WHAT IS A VOLUNTARY LIQUIDATION

There are a few companies whose purpose for formation has been fulfilled and therefore the Management feels that there is no point in continuing the Company as it involves a lot of cost, compliances and time. In such a scenario it is feasible to Voluntarily Liquidate the Company.

Voluntary liquidation is a self-imposed wind-up and dissolution of a Corporate Person that has been approved by owners.

The purpose of a voluntary liquidation is to:

• terminate a Corporate Person's operations;

• wind up its financial affairs;

• dismantle its corporate structure in an orderly fashion, while paying back creditors according to their assigned priority.

The Insolvency and Bankruptcy Code, 2016 (IBC) allows for 'voluntary liquidation' of Corporate Persons who are solvent i.e. the Companies/ entities who have assets that are sufficient to pay off all the outstanding liabilities as on the Date of Commencement of Voluntary Liquidation.

Therefore, Solvent companies can now file for voluntary liquidation as the procedure gets simpler with the introduction of the Insolvency and Bankruptcy Code, 2016 (IBC). As IBC also permits for 'voluntary liquidation' for Corporate Persons who are healthy and have the capacity to repay all their dues. This opportunity is offered to companies which either have zero debt or are confident of meeting all the debt obligations from the sale of assets of the firm during liquidation.

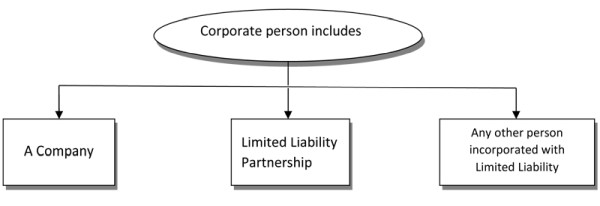

The voluntary liquidation of a corporate person under the Code has a much wider scope as it includes companies, limited liability partnerships and any other persons incorporated with limited liability. The New Regulations provides the process for initiating voluntary liquidation by a corporate person i.e. companies, limited liability partnerships and any other persons incorporated with limited liability.

It should be noted that the Companies going under voluntary liquidation should not have any prosecutions pending from any of the Regulatory Authorities.

INITIATION OF 'VOLUNTARY LIQUIDATION'

The initial decision to cease the operations of a corporate person is taken by the Corporate Person's leadership which is followed by the approval of its ownership in a General Meeting.

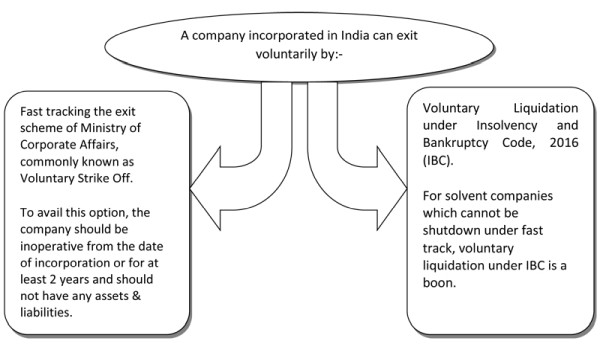

MODES OF VOLUNTARY EXIT OPTIONS

COMMENCEMENT OF REGULATIONS FOR VOLUNTARY LIQUIDATION UNDER IBC

Voluntary Liquidation, now made part of Insolvency and Bankruptcy Code, 2016, was earlier under the Companies Act, 1956. The Insolvency and Bankruptcy Board of India (Voluntary Liquidation Process) Regulations, 2016, have been notified on 31st March, 2017 and came into force with effect from 1st April, 2017.

SUSPENSION OF LIQUIDATION PROCESS

Where the liquidator is of the opinion that the voluntary liquidation is being done to defraud a person or that the corporate person will not be able to pay its debts in full from the proceeds of assets to be sold in the voluntary liquidation, he shall make an application to the Adjudicatory Authority to suspend the process of voluntary liquidation and pass any such orders as it deems fit.

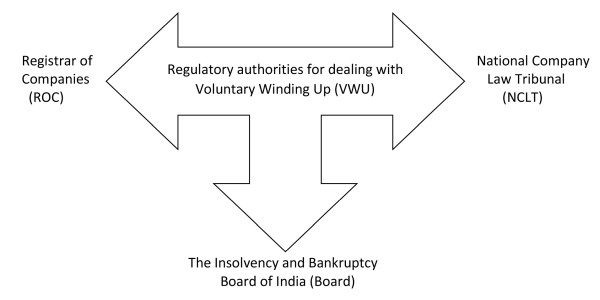

CONCERNED REGULATORY AUTHORITIES

PROCEDURE

Under New Regulations, the Government has also reduced the time period of various compliances.

Some of the significant things to be kept in mind and the entire procedure for bringing a lawful end to life of company is as under:

• There is no need to give government gazette unlike earlier acts;

• There are no specific provisions regarding ceasing of powers of board of directors;

• As per Section 59 of the Code read with the Regulations, any corporate entity may initiate a voluntary liquidation proceeding if it satisfies all the following conditions:

1. It has not committed any default;

2. If majority of the directors or designated partners or persons responsible for exercising its corporate powers, if the corporate person is not a company or a limited liability partnership make a declaration verified by an affidavit to the effect that as per Section 59 (3) of Insolvency and Bankruptcy Code, 2016, read with Regulation 3 (1) of IBBI (Voluntary Liquidation) Regulations, 2017:

(i) the corporate person has no debt or it will be able to pay its debts in full out of the sale proceeds of its assets under the proposed and

(ii) liquidation is not initiated to defraud any person;

3. Such declaration is accompanied by the audited financial statements and record of business operations of the corporate person for the previous two years or for the period since its incorporation, whichever is later along with valuation report of the assets of the corporate person, prepared by a registered valuer;

• Step I: Submission of declaration to ROC, affirming that the company will be able to pay its dues and is not being liquidated to defraud any person;

• Step II: Within a period of 4 weeks of the aforesaid declaration(s) passing of special resolution by the partners or contributories, as the case may be, of the corporate person requiring the corporate person to be liquidated and appointing an insolvency professional as a liquidator pursuant to Regulation 3 (3) of IBBI (Voluntary Liquidation) Regulations, 2017 (Contributories' Resolution) ("Approval"). The resolution for appointing the Liquidator shall contain the terms and conditions of the appointment of the insolvency professional, including the remuneration due to him.

• Step III: If a corporate person owes debts, in such case Creditor(s) representing two third in value of the total debt owed by the corporate person, approve the Contributories' Resolution within 7 (seven) days of its passage (Creditors' Approval) or provide a No Objection Certificate;

Effect of the resolution: As per the provisions of Section 59 (5) of Insolvency and Bankruptcy Code, 2016, read with Regulation 5 and Regulation 6 of IBBI (Voluntary Liquidation) Regulations, 2017 the voluntary liquidation proceedings in respect of a corporate person shall be deemed to have commenced from the date of passing of the Contributories' Resolution (Liquidation Commencement Date). Provided that the corporate state and corporate powers of the corporate person shall continue until it is dissolved.

On and from the Liquidation Commencement Date, the corporate person shall cease to carry on its business except as far as required for the beneficial winding up of its business.

• Step IV: In compliance with Regulation 14 of IBBI (Voluntary Liquidation) Regulations, 2017, Public announcement is given by the Liquidator Form A of Schedule I inviting claims of all stakeholders, within 5 days of such Approval, in 2 newspapers as well as on website of the corporate person, if any; and also on the website of the Board;

• Step V: Intimation to the ROC and the Board about the Approval of partners or contributories to liquidate the company or the subsequent approval by the creditors, as the case may be, within 7 days of such Approval;

• Step VI: Intimation to the Income Tax Department and any other Regulatory Authority as may be applicable and obtaining a No Objection Certificate;

• Step VII: Preparation of preliminary report about the capital structure, estimates of assets and liabilities, proposed plan of action etc., and submission of the same to a corporate person within 45 days of such Approval, whether the same is to be given to shareholders or the directors of the Company is not clearly mentioned;

• Step VIII: Verification of claims, within 30 days from the last date for receipt of claims and preparation of list of stakeholders by the Liquidator, within 45 days from the last date for receipt of claims; The list of stakeholders prepared as per Regulation 30 of IBBI (Voluntary Liquidation) Regulations, 2017, shall be available for inspection by the persons who submitted proofs of claim, members, partners, directors and guarantors of the corporate person and also shall be displayed on the website, if any, of the corporate person.

• Step IX: Sale of assets, recovery of monies due to corporate person, realization of uncalled capital or unpaid capital contribution in compliance with the provisions of Regulation 31 to 33 of IBBI (Voluntary Liquidation) Regulations, 2017;

• Step X: Pursuant to Regulation 34 of IBBI (Voluntary Liquidation) Regulations, 2017 open a bank account in the name of the corporate person followed by the words 'in voluntary liquidation', in a scheduled bank, for the receipt of all moneys due to the corporate person;

• Step XI: Distribution of the proceeds from realization within 6 months from the receipt of the amount to the stakeholders after deduction of Liquidation cost;

• Step XII: Closure of the bank account opened for liquidation;

• Step XIII: Submission of final report (inter alia consisting of audited liquidation accounts, statement(s) demonstrating details of the disposed assets and their manner of sale, and statement(s) that all debt has been discharged and sufficient provision has been made in case of any adverse outcome of a pending litigation) by the liquidator to the corporate person, ROC, Board and the NCLT in compliance with Regulation 38 of IBBI (Voluntary Liquidation) Regulations, 2017;

• Step XIV: As soon as the the affairs of the company have been completely wound up and its assets fully liquidated, without further ado, an application under section 59(7) of Insolvency and Bankruptcy Code, 2016, read with Regulation 38(3) of IBBI (Voluntary Liquidation) Regulations, 2017 shall be made by the liquidator to the NCLT for dissolution of the Corporate Person;

• Step XV: Pursuant to the application by the liquidator, the NCLT shall pass an order for dissolution and the entity shall stand dissolved from the date of NCLT's order as mentioned in section 59(8) of Insolvency and Bankruptcy Code, 2016

• Step XVI: Submission of a copy of the NCLT order regarding the dissolution, to the concerned ROC within 14 days of the receipt of order.

• Formats Prescribed under IBBI (Voluntary Liquidation Process) Regulations, 2017

Form Name Particulars

Form A Public Announcement

Form B Proof of claim by Operational creditors except by workmen & employees

Form C Proof of claim by financial creditors

Form D Proof of claim by workmen & employees

Form E Proof of claim by authorized representative of workmen & employees

Form F Proof of claim by any other stakeholder

TIMELINE FOR COMPLETION

It may take a minimum of 12 months or lesser than that, to complete the process. However, in cases where the process of Liquidation goes beyond a period of 12 months, liquidator has to present the status report along with audited account of the voluntary liquidation showing the receipts and payments pertaining to liquidation since the liquidation commencement date in compliance with Regulation 9 (1) of IBBI (Voluntary Liquidation) Regulations, 2017.

The process of Voluntary Liquidation is simple as compared to the earlier regulations, however it being a new Regulation, understanding and practically implementing the same is time consuming and tricky.

CAclubindia

CAclubindia