With the Notification 50/2018 (Central Tax) dated 13.09.2018, the provision for TDS under Section 51 of the CGST Act was enforced from 01.10.2018. This notification outlined the entities covered by this provision and specified the effective date for the implementation of TDS under GST.

Governing provisions of TDS under GST

- Sec 51 of CGST Act

- Rule 60(6) of CGST Rule as on date

- Rule 66 of CGST Rule as on date

Some pointers about TDS under GST:-

- 1% CGST (and 1% SGST) of

- Amount Paid or Credited to only the intra state supplier, including URD supplier

- Of taxable

- Goods or services or both

- If the value of such supply [Read with point 8, 9 & 10]

- Under a contract

- Exceeds 2.5 lakhs

- Value excludes GST and Cess mentioned in the invoice.

- So, Toll, other govt. fees or taxes to be included while calculating value

- So, TDS shall not be deducted on the GST component of invoice.

- So, TDS shall not be deducted for inter-state sale

GST TDS Return, Dates & GST TDS Credit

- The amount deducted to be paid & return GSTR 7 to be filed by 10th of the following month

- Details of deduction shall be made available electronically

- To each of the supplier [Means at GSTIN level]

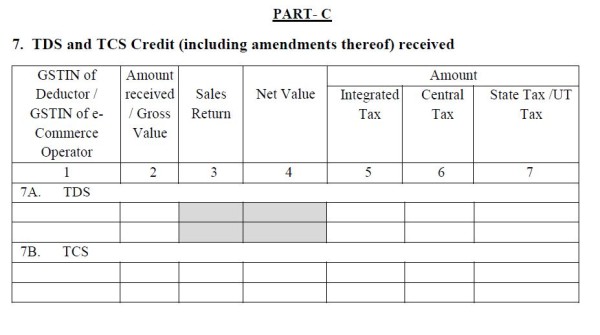

- In Part C of R. 2A or R. 4A and,

- On the common portal

- Deductee may include the same in FORM GSTR-2. [R. 60(6)]

- Deductee shall claim Credit in Electronic Cash ledger [Sec 51(5)]

- TDS certificate to be furnished to the deductee by 15th of the next month as per Rule 66(3)

- GST TDS Certificate shall be made available to the deductee, electronically on the common portal in R 7A

| Note : GSTR-7 is a return filed by the entity deducting TDS under GST. It includes details of TDS deducted, liability, and payments. Deductees can claim TDS as Input Tax Credit to offset output tax liability. TDS details are available in GSTR-2A, and a certificate (GSTR-7A) is issued based on GSTR-7 filing. |

Interest, Penalty, fees under GST TDS

- Late fee of Rs 100/- under CGST (Similar under SGST), maximum Rs 5000/-

- If failed to furnish TDS certificate as per Rule 66(3)

- It means late fees cannot be levied if GST TDS Certificate is not been issued due to portal or other issues.

- For non-payment of GST TDS by 10th to attract 18% PA interest.

Extract of GSTR 2A, (it is unclear why IGST column is there in R7 & R7A. Is IGST col in R2A for TCS purpose?):

The author can also be reached at cp171185@gmail.com

Disclaimer: The contents of this document are solely for informational purpose & personal view. It does not constitute professional advice or a formal recommendation. It is also not meant to portray anything against the GST law or any other law of the land for that matter. While due care has been taken in preparing the document, the existence of mistakes & omissions herein are not ruled out. The author does not accept any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied without express written permission of the author.

CAclubindia

CAclubindia