Introduction

The Provisions of voluntary winding up have been removed from the Companies Act, 2013 and are now governed by the IBC, 2016. Ministry of Corporate Affairs vide notification dated 30th March, 2017 notified Section 59 of the Code which is relating to Voluntary Liquidation of Corporate persons. On the very next day, the Insolvency and Bankruptcy Board of India (IBBI) vide its notification dated 31st March 2017, notified the Insolvency and Bankruptcy Board of India (Voluntary Liquidation Process) Regulations, 2017 which will come into effect from 1st April 2017.

Who may apply for voluntary liquidation?

A corporate person who intends to liquidate itself voluntarily which has not committed any default may initiate voluntary liquidation proceedings under the provisions of this Chapter. [Section 59(1)] So, Any Company or LLP which has not defaulted in payment and have a full capacity to repay debt can apply for voluntary liquidation.

Pre-liquidation Process

Declaration of Solvency

A declaration from majority of the directors of the company verified by an affidavit stating that:

- They have made a full inquiry into the affairs of the company and they have formed an opinion that either the company has no debt or that it will be able to pay its debts in full from the proceeds of assets to be sold in the voluntary liquidation; and

- The company is not being liquidated to defraud any person;

The above declaration shall be accompanied with the following documents:

- Audited financial statements and record of business operations of the company for the previous 2 years or for the period since its incorporation, whichever is later;

- A report of the valuation of the assets of the company, if any prepared by a registered valuer;

Members Approval

A special resolution of the members of the company in a general meeting requiring the company to be liquidated voluntarily and appointing an insolvency professional to act as the liquidator must be passed within 4 weeks of declaration of solvency;

Creditors Approval

If the company owes any debt to any person, Creditors representing two thirds in value of the debt of the company shall approve the resolution passed for voluntary liquidation within seven days of such resolution.

Intimation to ROC and IBBI

The company shall notify the ROC and the IBBI about the resolution passed to liquidate the company within 7 days of such resolution or the subsequent approval by the creditors, as the case may be. [Section 59(4)]

Voluntary Liquidation Commencement Date

The voluntary liquidation proceedings in respect of a company shall be deemed to have commenced from the date of passing of the special resolution, subject to the approval of the creditors. [Section 59(5)]

Voluntary Liquidation Process

Public Announcement

Liquidator shall make public announcement within 5 working days of his appointment to submit claims within 30 days. It must be published in one English daily and one regional daily newspapers wherein registered office of the corporate person is situated. It must also be posted in the website of corporate persons, if having. It must be sent to the IBBI via e-mail public.ann@ibbi.gov.in for posting it in board's website.

Public Announcement must contain the following:

- Liquidation commencement date;

- Name, Address, Contact number, Registration number of liquidator;

- Mode of submission of claim;

- Last date of submission of claim;

Opening of Bank Account

A new bank account with scheduled bank must be opened with the word 'In Liquidation' at last after the name of corporate person for receiving and paying settlement amount. Each and every financial transaction must be settled through these account.

Claims Collection, Segregation, Acceptance And Rejections

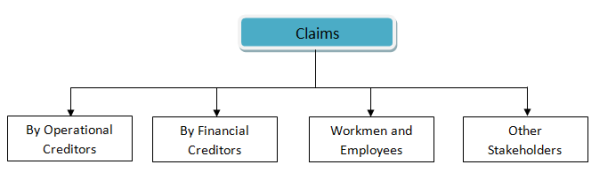

Claims

Claim means

- A right to payment whether or not such right is reduced to judgment, fixed, disputed, undisputed, legal, equitable, secured or unsecured;

- A right to remedy for breach of contract under any law for the time being in force, if such breach gives rise to a right to payment, whether or not such right is reduced to judgment, fixed, disputed, undisputed, legal, equitable, secured or unsecured;

Claim by Operational Creditors

Operational Creditor other than workman or employee shall submit proof of claim to the liquidator in person, by post or electronic means in Form B of schedule 1 of Voluntary Liquidation Process Regulation.

Claim by Financial Creditors

A person claiming to be a financial creditor of the corporate person shall submit proof of claim to the liquidator in electronic means in Form C of Schedule I.

Claim by Workmen and Employees

A person claiming to be a workman or an employee of the corporate person shall submit proof of claim to the liquidator in person, by post or by electronic means in Form D of Schedule I. Where there are dues to numerous workmen or employees of the corporate person, an authorized representative may submit one proof of claim for all such dues on their behalf in Form E of Schedule I.

Claim by Other Stakeholders

A person, claiming to be a stakeholder other than those above, shall submit proof of claim to the liquidator in person, by post or by electronic means in Form F of Schedule I.

Formats Prescribed in Schedule 1 of IBBI (Voluntary Liquidation Process) Regulations, 2017

|

Form Name |

Particulars |

|

Form A |

Public Announcement |

|

Form B |

Proof of claim by Operational creditors except by workmen & employees |

|

Form C |

Proof of claim by financial creditors |

|

Form D |

Proof of claim by workmen & employees |

|

Form E |

Proof of claim by authorized representative of workmen & employees |

|

Form F |

Proof of claim by any other stakeholder |

Process flowchart of Voluntary Liquidation

Convening Board Meeting

• To Approve Voluntary Winding up;

• To Approve Declaration of Solvency to be filled with ROC and IBBI;

• To Appoint Insolvency Professional to act as Liquidator and Registered Valuer,

Subject to Shareholder' approval;

• To Approve notice calling General Meeting for consideration of Voluntary

winding up, appointment of Liquidator and Registered valuer;

Filing of Declaration of Solvency

Filing of 'Declaration of Solvency' with ROC in form e-GNL-2 verified by an Affidavit signed by majority of Directors along with following attachments:

(i) Latest 2 years audited financial statements;

(ii) Valuation Report, if any, prepared by Registered Valuer;

Sending Notice of EGM to all Shareholders

Convening EGM within 4 weeks of filing Declaration of Solvency

• To Approve Voluntary Winding up;

• To Appoint Insolvency Professional to act as Liquidator and Registered Valuer

and fix their remuneration;

Creditors' NOC

Approval from Creditors' representing 2/3rd value of debt is required either by way of holding meeting or NOC from each creditors.

Public Announcement

P.A must be made within 5 working days from the date of appointment of Insolvency Professional.

Intimation to IBBI and ROC

Within 7 days of public announcement, Intimation must be sent to IBBI and ROC.

Opening of 'In Liquidation' Bank Account

A new bank account with scheduled bank must be opened with the word 'ABC Private Limited-In Liquidation' for receiving and paying settlement amount.

Collection and Verification of Claims

All claims must be made within 30 days of public announcement. Liquidator must verify the correctness of each claim and prepare a list of stakeholders.

Preparation of Preliminary Report

Based on claims received, liquidator needs to prepare Preliminary Report within 45 days from the date liquidation commencement date containing capital structure, assets and liabilities, claims received etc.

Distribution of Proceedings

Liquidator needs to sell all the assets by auction or through direct party, realize amount from creditor and distribute proceedings among all the stakeholders.

Submission of Final Report

Liquidator must prepare a final report containing liquidation proceedings and submit it to the ROC, IBBI and NCLT. Based on final report and application for dissolution, NCLT pass an order for dissolution of corporate entity.

Filing of order with ROC

Copy of order received from NCLT needs to be filled with ROC in e-form INC-28 for dissolution of a corporate entity.

Role of Adjudicating Authority i.e. NCLT in whole Process

The Adjudicating Authority i.e. NCLT is competent to declare the corporate person as dissolved after due liquidation and distribution of its assets. The NCLT comes into the picture only at the final stage of liquidation after application for Dissolution of Corporate Person is made by Liquidator after distribution of Liquidation assets of the Corporate Person by following the procedure stipulated under the Code.

Roles and Responsibilities of Liquidator in whole Process

Liquidator of corporate person is assigned with the following task

• To verify claims of all the creditors;

• To carry on the business of the corporate debtor for its beneficial

liquidation as he considers necessary;

• To value, sell, recover and realize all assets of and monies due to such

corporate person in a time bound manner;

• To open a bank account for the purpose of receiving all moneys due to the

corporate person;

• To pay and settle with the creditors of the corporate person;

• To obtain any professional assistance from any person or appoint any

professional, in discharge of his duties, obligations and responsibilities;

• To maintain registers specified under regulation 10 of schedule 2;

• To distribute proceeds to the stakeholders within a period of 6 (six) months

of receipt of the proceeds; and

• To preserve a physical or an electronic copy of the reports, registers and

books of account for at least 8 (eight) years after the dissolution of the

corporate person, either with himself or with an information utility.

Unclaimed Proceeds of Liquidation (Regulation 39)

The liquidator shall apply to the NCLT for an order to

transfer into the Companies Liquidation Account to the Public Account of India,

any unclaimed proceeds of liquidation or undistributed assets or any other

balance payable to the stakeholders on the date of the order of dissolution.

A person claiming to be entitled to any money paid into

the Companies Liquidation Account may apply to the Board for an order for

payment of the money claimed; which may, if satisfied that such person is

entitled to the whole or any part of the money claimed, make an order for the

payment to that person of the sum due to him, after taking such security from

him as it may think fit.

Any money paid into the Companies Liquidation Account,

which remains unclaimed thereafter for a period of fifteen years shall be

transferred to the general revenue account of the Central Government.

CAclubindia

CAclubindia