The Companies Act, 2013, requires the Board of Directors of every company to attach its report to the financial statements to be laid before the members at the annual general meeting, this Standard prescribes a set of principles for making disclosures in the Report of the Board of Directors of a company and matters related thereto.

To promote the standardised practices in preparation of Board's Report, the ICSI has issued SS-4 effective from 1st October 2018 for Voluntary adoption by the Companies.

Prescribed Format of Board of Directors Report

Part I: Disclosures

The Report shall include the following:

1. Company-Specific Information:

- Financial summary and highlights

- Amount, if any, which the Board proposes to carry to any reserves.

- Dividend

- Major events occurred during the year.

- Details of revision of financial statement or the Report

2. General Information:

- This Information contains Overview of the industry and changes in the industryduring the last year.

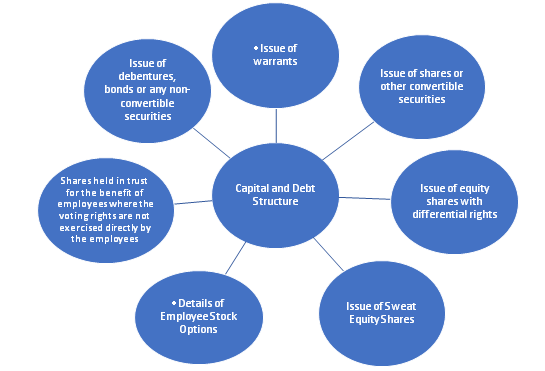

3. Capital and Debt Structure:

4. Investor Education and Protection Fund (IEPF):

- Details of the transfer/s to the IEPF made during the year.

- Details of the resultant benefits arising out of shares already transferred to the IEPF.

- Year wise amount of unpaid/unclaimed dividend lying in the unpaid account upto the Year and the corresponding shares, which are liable to be transferred to the IEPF, and the due dates for such transfer.

- The amount of donation, if any, given by the company to the IEPF

5. Management:

6. Disclosures Relating to Subsidiaries, Associates and Joint Ventures:

- Report on performance and financial position of the subsidiaries, associates and joint ventures

- Companies which have become or ceased to be subsidiaries, associates and joint ventures.

7. Details of Deposits:

- The disclosure shall include details of deposits accepted during the year, deposits remaining unpaid or unclaimed as at the end of the year and such other information.

8. Particulars of Loans, Guarantees and Investments:

- Particulars of the loans given, investments made, guarantees given or securities provided during the year and the purpose for which the loans / guarantees / securities are proposed to be utilised by the recipient of such loan / guarantee / security.

9. Particulars of Contracts or Arrangements with Related Parties:

- contracts/arrangements / transactions with related parties which are not at arm's length basis, material contracts/arrangements / transactions with related parties which are at arm's length basis.

- contracts/arrangements with related parties which are not in the ordinary course of business and justification for entering into such contract.

10. Corporate Social Responsibility (CSR):

- The Report shall disclose CSR Policy and CSR initiatives taken during the year.

11. Conservation of Energy, Technology Absorption, Foreign Exchange Earnings and Outgo

12. Risk Management

- The disclosure shall include development and implementation of a risk management policy for the company.

13. Details of Establishment of Vigil Mechanism

14. Material Orders of Judicial Bodies /Regulators:

- Details of significant and material orders passed by any Regulator, Court, Tribunal, Statutory and quasi-judicial body.

15. Auditors:

- Names of the Statutory Auditor, Cost Auditor and Secretarial Auditor and details of any change in such Auditors, during the year

16. Explanations in Response to Auditors' Qualifications:

- The Report shall include explanations or comments on every qualification, reservation or adverse remark or disclaimer made in the Auditor's Report and the Secretarial Auditor's Report.

17. Compliance with Secretarial Standards:

- This shall include a statement on compliance of applicable Secretarial Standards and other Secretarial Standards voluntarily adopted by the company.

18. Corporate Insolvency Resolution Process Initiated Under the Insolvency and Bankruptcy Code, 2016 (IBC):

- Details of any application filed for corporate insolvency resolution process.

19. Failure to Implement Any Corporate Action:

- In case the company has failed to complete or implement any corporate action within the specified time limit.

20. Annual Return:

- A copy of the annual return shall be placed on the website of the company, if any.

21. Other Disclosures:

- Key initiatives or reasons for delay, if any, in holding the AGM and such other Disclosures.

22. Disclosures Pertaining to The Sexual Harassment of Women at The Workplace (Prevention, Prohibition and Redressal) Act, 2013:

- A statement regarding company has complied with the provision relating to the constitution of Internal Complaints Committee under the Sexual Harassment of Women at the Workplace (Prevention, Prohibition and Redressal) Act, 2013And details of number of cases Filed.

PART II: Other Requirements

23. Approval of the Report-to be approved in duly convened Board meeting

24. Signing of the Report-Chairman of the company, if authorised in that behalf by the Board or by two Directors one of whom shall be the Managing Director or in the case of a One Person Company, by one Director

25. Dissemination

26. Filing and Submission of The Report

- The Report along with the audited financial statement of the company shall be filed with the Registrar of Companies.

CAclubindia

CAclubindia