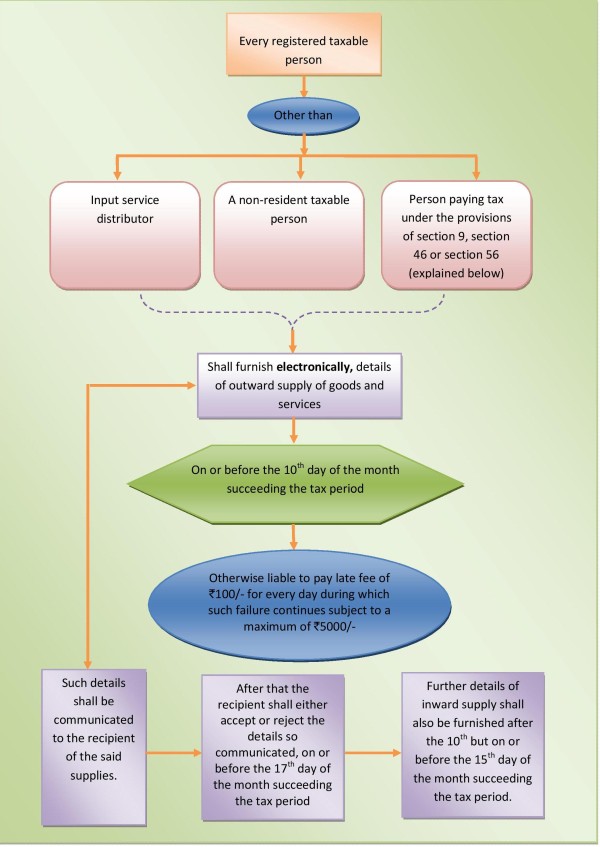

A. TIME LIMIT OF FURNISHING DETAILS OF INWARD/OUTWARD SUPPLY: It is explained as below:

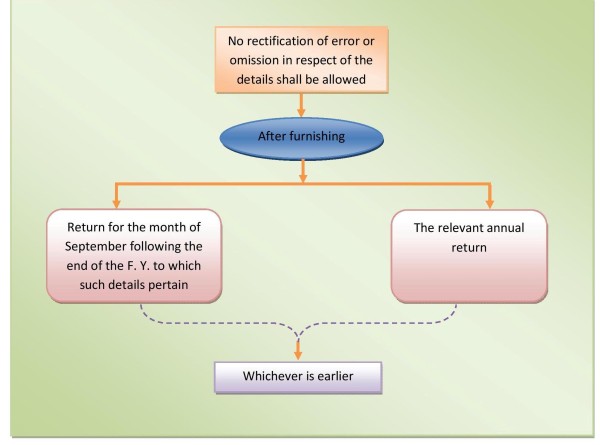

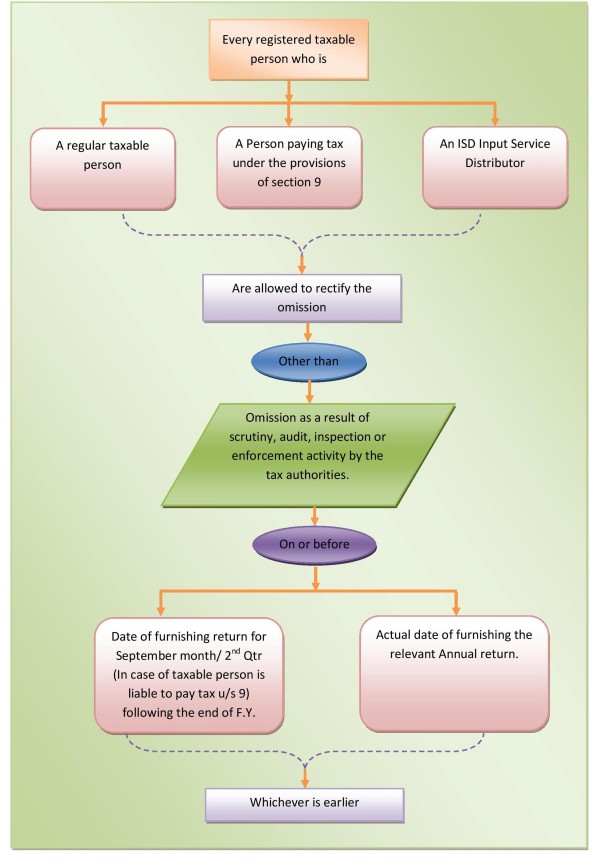

B. TIME LIMIT FOR RECTIFICATION OF ERROR OR OMISSION IN THE DETAILS :

Where any mismatch found by the recipient in the details furnished by the supplier due to any error or omission then rectification thereof shall be allowed within the time period as discussed in the below diagram:

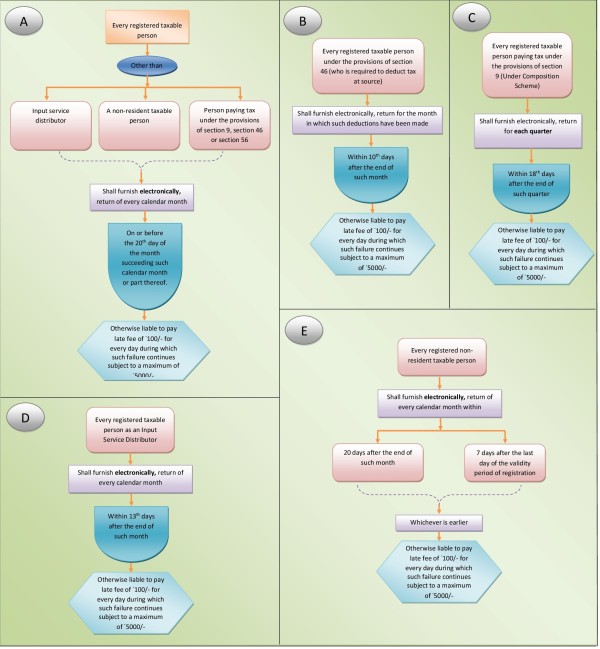

C. TIME LIMIT FOR FURNISHING RETURNS: It is explained in the following diagram:

D.PAYMENT OF TAX : Every registered taxable person is required to pay due tax on or before date of furnishing return.

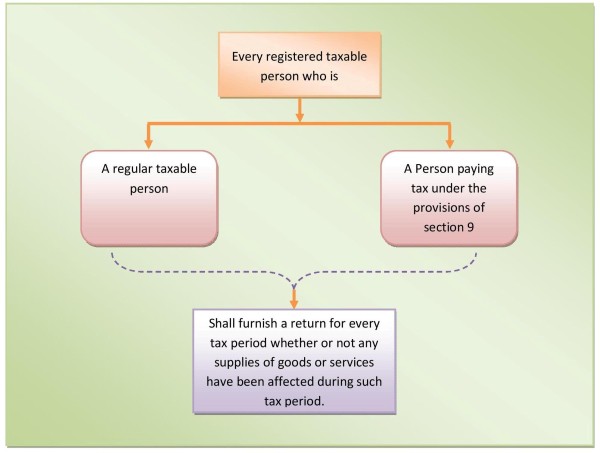

E. MADATORY NIL RETURNS:

F. RECTIFICATION IN RETURN: It is explained in the following diagram:

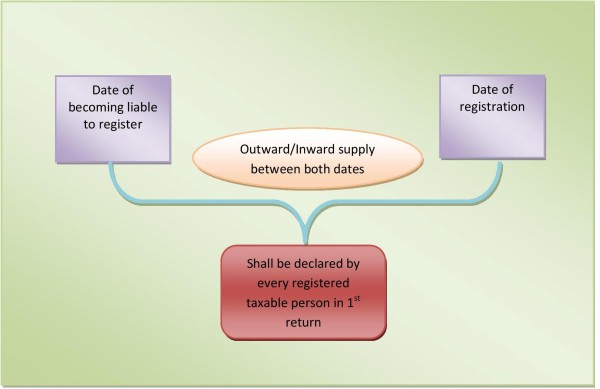

G. FIRST RETURN: It is the return which is furnished just after granting the registration. The provision relating to the first return are explained as below:

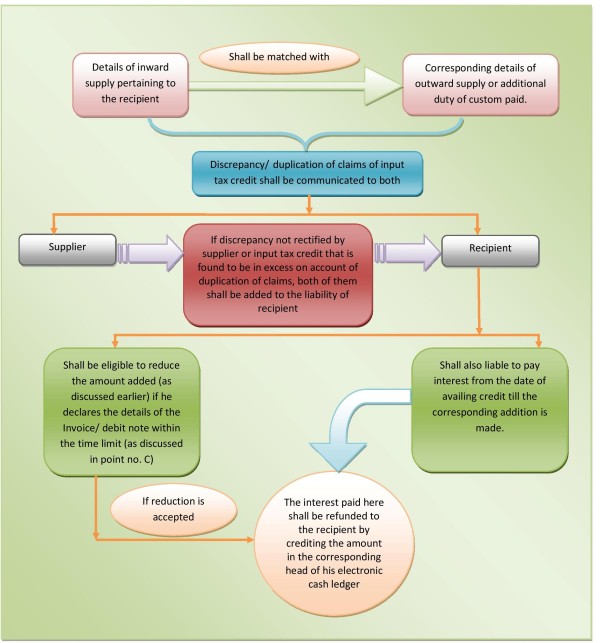

H. MATCHING CONCEPT: It is explained in the following diagram:

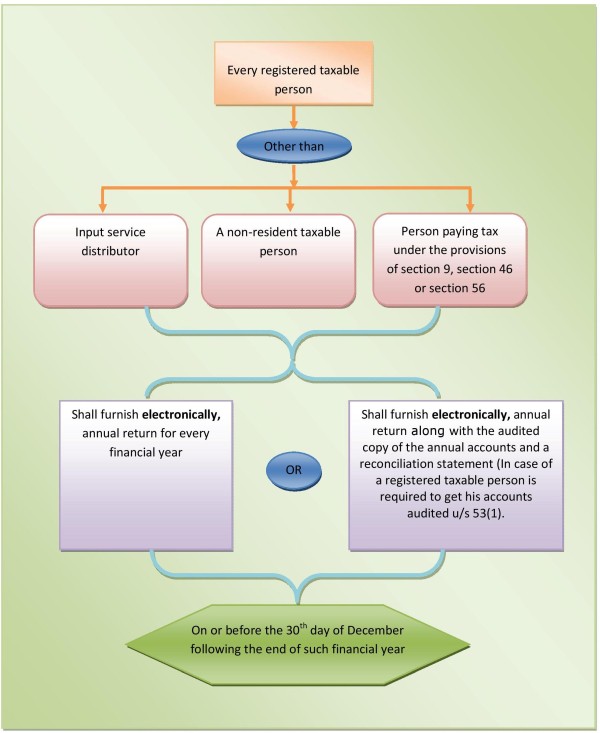

I. ANNUAL RETURN: It is explained in the following diagram:

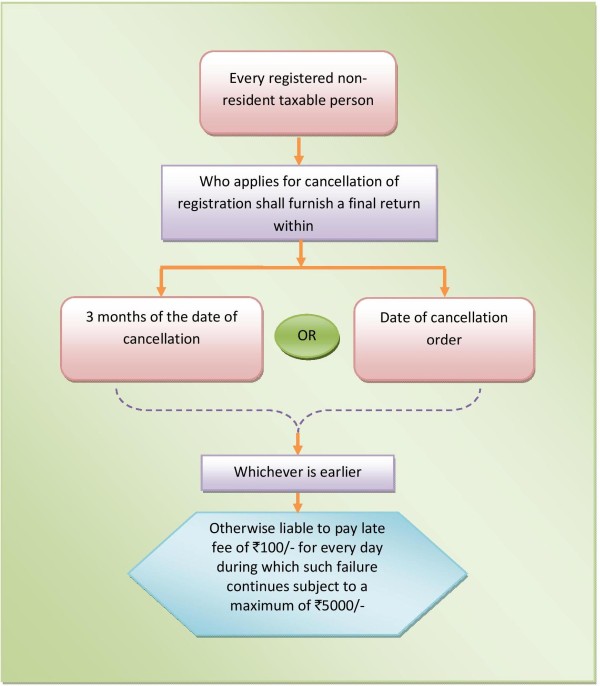

J. FINAL RETURN: It is explained in the following diagram:

CAclubindia

CAclubindia