194C. (1) Any person responsible for paying any sum to any resident (hereafter in this section referred to as the contractor) for carrying out any work (including supply of labour for carrying out any work) in pursuance of a contract between the contractor and a specified person shall, at the time of credit of such sum to the account of the contractor or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode, whichever is earlier, deduct an amount equal to—

(i) one per cent where the payment is being made or credit is being given to an individual or a Hindu undivided family;

(ii) two per cent where the payment is being made or credit is being given to a person other than an individual or a Hindu undivided family,

of such sum as income-tax on income comprised therein.

(2) Where any sum referred to in sub-section (1) is credited to any account, whether called "Suspense account" or by any other name, in the books of account of the person liable to pay such income, such crediting shall be deemed to be credit of such income to the account of the payee and the provisions of this section shall apply accordingly.

(3) Where any sum is paid or credited for carrying out any work mentioned in sub-clause (e) of clause (iv) of the Explanation, tax shall be deducted at source—

(i) on the invoice value excluding the value of material, if such value is mentioned separately in the invoice; or

(ii) on the whole of the invoice value, if the value of material is not mentioned separately in the invoice.

(4) No individual or Hindu undivided family shall be liable to deduct income-tax on the sum credited or paid to the account of the contractor where such sum is credited or paid exclusively for personal purposes of such individual or any member of Hindu undivided family.

(5) No deduction shall be made from the amount of any sum credited or paid or likely to be credited or paid to the account of, or to, the contractor, if such sum does not exceed thirty thousand rupees :

Provided that where the aggregate of the amounts of such sums credited or paid or likely to be credited or paid during the financial year exceeds one lakh rupees, the person responsible for paying such sums referred to in sub-section (1) shall be liable to deduct income-tax under this section.

(6) No deduction shall be made from any sum credited or paid or likely to be credited or paid during the previous year to the account of a contractor during the course of business of plying, hiring or leasing goods carriages, where such contractor owns ten or less goods carriages at any time during the previous year and furnishes a declaration to that effect along with his Permanent Account Number, to the person paying or crediting such sum.

(7) The person responsible for paying or crediting any sum to the person referred to in sub-section

(6) shall furnish, to the prescribed income-tax authority or the person authorised by it, such particulars, in such form and within such time as may be prescribed.

Explanation.—For the purposes of this section,—

(i) "specified person" shall mean,—

(a) the Central Government or any State Government; or

(b) any local authority; or

(c) any corporation established by or under a Central, State or Provincial Act; or

(d) any company; or

(e) any co-operative society; or

(f) any authority, constituted in India by or under any law, engaged either for the purpose of dealing with and satisfying the need for housing accommodation or for the purpose of planning, development or improvement of cities, towns and villages, or for both; or

(g) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any law corresponding to that Act in force in any part of India; or

(h) any trust; or

(i) any university established or incorporated by or under a Central, State or Provincial Act and an institution declared to be a university under section 3 of the University Grants Commission Act, 1956 (3 of 1956); or

(j) any Government of a foreign State or a foreign enterprise or any association or body established outside India; or

(k) any firm; or

(l) any person, being an individual or a Hindu undivided family or an association of persons or a body of individuals, if such person,—

(A) does not fall under any of the preceding sub-clauses; and

(B) 47[has total sales, gross receipts or turnover from business or profession carried on by him exceeding one crore rupees in case of business or fifty lakh rupees in case of profession] during the financial year immediately preceding the financial year in which such sum is credited or paid to the account of the contractor;

(ii) "goods carriage" shall have the meaning assigned to it in the Explanation to sub-section (7) of section 44AE;

(iii) "contract" shall include sub-contract;

(iv) "work" shall include -

(a) advertising;

(b) broadcasting and telecasting including production of programmes for such broadcasting or telecasting;

(c) carriage of goods or passengers by any mode of transport other than by railways;

(d) catering;

48[(e) manufacturing or supplying a product according to the requirement or specification of a customer by using material purchased from such customer or its associate, being a person placed similarly in relation to such customer as is the person placed in relation to the assessee under the provisions contained in clause (b) of sub-section (2) of section 40A,] but does not include manufacturing or supplying a product according to the requirement or specification of a customer by using material purchased from a person, other than such customer 49[or associate of such customer].

1) Who is responsible to deduct tax u/s 194C?

Any person, other than an Individual or HUF, responsible for making payment to a resident contractor or sub-contractor for carrying out any work (including supply of labour) is liable to deduct tax at source under Section 194C.

However, an Individual or HUF, AOP/BOI is liable to deduct TDS under section 194C, if total sales, gross receipts or turnover exceed one crore rupees in case of business or fifty lakh rupees in case of profession during the financial year immediately preceding the financial year in which such sum is credited or paid.

2) Which works contract is covered under Section 194C?

Works Contract includes:

• Advertising

• Broadcasting and telecasting including production of programs for such broadcasting or telecasting

• Carriage of goods or passengers by any mode of transport other than by railways

• Catering

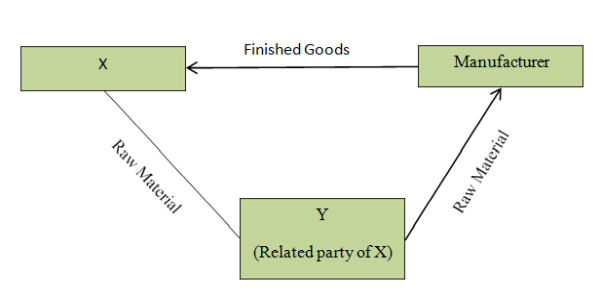

• Manufacturing or supplying a product according to the requirement or specification of a customer by using material purchased from such customer or its associate covered u/s. 40A(2)(b), but does not include manufacturing or supplying a product according to the requirement or specification of a customer by using material purchased from a person, other than such customer or associate of such customer.

In the case of work contract being manufacturing or supplying product according to the specification of customer (by using material purchased from such customer), TDS shall be deducted on the invoice value excluding the value of material purchased from such customer, if such value is mentioned separately in the invoice. Where the material component has not been separately mentioned in the invoice, TDS shall be deducted on the whole of the invoice value.

• Supply of labour for works contract.

• Current definition of "work" includes OEM Manufacturing by using material purchased from such customer but excluded if material is not purchased directly from such customer.

• Contract Manufacturing: Some Assesses were using the escape clause of the section by getting the contract manufacturer to procure the raw material supplied through its related parties. As a result, a substantial amount of income was escaping the tax net.

• Definition of "work" has been amendment for the purpose of TDS under Section 194C. To provide that in a contract manufacturing, the raw material provided by the assessee or its associate shall fall within the purview of the "work" under Section 194C.

Case Law:

• Malayalam Communications Ltd vs. Income tax Officer (TDS) [2019] 175 ITD 433 (Cochin - Trib.)

Where assessee made payments to various artists like singers, musicians etc. who participated in reality shows hosted by it as guests or judges, tax was required to be deducted at source u/s 194C.

• Principal Commissioner of Income-tax (TDS) vs. National Health & Education Society [2019] 103 taxmann.com 286 (Bom)

Where contract between assessee and Call Center operator was in nature of a 'works contract' and not of a technical or professional nature, payments towards call centre expenses would be covered u/s 194C and not u/s 194J

• CIT (TDS) vs. Saifee Hospital [2019] 104 taxmann.com 64 (Bom)

Where assessee-hospital made payments for services rendered towards maintenance of its medical equipments for proper and long functioning, it was required to deduction TDS u/s 194C not u/d 194J

• CIT vs Dabur India Ltd.[2006] 283 ITR 197 (Delhi)

P urcha s e of prin te d packing m a te rial is a ‗C ontract of Sale' and not ‗ Works contract'. Thus, not liable for TDS u/s 194C.

3) When to Deduct TDS under Section 194C?

Any person responsible for making payment to resident contractor/sub-contractor should deduct tax at the time of actual payment to the payee or at the time of credit to the accounts of the payee, whichever is earlier.

4) Rate of TDS under Section 194C

A. 1%, if payment is made to an Individual or HUF (0.75% w.e.f. 14.05.2020 to 31.03.2021)

B. 2%, if payment is made to any other person (1.5% w.e.f. 14.05.2020 to 31.03.2021) The tax shall be deducted at these rates without including the surcharge, Health & Education Cess @ 4%.

However, if PAN of recipient is not available, then tax shall be deducted at the rate of 20% in accordance with the provisions of Section 206AA.

5) When is TDS under Section 194C not applicable?

Tax is not required to be deducted in the following cases:

a. If amount is payable to a person who is engaged in business of plying , hiring or leasing goods carriages and he does not own more than 10 goods carriage vehicle's, during the financial year. Such exemption is provided only if the recipient furnishes his PAN and payer intimate's the details to IT Dept. in TDS Return.

Payments to transporters: If any person owns 10 or less goods carriage at any time during the year and he furnishes a declaration to this effect, TDS u/s.194C is not required to be deducted. [Such details of non-deduction of tax are to be furnished in Form No. 26Q] This exemption is not available if payment is made to a person merely acting as a transport agent and not a goods carriage owner.

b. If amount paid or credited does not exceed Rs. 30,000 in a single payment and Rs. 1,00,000 in aggregate during the financial year.

c. If the payment or amount credited to the contractor is for personal use.

6) Will Tax be Deductible at Source on the GST amount charged in the bill?

No tax is to be deducted on the "GST on services" component if separately charged in the bill. GST for these purposes shall include IGST, CGST, SGST and UTGST.

7) TDS at lower rate

According to Section 194C where the AO is satisfied that the total income of contractor or sub-contractor justifies the deduction of income-tax at any lower rate or no deduction of income-tax, as the case may be, the AO shall, on application made by the contractor or sub-contractor in this behalf give to him such certificate as may be appropriate.

ILLUSTRATION 1

A, an individual whose total sales in business during the year ending March 31, 2019 was Rs. 1.25 crore, paid Rs. 8 lakhs by cheque on February 15, 2020 to a contractor for construction of his business premises in full and final settlement. No amount was credited earlier to the account of the contractor in the books of A.

An individual is required to deduct tax at source if his turnover exceeds Rs. 1 Crore in the preceding financial year. In the given case, since receipts of Mr. A exceeds Rs. 1 Crore in Financial year 31.03.2019 (Preceding year), he is required to deduct tax at source on payment made to contractor i.e., on Rs. 8 Lakhs at the applicable rate in force.

ILLUSTRATION 2

|

Situations |

Whether TDS to be deducted |

|

|

1. |

Single contract of Rs. 30,000 in the year |

No |

|

2. |

Two contracts of Rs. 30,000 each in the year |

No |

|

3. |

Three contracts of Rs. 40,000 each in the year |

Tax to be deducted on Rs. 1,20,000 |

|

4. |

Single contract of Rs. 40,000 in the year |

Yes |

|

5. |

Five contracts of Rs. 14000 each in the year |

No |

|

6. |

Six contracts of Rs. 20000 each in the year |

Tax to be deducted on Rs. 1,20,000 |

|

7. |

Five contracts of Rs. 20,000 each in the year |

No |

ILLUSTRATION 3

AB Ltd has made following payments on various dates to CD Ltd. towards work done under different contracts

|

Contract |

Date of Payment |

Amount (Rs. ) |

|

1. |

05.05.2019 |

20000 |

|

2. |

06.06.2019 |

15000 |

|

3. |

08.08.2019 |

25000 |

|

4. |

10.12.2019 |

25000 |

|

5. |

29.01.2020 |

17000 |

In present case, though the value of each contract does not exceed Rs. 30,000 the aggregate amount exceeds Rs. 1,00,000 during the financial year. Hence, AB Ltd is required to deduct tax at source on the whole amount of Rs. 1,02,000 from the last payment of Rs. 17000.

ILLUSTRATION 4

A LTD. has entered into a contract to buy shirts from B Ltd. as per the designs & specifications given to it. For this A Ltd. sold necessary raw material to B Ltd. For the previous year 2019-20, B Ltd. has raised following invoices on A ltd.

|

Date |

Invoice no. |

Qty. |

Value of Raw Material |

Labour Charges |

Total Bill Rs. |

|

14/10/19 |

1020/19-20 |

10,000 |

- |

- |

60,000 |

|

31/11/19 |

1255/19-20 |

20,000 |

80,000 |

45,000 |

1,25,000 |

In present case A Ltd. is required to deduct TDS on Rs. 60000 for the invoice no. 1020/19-20 while in invoice no. 1255/19-20 TDS to be made on Rs. 45,000 only.

CAclubindia

CAclubindia