Articles by CA Ruby Bansal

How to Choose the Right Broker or Brokerage App

CA Ruby Bansal 12 July 2023 at 09:21In this article, we’ll share more about Pocket Option, a popular brokerage app and a potential option for future trading and investments. We’ll also give some insights into how to choose the right broker or brokerage app for your needs.

Is Crypto Tax the Next Big Opportunity for Chartered Accountants in India?

CA Ruby Bansal 03 July 2023 at 17:51Cryptocurrencies are an evolving landscape in India and so is crypto taxation.

Exploring Different Types of Trading in India: A Guide for Indian Traders

CA Ruby Bansal 24 June 2023 at 10:22Discover the various types of trading in India, including day trading, swing trading, and more. This guide provides insights into the characteristics and benefits of each trading approach, helping Indian investors make informed decisions.

Simplify Your Crypto Tax Journey with Binocs: A Game-Changer for Chartered Accountants

CA Ruby Bansal 21 June 2023 at 14:14Binocs seeks to make crypto taxes less of a burden and more of a gain by streamlining them as a cutting-edge CA solution. Binocs is prepared to handle any situation, whether your clients are novices in the cryptocurrency world or seasoned investors. Here's why it's time to accept this paradigm-shifting idea.

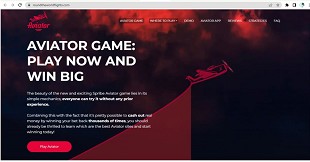

The Future of Aviator Slot Games: Trends and Predictions

CA Ruby Bansal 16 May 2023 at 14:07Aviator slot games are getting more popular y the day. In this article, we will discuss what the future looks like for Aviator games.

9 Best Ways to Save on Taxes with Fixed Deposits

CA Ruby Bansal 12 May 2023 at 13:48In this article, we'll explore the 10 most effective ways to save on taxes with FDs and how they can be a tool for managing your finances.

All You Need To Know About Financial Engineering

CA Ruby Bansal 26 April 2023 at 16:45Financial engineering is an interdisciplinary branch of the investment industry that makes use of applied mathematics, statistics, computer science, financial theory, and economics to conduct quantitative analysis on the financial markets.

Section 194DA: TDS on Payment of Life Insurance Policy

CA Ruby Bansal 22 April 2023 at 14:37Section 194D of the Income Tax Act requires tax to be deducted at source on any commission or reward paid for procuring insurance business.

Section 194IA | TDS on Sale of Property

CA Ruby Bansal 20 April 2023 at 14:45Section 194IA of the Income Tax Act is a provision related to the deduction of tax at source (TDS) on payments made for the purchase of immovable property.

FAQs relating to professional ethics of members pertaining to Bank Assignments

CA Ruby Bansal 10 April 2023 at 09:50Q 1: Whether a Firm of Chartered Accountants can accept Audit of a branch of a bank, while one of the partners of the said firm has taken loan from a different ..

Popular Articles

- Interest Computation Changes under GST (Effective from January 2026)

- TDS Rate Chart For Tax Year 2026-27: With Revised Section Codes in Challans

- Revised Return Due Date Extension

- Tax Deduction Rules for Employee Contributions From April 2026

- TDS and TCS: The New Shields and Arrows of the Taxpayer

- Tax Calculation Slabs For FY 2025-26 (AY 26-27)

- Comprehensive Guide to Statutory, Tax & Regulatory Compliances for Hotels

- Section 144C Time-Limit Finally Clarified: No More Litigation on Draft vs Final Assessment Deadlines

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia