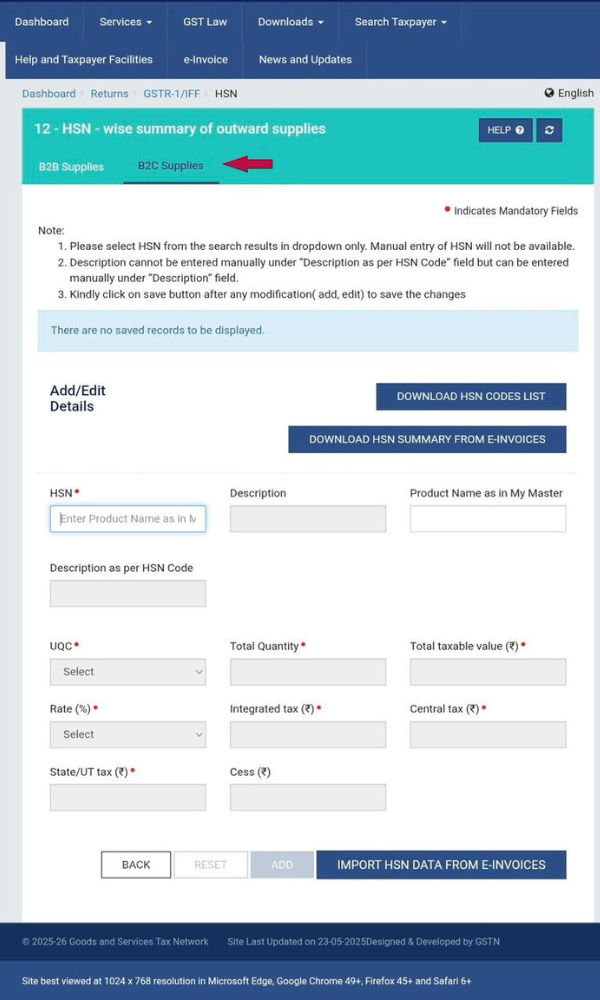

Table 12 of GSTR-1/1A has been bifurcated into two parts "B2B Supplies" & "B2C Supplies"

B2B and B2C transactions are required to be reported separately starting from the May 2025 tax period (filing due in June 2025).

Taxpayers are now advised to prepare data accordingly.

Key Points To Note

- Taxpayers whose turnover is up-to 5 crore are required to report 4-digit HSN codes for goods & services. However, reporting of B2C supplies are optional for those whose turnover is up to 5 crore.

- Taxpayer's total turnover above 5 crore are mandatory to report 6-digit HSN codes for goods & services.

- Users are not allowed to entry HSN code manually

- They can select HSN codes only from a dropdown list.

- A customized description mentioned in HSN master will auto-populate in a new filed called "Description as per HSN Code".

Click Here To Know More About Reporting of HSN Codes in GSTR-1

CAclubindia

CAclubindia