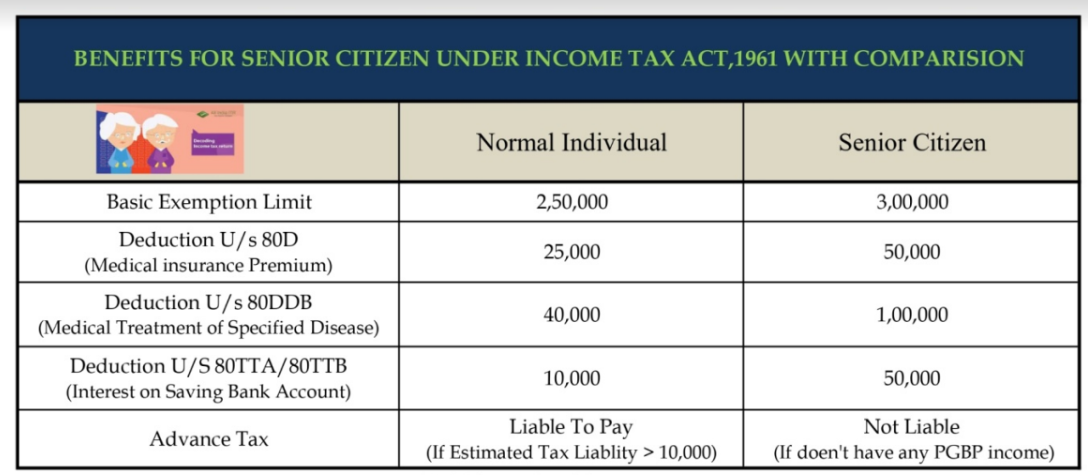

1. Higher Basic Exemption Limit

For Senior Citizens the basic exemption limit is fixed at Rs. 3 lakh & For Super Senior Citizen it is Rs. 5 lakh of annual total income.

2. Exemption from Payment of Advance Tax

A senior citizen need not have to pay any advance tax, provided he does not have any income under the head "Profits and Gains of Business or Profession"

3. Higher Deduction limit for Medical Insurance Premium(80D)

The maximum limit for deduction u/s 80D in respect of payment made for health insurance premium in respect of a senior citizen has been allowed at Rs. 50,000 as against that allowed to other individuals at Rs. 25,000

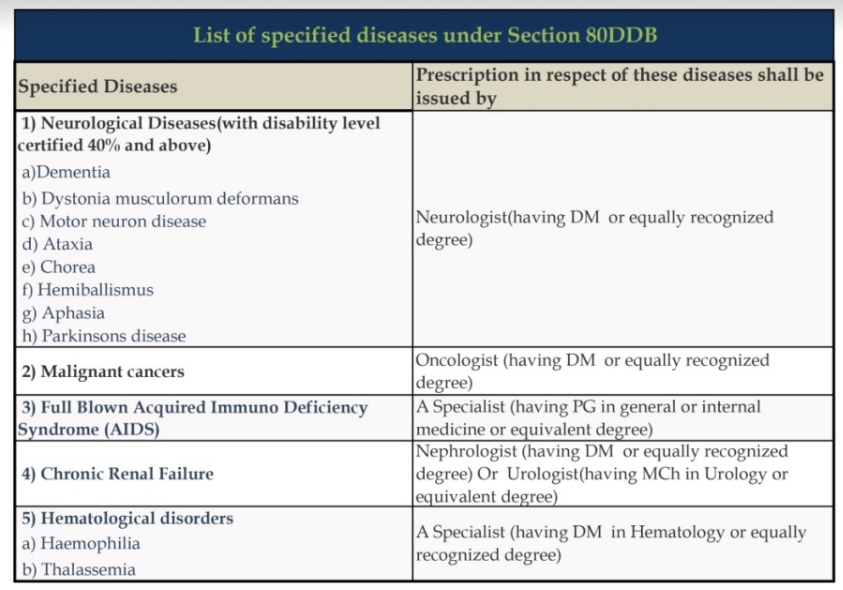

4. Higher Deduction Limit for Medical Treatment of a specified disease (80DDB)

The amount of deduction available in respect of expenses incurred for medical treatment of specified disease for a dependent senior citizen is Rs.1 lakh & for normal individual amount is Rs. 40,000.

5. Higher Deduction limit for interest earned. (80TTA/80TTB)

A senior citizen can claim deduction upto Rs. 50,000 u/s 80TTB in respect of interest income earned on Savings bank accounts,any bank deposits or any deposit with post office or cooperative banks Whereas normal taxpayers are allowed maximum deduction of Rs. 10,000 u/s 80TTA in respect of interest income from saving bank accounts.

6. The conditions under which Certain specified senior citizens are not required to file ITR.(194P)

In case of senior citizens of the age of 75 years or above having only pension income and interest income only from the account(s) maintained with a bank In which they receive such pension, such senior citizen shall not be required to file their ITRs. The specified bank shall be responsible for computing their total income and deducting tax Thereon after giving effect to various deductions and rebate.

CAclubindia

CAclubindia