Introduction:

Secretarial Audit is a process to check compliance with the provisions of various laws and rules/regulations/procedures, maintenance of books, records etc., by an independent professional to ensure that the company has complied with the legal and procedural requirements and also followed due processes. It is essentially a mechanism to monitor compliance with the requirements of stated laws and processes.

The Objectives of Secretarial Audit

The objectives of Secretarial Audit may be briefed as under.

• To check & Report on Compliances

• To Point out Non-Compliances and Inadequate Compliances

• To protect the interest of the Customers, employees, society etc.

• To avoid any unwarranted legal actions by law enforcing agencies and other persons as well.

Scope of Secretarial Audit

Pursuant to Section 204(1) of the Companies Act 2013 and rule no.9 of the Companies (Appointment & Remuneration personnel Rules, 2014) The scope of Secretarial Audit comprises verification of the compliances under the following enactments, rules, regulations and guidelines:

o The Companies Act, 2013 and the Rules made there under;

o The Securities Contracts (Regulation) Act, 1956 (‘SCRA’) and the Rules made there under;

o The Depositories Act, 1996 and the Regulations and Bye-laws framed there under;

o Foreign Exchange Management Act, 1999 and the rules & regulations made there under;

o The following Regulations and Guidelines prescribed under the Securities and Exchange Board of India Act, 1992 (‘SEBI Act’) which inter alia includes;

a) The Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011;

b) The Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 1992;

c) The Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009;

d) The Securities and Exchange Board of India (Employee Stock Option Scheme and Employee Stock Purchase Scheme) Guidelines, 1999;

e) The Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008;

f) The Securities and Exchange Board of India (Issue and Transfer Agents) Regulations, 1993 regarding dealing with client

g) The Securities and Exchange Board of India (Delisting of Equity Shares) Regulations, 2009; and

h) The Securities and Exchange Board of India (Buyback of Securities) Regulations, 1998;

i) The Listing Agreement(s) entered into by the Company with Stock Exchange (s).

j) Secretarial Standards issued by The Institute of Company Secretaries of India.

k) Corporate Governance Guidelines;

l) Corporate Social Responsibility Voluntary Guidelines, 2013 issued by the Ministry of Corporate Affairs, Government of India;

m) Other corporate laws as may be applicable specifically to the auditee company.

Need for Secretarial Audit Secretarial

Audit is the process of independent verification, examination of level of compliance of applicable Corporate Laws to a company. The audit process if properly devised ensures timely compliance and eliminates any un-intended non compliance of various applicable rules and regulations. An action plan of the Corporate Secretarial Department is to be designed so as to ensure that all event based and time based compliances are considered and acted upon. Secretarial Audit is to be on the principle of “Prevention is better than cure” rather than post mortem exercise and to find faults. Broadly, the need for Secretarial Audit is:

• Effective mechanism to ensure that the legal and procedural requirements are duly complied with.

• Provides a level of confidence to the directors, officers in default, Key Managerial Personnel etc.

• Directors can concentrate on important business matters as Secretarial Audit ensures legal and procedural requirements.

• Strengthen the image and goodwill of a company in the minds of regulators and stakeholders

• Secretarial Audit is an effective compliance risk management tool.

• It helps the investor in analyzing the compliance level of companies, thereby increases the reputation.

• Secretarial Audit is an effective governance tool.

• Pursuant to Section 204(1) of the Companies Act 2013 and rule no.9 of the Companies (Appointment & Remuneration personnel Rules, 2014

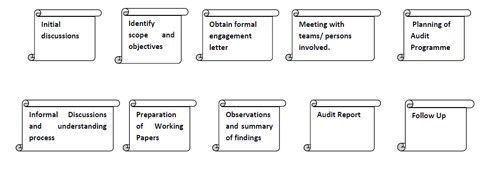

Secretarial Audit – The process

Sample List of Documents to be verified

o Registers and Records

o Register of investments

o Register of deposits

o Register of charges /Copies of instruments creating charges

o Register & Index of members

o Register & Index of debenture holders

o Foreign registers of members of debenture holders

o Registers and returns

o Minutes book of meetings

o Minutes book of class meeting/creditors meeting

o Books of accounts & cost records

o Register of contracts

o Register of directors, MD, manager & secretary

o Register of directors' shareholding

o Register of investments of loans made, guarantee given or security provided

o Register of renewed & duplicate certificates

o Register of destruction of records/documents

o Register of directors' attendance

o Register of shareholders' attendance

o Register of proxies

o Register of Transfer

o Register of fixed assets

o Register of documents sealed

o Register of debenture holders

o Periodical Returns

o Annual Returns

o Annual Accounts/Reports

o Other Important Returns

o Return of allotment

o Notice of redemption of preference shares, consolidation, division, increase in Share capital, cancellation of shares and increase in number of member

o Notice of situation/change in situation of registered office

o Court/CLB orders

o Registration of resolution & agreements

o Return of appointment of managing director/whole-time director/manager

o Particulars of appointment of directors, managing director, manager or secretary & changes made

o Return of deposits

o Particulars of beneficial interest in shares

o Registration of creation/modification/satisfaction of charge

o Meeting Board/Committees/General Meetings and Minutes

o Meetings of directors/Committee Members

o Minutes book of meetings of directors/committee members

o AGM/EGM/deemed Meeting minutes

o Proof of despatch of notices to members share Certificates, Transfer/Transmission of Shares, Dividend, Board's Report

o Copies of Endorsed shares certificates and other securities

o Transfer Deeds and transmission request letters etc.

o Declaration, payment and transfer of dividend

o Board's report

o Transfer of unpaid amounts to the IEPF C

o Contracts

o Details of related parties

o Copies of Disclosure forms

o Details of transactions/contracts entered into Entries made in Register of contracts

o Notices Copies of Show cause notices/default notices etc. received by the company if any.

o Compliances with SEBI/Stock Exchanges

o Correspondences exchanged with stock exchanges for complying with listing agreement clauses.

o Returns and intimations submitted with exchanges

o Shareholding Pattern

Professional Fees:

Normally based on the size and activity level of the company.

BHAVESH DESAI

B.COM. LLB. ACS

PRACTISING COMPANY SECRETARY

bndesai4u@gmail.com

CAclubindia

CAclubindia