INTRODUCTION: The Real Estate (Regulation and Development) Act, 2016 (hereinafter referred to as 'RERA' or 'Act') got the presidential assent on March 25, 2017. The Act is applicable throughout the country, however, is not applicable in the state of Jammu & Kashmir.

NEEDS OF RERA: The need for RERA was arises due to following reasons:

(i) No proper information about the builders

(ii) Lack of remedies available to the buyers

(iii) Lack of transparency in projects

(iv) No value for Commitments from the builders

(v) Poor track record of timely deliveries

(vi) Fund diversions

(vii) Poor quality of work

(viii) Improper litigation conduct

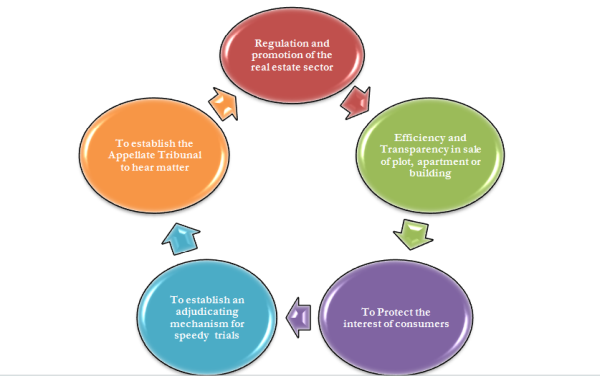

In order to diminish the above problems, the Act was designed to achieve the following objectives:

(i) to establish the Real Estate Regulatory

Authority for regulation and promotion of the real estate sector;

(ii) to ensure sale of plot, apartment or building, as the case may be, or sale

of real estate project, in an efficient and transparent manner;

(iii) to protect the interest of consumers in the real estate sector;

(iv) to establish an adjudicating mechanism for speedy dispute redressal;

(v) to establish the Appellate Tribunal to hear appeals from the decisions,

directions or orders of the Real Estate Regulatory Authority and the

adjudicating officers and for matters connected therewith or incidental thereto.

Apart from the above, the basic idea for enacting the Act was to:

(i) ensure accountability

towards allottees and to protect their interest;

(ii) to infuse transparency, ensure fair-play and reduce frauds & delays;

(iii) to introduce professionalism and pan India standardization;

(iv) to establish symmetry of information between the promoter and allottees;

(v) to impose certain responsibilities on both promoter and allottees;

(vi) to establish regulatory oversight mechanism to enforce contracts;

(vii) to establish fast- track dispute resolution mechanism;

(viii) to promote good governance in the sector which in turn would create

investor confidence.

Fig: Objectives of RERA

UNDERSTANDING RERA: RERA has given immense opportunity to the practising professionals such as Chartered Accountants, Cost and Management Accountants, Advocates and Company Secretaries. There are certain persons/projects (viz. Promoter, real estate agent and real estate project) for which registration under RERA is mandatory. Before understanding the process for registration of Promoter and Agent, first we need to understand the following terms:

- Promoter;

- Real estate Agent;

- Real estate project.

(1) PROMOTER

i. Who constructs building or apartments for

selling purpose

ii.

Who converts existing building or apartments for selling purpose

iii.

Who sell land (plots)

iv.

Any development authority [eg: DDA, HUDA etc.]

v.

Housing Board Co-operative society

vi.

Holder of power of attorney from owner to construct apartment or building or

plot for sale

vii.

Any other person who construct any building or apartment for sale to the general

public

(2) REAL ESTATE AGENT

i. Real estate agent means any person who:

ii.

Introduce buyer & seller for negotiation, whether for sale or purchase of plot,

apartment or building

iii.

Receive remuneration or commission or brokerage for providing services

(3) REAL ESTATE PROJECT

i. Real Estate Project means Development of

building or apartment for selling purpose

ii.

Converting of building (existing) for selling purpose

iii.

Development of land into plot/ apartment for selling purpose

REGISTRATION PROCESS UNDER RERA: Section 3, Section 4 and Section 9 of RERA provides for registration of Promoter; Agent and Real estate Project, respectively and conditions to be fulfilled before taking such registration.

Following projects should be registered under RERA by making an application in Form-A.

(i) ON-GOING PROJECTS: It is the responsibility of the Promoter to make an application to the authority for registration within a period of 3 months of projects that are ongoing on the date of commencement of the Act and where the Completion Certificate has not been issued.

(ii) NEW PROJECTS: It is the responsibility of the Promoter to make an application to the authority for registration for all commercial or residential projects where land area exceeds by 500 Square Metres or Number of apartments exceeds by 8.

Terms before Selling of Real Estate Project:

- No advertisement, marketing, booking, selling or any invitation for purchase of plot, apartment or building by promoter in any planning area, without registering the real estate project with the Regulatory Authority;

- No registration of real estate project is required in case area of land does not exceed five hundred square meters or the number of apartments does not exceed eight inclusive of all phases;

- No registration is required where completion certificate has already been received for a real estate project prior to commencement of this Act;

- No registration is required in case of renovation or repair or re-development which does not involve marketing, advertising selling or new allotment of any apartment, plot or building, as the case may be, under the real estate project

It is to be noted that where the real estate project is to be developed in phases, every such phase shall be considered as a standalone real estate project, and the promoter shall obtain registration under this Act for each phase separately.

GRANT OF REGISTRATION: On receipt of application in Form A, the authority shall within 30 days may grant or reject the Registration subject to the provisions of the Act and the rules and regulations made thereunder.

In case registration is granted to the Promoter, he shall be provided a registration number, including a Login Id and password for accessing the website of the Authority to create his web page and to fill therein the details of the proposed project.

It is pertinent to mention here that no application shall be rejected by the Authority unless the applicant has been given an opportunity of being heard in the matter.

DEEMED REGISTRATION: If application is neither accepted nor rejected by the Authority, within 30 days, then application shall deem to be registered.

PROCESS FOR REGISTERING A REAL ESTATE AGENT WITH THE RERA AUTHORITY:

A real estate agent can register himself/herself by filling up the Form G. Section 9 of the Act makes it mandatory to take Registration for the Real estate Agent who facilitate the sale or purchase of or act on behalf of any person to facilitate the sale or purchase of any plot, apartment or building, as the case may be, in a real estate project or part thereof, being the part of the real estate project registered under section 3, being sold by the promoter in any planning area without obtaining registration under section 9.

A very good move by the government as there are a lot of agents present in the market who are evading taxes by dealing in cash and there are no ways till date to trace them. Therefore, through RERA the government tried to get control over such agents by mandating them to register under the Act.

After receiving the application for registration under the Act concerned authority shall grant or reject (reason to be recorded in writing) the Registration as per the provisions of the Act, rules or regulations made thereunder.

It is to be noted that no application shall be rejected unless the applicant has been given an opportunity of being heard. In case no communication has been received from the regulatory authority within such period as provided under the Act, the Applicant shall be deemed to have been registered.

Further, after getting the approval he shall be granted a registration number by the Authority, which shall be quoted by the real estate agent in every sale facilitated by him under the Act.

REGISTRATION FEES:

To conduct the real estate business, the promoter, real estate agent shall pay a registration fee while applying for registration with the RERA authority by way of demand draft, cheque or through online payment. The amount of fee shall be payable as may be prescribed under respective states' rules.

PENAL PROVISIONS IN CASE OF FAILURE OF REGISTRATION:

|

S. No. |

CIRCUMSTANCES |

Penalty |

|

1. |

If registration is not taken by the Promoter under section 3 |

- A penalty of 10 % of the estimated cost of the real estate project. |

|

2. |

In case promoter does not comply with the order or direction of the authority |

- Imprisonment up to 3 year, or - fine which may extend up to further 10 percent of the estimated cost the real estate project or - both. |

|

3. |

If registration is not taken for Real Estate Project under section 4 |

- Fine of 5 % of the estimated cost of real estate project. |

|

4. |

If registration is not taken by the Real Estate Agent under section 9 |

- A penalty of 10,000/- for every day during which such default continues which may cumulatively extend up to 5 per cent of the cost of plot, apartment or buildings, for which the sale or purchase has been facilitated as determined by the Authority. |

Role of Chartered Accountants under the ACT:

Section 56 gives legal authorization to the "Chartered Accountants, Cost and Management Accountants, Advocates and Company Secretaries" to act as a Legal representative of promoter or Real estate agent under the Act. Following are the opportunities provided under the Act to Chartered Accountants, Cost and Management Accountants, Advocates and Company Secretaries:

- To present the case before the Appellate Tribunal or the Regulatory Authority or the adjudicating officer;

- Drafting of Reply to show cause notice; appeal etc.;

- Assisting client in respect of filing of application for registration under the Act;

- Preparing up-to-date list regarding number and types of apartments or plots, garages booked;

- Assisting client in taking approvals which are pending subsequent to commencement certificate;

- Assisting client in obtaining completion certificate or the occupancy certificate;

- Assisting client in obtaining the lease certificate and any other certificates as and when required;

- Assisting client in preparing various documents, agreement and deed from time to time;

- Help in maintaining web page and providing information as are required to be mentioned on that web page;

- Providing consultancy/opinion with respect to various transaction under RERA and other laws;

- Provide assistance with regard to any other information and documents as may be demanded by the Authority;

- Valuation of projects under RERA.

CONCLUSION

RERA is very interesting to read and it provides a fascinating field to the professionals like chartered accountants or company secretaries or cost accountants or legal practitioners to impart their expertise in order to assist Promoters as well as to Real Estate Agents.

A good and strong step has been taken by the government to curb black money and it will be interesting to know the way forward after some time in various states.

Further, it is a massive field for the Chartered Accountants or Company Secretaries and they will definitely play a substantive role under the Act. There will be no restriction on young professionals to practice under this law unlike Insolvency Bankruptcy Code ('IBC').

The author can also be reached at mail.rasu.cs@gmail.com

CAclubindia

CAclubindia