Job Work under the Model GST Law

The Independent India is on the verge of the most important indirect tax reform GST. Blah! Blah!. The present article deals with the provisions of job work provided under Model GST Law.

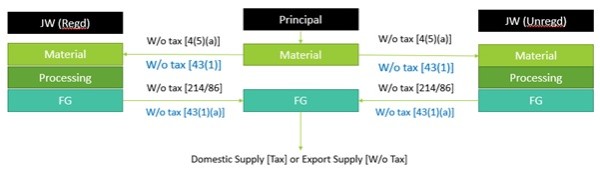

Let us first take a look at the job work provisions prevailing under current laws and their comparison with Model GST Law in a nutshell;

Figure 1

Apparently, it can be seen that, for a registered dealer, the job work provisions are very much similar to current provisions. Now let us discuss one by one where the provisions differ?

1. Non coverage of Unregistered person

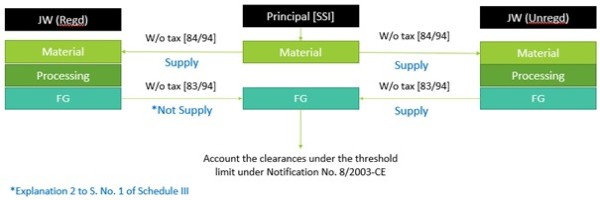

The job work exemptions under central excise law is permissible to both the registered manufacturers as well as SSI manufacturers [availing benefit under Notification No. 8/2003-CE]. For SSI manufacturers job work exemptions operate through Notification Nos. 83/94-CE and 84/94-CE. The exemptions can be explained through another figure below;

Figure 2

As can be seen, that currently, the SSI (or “unregd”) manufacturers can also avail the job work option, provided they account the finished products under their threshold limit of 1.5 Crores. However, section 43A of the model GST law only covers only a registered taxable person.

They would mean that supplying of goods by an unregistered dealer would be covered under the definition supply and will accordingly be liable to GST upfront, meaning thereby an increase in working capital requirement. Also, I wonder whether the differentiation between a registered person and an unregistered person is in violation of Article 14 of the Constitution, which prohibits an arbitrary differentiation between the persons of same cadre.

2. Exhaustion of threshold limit of unregistered job worker

Referring to figure 2 above, on the right hand side, under the current laws, when an unregistered person, returns back the goods, to the job worker under Notification No. 83/94-CE, these clearances do not form part of the threshold available to him under SSI exemption, in other words, for counting the threshold limit of 1.5 Crores without payment of excise, the clearances of goods returned back to Principal manufacturer are not counted, and they should rightly be so. However, no such exclusion has been provided under the Model GST Law. Although one may understand that these supplies are being exempted under Section 43(1) (a), however, these supplies are not being excluded for counting turnover for the purpose of threshold exemption. Assuming the threshold is granted Rs. 25 lakhs, illustratively, a small job worker who on his own supplies goods worth 20 lakhs, and the value [Value? Er! Another issue, covered under point 5 below] of job work is 6 lakhs, his threshold exemption gets exhausted when it shouldn’t have been.

3. Exhaustion of threshold of a unregistered principal manufacturer

As we understand, job work exemption is not available to an unregd principal manufacturer, and consequently shall be treated as supply. Consider the following example,

|

Case 1 |

Case 2 |

||||||

|

|

|

Principal |

Net Payoff |

Job worker (Unregd) |

Principal |

Net Payoff |

Job worker (Unregd) |

|

1 |

Raw material bought & Supplied FOC to job worker |

10 |

|

|

5 |

|

|

|

2 |

GST on 1 above @ 18% |

1.8 |

1.8 |

0 |

0 |

||

|

3 |

Value of Material to be included under section 15(2)(a) |

10 |

5 |

||||

|

4 |

Processing + Profit of Job worker |

3 |

3 |

||||

|

5 = 3+4 |

Supply Value for Job Worker |

13 |

8 |

||||

|

6 |

GST @ 18% |

0.54 |

2.34 |

1.44 |

1.44 |

||

|

7 = 5 |

Base Price of bought back goods from job worker |

13 |

8 |

||||

|

8 |

Principal Processing + Profit |

4 |

4 |

||||

|

9 = 7+8 |

GST Value |

17 |

12 |

||||

|

10 |

GST @ 18% |

3.06 |

0.72 |

0 |

|||

|

11 =1+9 |

Threshold of Principal |

27 |

17 |

||||

|

12 = 1+4+8 |

Threshold of Principal if Intermediate supply is not taken as supply |

17 |

12 |

||||

|

13= (2+6+10)/.18 |

GST Base |

17 |

8 |

||||

In the absence of any exclusion in threshold exemption, when the principal manufacturer supplies goods to the job worker for performing job work [S. No. 1 above], the supplies gets counted under the total threshold amount for exemption. Now when the finished goods are cleared after their final processing at the end of job worker [Sl. No. 9 above], these supplies also gets counted under threshold limit. This ultimate results in erosion of threshold limit for the principal manufacturer, even though the total (value addition along with value of Raw materials) at job worker’s end is actually less than the threshold limit. Comparison of above cases [1 & 2] shows that the exemption, even though, in both cases the total value addition is less than 25 lakhs [S. No. 12], but still the exemption is not available in 1st case because, the accountable threshold exceeds Rs 25 lakhs [S. No. 11].

Again, this might be intentional provision, so as to increase the GST base [S. No. 13].

4. Exemption available to the discretion of Commissioner

Currently, job work exemption is available on self-declaration by the Principal to the Assistant Commissioner having jurisdiction over the job worker. Earlier before this self-declaration, the exemption was available through permission only. Section 43A however, has again put the hassle of taking permission from the Commissioner. The permission could have following ramifications;

- Discretion at the hand of Commissioner to grant exemption or not. Distress of putting unnecessary conditions if at all the exemption is granted by the Commissioner.

- In many cases it has been seen that mere procedural lapses viz. taking permission has been accorded the status of fraud etc. by the revenue authorities, for the purpose of demand and recovery. One can imagine, the difference between declaration and permission in the light of this.

- On a side note, this permission would subsume the permission requirement currently required under rule 4(6) of the Cenvat Credit Rules, 2004 in cases when a principals wants to clear goods from the premises of job worker.

5. Valuation Issue

Currently, Notification No 214/86-CE grants exemption from paying excise duty, to job worker on the clearance of goods by job worker to the principal provided the conditions under Notification no 214/86-CE are satisfied.

Under GST, (1) the return back of goods by the job worker is not treated as a supply [Section 43(1)(a)] and (2) however the job work activity performed by the job worker for a principal is another supply which is not being exempted, consequently job work charges shall be treated as supply of service, liable to upfront GST. This gives rise to two issues:

- One, increase in cash outflow of principal manufacturer, since he now needs to payoff job worker’s GST component at the intermediate stage itself. Earlier, the principal manufacturer had to pay duty only when the goods are finally sold.

- Two, what shall be the value of job work charges for the purpose of levying GST by the job worker? Ideally the value should only be the transaction value i.e. labour employed by the job worker along with necessary profits of his. However, Section 15(2)(a) provides that transaction value shall include the value,

This deeming fiction gives rise to problem in cases of tooling job works where job work charges could only represent 2% of the supply of services and raw materials supplied by the principal might worth 98%, GST would again get embedded on those raw materials.

A special thanks to Mr Sujit Ghosh for providing insight on this aspect, the video (in association with INBA) can be seen on Youtube.

6. Interest on non-reversal of ITC, if goods sent for job work not received within given time period

Section 16A allows the principal to retain ITC on goods sent to job work provided, they are received back within 180 days (for inputs) or 2 years (for capital goods). Else, the section requires reversal of ITC on expiration of such periods, and permits re-availing of the same when the goods are finally received. The provisions are pretty much similar to provisions under Rule 4(5) of Cenvat credit rules, 2004. However, there is one difference which says that reversal of ITC on expiration of specified period have to be done along with Interest. The interest provision in current law is guided by Rule 14, which says that interest has to be paid only if the cenvat utilization exceeds cenvat availment. Matching concept operate under the GST Law, so say good bye to utilization and availment. Simply put, an increased burden of interest.

7. Clearance of “semi-finished” goods by the principal

Raw materials can be cleared by principal without reversal of cenvat credit, however, the semi-finished goods cleared by the principal attracts excise duty on Cost (CAS-4) + 10% in accordance with Rule 11 read with Rule 8 of Valuation Rules, 2000, unless Rule 16B permission is taken from Commissioner. Accordingly, upfront cash flow is released on clearance of non-raw material goods for job work, GST provides relief on that account in a sense that section 43A reads, “Taxable goods” which shall include “raw materials” as well as “semi-finished goods” and “to be finished goods”. So the permission under Section 43A subsume Rule 16B permission.

8. Definition of job work

The definition of job work has not been adopted from previous law(s), but has been provided a new nomenclature. Let us look what happens when a job worker incorporates his own goods in the course of job work,

|

Notification No. 119/75-CE |

Notification No. 214/86-CE |

Section 2(62) of Model GST Act |

|

|

Definition of Job work |

`job work’ shall mean such items of work where an article intended to undergo manufacturing process is supplied to the job worker and that article is returned by the job worker to the supplier, after the article has undergone the intended manufacturing process, on charging only for the job work done by him |

"Job work" means processing or working upon of raw materials or semi-finished goods supplied to the job worker, so as to complete a part or whole of the process resulting in the manufacture or finishing of an article or any operation which is essential for the aforesaid process. |

“job work” means undertaking any treatment or process by a person on goods belonging to another registered taxable person |

|

Whether substantial goods incorporated by job worker would detract him for claiming exemption? |

The Hon’able Supreme Court in Prestige Engineering (India) Ltd Vs CCE Meerut (1994 (73) E.L.T. 497 (SC)) has held that where the sub job worker contributed his own raw material for manufacturing which were substantial in value, the transaction was not one of job work. Only minor additions by the job worker would not detract the transaction from being one of job work. |

2012 (284) E.L.T. 589 (Tri. - Del.) The Tribunal held that the definition of job work in Notification No. 214/86-C.E. does not provide that all raw materials for manufacture of final product must be supplied by principal manufacturer. It only states that "job work" means processing or working upon of raw materials supplied to job work. Job work Exemption - Definition of - It is differently worded in Notification Nos. 119/75-C.E. and 214/86-C.E. - Its meaning in former cannot be extended into latter. |

Go to Tribunal, High Court and then Supreme Court, and then in probably 15 years, one might know whether job worker exemption is available. |

The point, I want to make is, why dilute the definition of job work again, for it to invite unnecessary litigation.

Closing Comments

Additionally, there are some transitional provisions on job work, which are not dealt by the present article. The purpose of the article is to go in depth of so called simpler GST Law. Thank you for the patient reading.

The author can also be reached at manish619sachdeva@yahoo.in

CAclubindia

CAclubindia