1) Meaning of Small Scale Exemption.

Under the provisions of the Central Excise Act a Small Scale Industry is one whose aggregate value of Turnover does not exceed Rs. One Hundred and Fifty Lakhs made on or after the 1st day of April in any financial year.

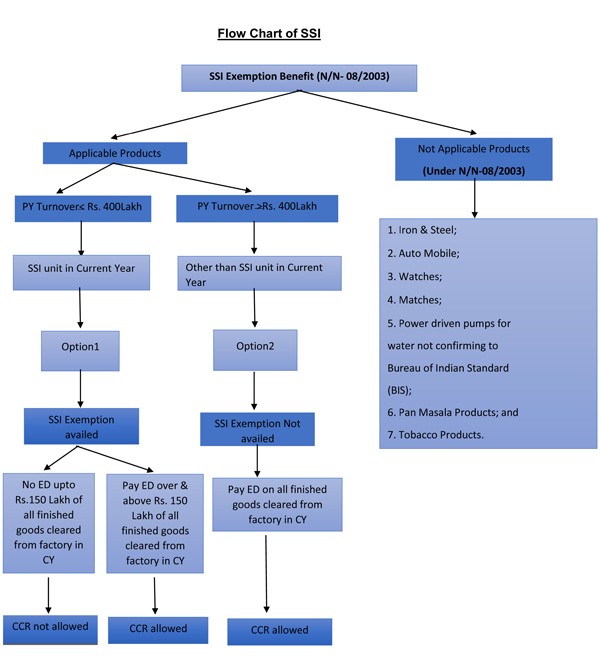

2) Products covered under the SSI Exemption Notification.

The exemption to be given to SSIs are not applicable for all the goods. The benefit of the said notification is restricted to the products listed in the notification. The notification covers most of the products to fulfill the intension of the notification.

However tobacco products, pan masala, watches, matches, aluminium pattis/patta, steel pattis/pattas and some textile products are specifically excluded from SSI exemption.

3) Determining the aggregate value of clearances for home consumption of Rs. 150 Lakh.

For the purpose of determining the first clearances upto an aggregate value not exceeding Rs.150 Lakh made on or after the 1st day of April in any financial year, the following clearances shall not be taken into account:

a) Clearances exempt from the excise duty:

Clearances, which are exempt from the whole of the excise duty leviable thereon (other than an exemption based on quantity or value of clearance) under any other notification or on which no excise duty is payable for any other reason.

b) Clearances bearing the brand name or trade name of another person:

Clearances bearing the brand name or trade name of another person, which are ineligible for the grant of this exemption.

c) Clearances of intermediate goods/ goods captively consumed in case the final products is eligible for SSI exemption:

Clearances of the specified goods which are used as inputs for the further manufactures of any specified goods within the factory of production of the specified goods. Here specified goods are those goods, which are eligible for SSI exemption.

d) Export clearances:

Clearances meant for export.

4) Determining the aggregate value of clearances for home consumption of Rs.400 Lakh.

For the purpose of determining the aggregate value of clearances of all excisable goods for home consumption, i.e. Rs.400 Lakh, the following clearances shall not be taken into account:

a) Clearances to FTZ/SEZ/100% EOU/EHTP/STP/UNO/International organization.

i. Clearances of excisable goods without payment of duty-

ii. to a unit in a free trade zone (FTZ);or

iii. to a unit in a special economic zone (SEZ);or

iv. to a hundred percent export-oriented undertaking (100% EOU);or

v. to a unit in an Electronic Hardware Technology Park or Software Technology Park (EHTP/STP);or

vi. supplied to the United Nations Organization (UNO) or an international Organization for their official use or supplied to projects funded by them, on which exemption of duty is available under Notification No. 108/95-C.E., dated 28.08.1995.

b) Clearances bearing the brand name or trade name of another person.

Clearances bearing the brand name or trade name of another person, which are ineligible for the grant of this exemption.

c) Clearances of intermediate goods/ goods captively consumed in case the final product is eligible for SSI exemption.

Clearances of the specified goods which are used as inputs for further manufacture of any specified goods within the factory of production of the specified goods. Here, specified goods are those goods, which are eligible for SSI exemption.

d) Clearances exempt under specific job work notifications.

Clearances which are exempt from the whole of the excise duty leviable thereon under specific jib work notifications, viz. Notification No. 214/86- C.E., dated 25.03.1986 or No. 83/94- C.E., dated 11.04.1994 .

e) Export clearances.

Clearances meant for exports.

Points which merit consideration.

1. Export to Nepal and Bhutan is not considered as exports. It is taken as clearance for home consumption. Thus, export turnover of Nepal and Bhutan shall be included for determining the limit of Rs. 150 Lakh as well as Rs. 400 Lakh.

2. For computing the turnover of Rs. 150 Lakh, the clearances of goods exempted under any other notification is to be excluded. It is important to note here that while computing the limit of Rs. 400 Lakh, turnover of goods exempted under any other notification ( except clearances to FTZ, SEZ, 100% EOU, EHTP/STP, UN, etc. and specific job work notifications) has to be included.

5) How is turnover/aggregate clearances of Rs.400 Lakh for previous year determined?

Typical format for computation:

|

Particulars |

Rs. |

|

Goods cleared with payment of excise duty |

X |

|

ADD (if not included in the above) |

|

|

Exempted turnover (other than SSI or job Work notification) |

X |

|

Goods produced in rural areas with the brand name of others |

X |

|

Export to Nepal or Bhutan |

X |

|

Captive consumption (if final product is exempt) |

X |

|

LESS (if included in the above) |

|

|

Export turnover |

X |

|

Clearances to EOU/SEZ/EHTP/STP/UN |

X |

|

Non excisable goods |

X |

|

Goods manufactured with brand name of others on payment of duty |

X |

|

Job Work u/n no. 214/86, 83/94, 84/94, etc |

X |

|

Export under bond through merchant exporter |

X |

|

BALANCE: TURNOVER/AGGREGATE CLEARANCES (Rs.) |

X |

6) Declaration to be filed on reaching specified limit.

a) SSI units whose turnover are more specified limit (at present Rs.90 Lakh) but less than exemption limit (i.e. Rs.150 Lakh) have to file a declaration in the prescribed form.

b) Such declaration has to be filed only once in the lifetime of the assessee (and not every year).

7) Registration

SSI units whose turnover is less than Rs.150 Lakh are exempted from registration. Once the exemption limit exceeds, the unit shall compulsory gets registered with the central Excise authorities.

?

?

CAclubindia

CAclubindia