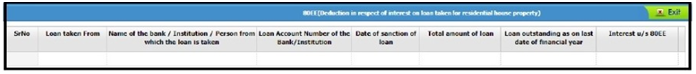

9. Deduction U/s 80EE : Interest on loan taken for Residential House Property

In this annexure, the user is required to fill in the following details:

- Loan taken from

- Name of bank/Institution from which the loan is taken

- Loan account number of bank

- Date of sanction of loan

- Total amount of loan

- Loan outstanding as on 31st March

- Interest under Section 80EE

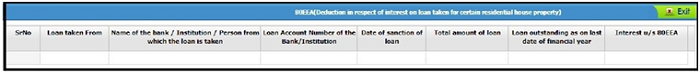

10. Deduction U/s 80EEA: Interest on loan taken for Residential House Property

In this annexure, the user is required to fill in the following details:

- Loan taken from

- Name of bank/Institution from which the loan is taken

- Loan account number of bank

- Date of sanction of loan

- Total amount of loan

- Loan outstanding as on 31st March

- Interest under Section 80EEA

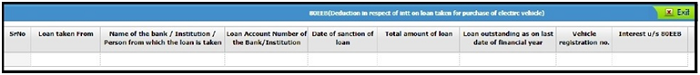

11. Deduction U/s 80EEB: Interest paid on purchase of Electric Vehicle

In this annexure, the user is required to fill in the following details:

- Loan taken from

- Name of bank from which the loan is taken

- Loan account number of bank

- Date of sanction of loan

- Total amount of loan

- Loan outstanding as on 31st March

- Vehicle registration number

- Interest under Section 80EEB

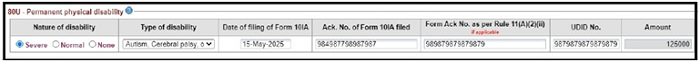

12. Details for Deduction U/s 80U

For claiming deduction under Section 80U, the following details must be provided:

- Nature of disability

- Type of disability

- Date of filing of Form 10IA

- Acknowledgment Number of Form 10IA filed

- Form Acknowledgment Number as per Rule 11A(1)(a)(ii)

- UDID Number

- Deduction Amount

Due date for filing the Income tax return for individuals (other than audit assessee) has been extended from 31st July 2025 to 15th September 2025.

CAclubindia

CAclubindia