This article is in continuation of our previous article on Significant Beneficial Ownership which explains this new concept.

Rule 3(2) of SBO Rules provides that every individual, who subsequently becomes an SBO, or where his significant beneficial ownership undergoes any change shall file a declaration in Form No. BEN-1 to the Reporting Company, within thirty days of acquiring such significant beneficial ownership or any change therein. Upon receipt of declaration in Form BEN-1 from SBO, the Reporting Company shall file a return in Form No. BEN-2 with the Registrar in respect of such declaration, within a period of thirty days from the date of receipt of such declaration.

The SBO Rules do not define the word 'change”, it is still unclear in the rules whether we have to consider every change in significant beneficial ownership or to consider major increase or decrease in shareholding (i.e. specified % of increase or decrease in shareholding). So, there arises an issue i.e. when an individual considers the SBO undergoes any change. The MCA should clarify in this regard. In this article, we have tried to explain an aspect of the interpretation of the words used in Rule 3(2).

Before understanding the change, we should understand the meaning of significant beneficial ownership? The significant beneficial ownership means a right or entitlement exercise through indirect or direct with the indirect holding of not less than ten percent of the shares/voting right/dividends/significant influence or control in Reporting Company. For a better understanding of the significant beneficial ownership concept, visit our previous article.

'Change” means any change in the rights or entitlement (irrespective of change of % holding) held directly and indirectly in the Reporting Company. The Change may arise due to further issue of shares, buyback of shares, transfer of shares, change in holding at any layer, exercising ESOP option, conversion on entity into another one, becoming holding Subsidiary Companies, change in Karta of HUF, change in trustee/beneficiary/author, Admission/Resignation/Retirement/Removal of a partner in LLPand death of existing SBO, etc. Due to a change in Significant Beneficial Ownership, an existing SBO can lose its status as SBO and ceased to be SBO.

For better understanding, let's discussed some situations:

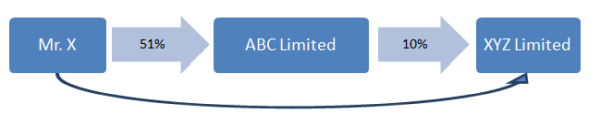

Mr. X is holding a majority stake (51%) in ABC Limited and ABC limited is holding10% in XYZ Limited. In this case, Mr. X is SBO for XYZ Limited.

Situation No. 1: Changes in the capital structure of XYZ Limited i.e. Reporting Company (RC)

The capital structure of RC can change due to the issue of shares, conversion of convertible security into equity shares, conversion of loan into equity shares and buyback of shares, etc. then shareholding of ABC Limited in XYZ Limited i.e. Reporting Company can be an increase or decrease. In this case, a declaration in Form BEN-1 by Mr. Xis required even in the case when he loses its status as an SBO.

Situation No. 2: Changes in the capital structure of ABC Limited i.e. body corporate member of Reporting Company and transfer of shares by ABC Limited

If the shareholding of Mr.X in ABC Limited is changed due to the above-mentioned reasons given in situation 1 then the shareholding of Mr.X in ABC Limited i.e. body corporate member reporting Company can be increased/decreased. In this case, a declaration in Form BEN-1 by Mr. Xis required.

If ABC Limited transfers its shares resulting in a decrease in the shareholding of ABC Limited and the shareholding will become less than 10%, then Mr.X is no longer be an SBO for XYZ Limited. In this case, a declaration in Form BEN-1 by Mr. X is required because Mr.X ceases to be SBO for XYZ Limited.

Situation No. 3: Changes in holding of individual who is SBO

The shareholding of Mr.X can be changed due to the transfer of shares and allotment of shares etc. which may result in an increase or decrease in his shareholding. In this case, a declaration in Form BEN-1 by Mr. Xis required even he sold his entire shareholding.

Situation No. 4: XYZ Limited become subsidiary of ABC Limited

If XYZ Limited becomes a subsidiary of ABC Limited then SBO rules shall not apply on the XYZ Limited provided ABC Limited is a Holding Reporting Company i.e. ABC Limited is a Reporting Company which is required to comply with SBO Rules and is required to file Form BEN-2.

Although this is a change Mr.X is not required to give Form BEN-1 to RC because of the non-applicability of SBO Rules.

Situation No. 5: XYZ Limited converted into XYZ LLP

If XYZ Limited converted into XYZ LLP then SBO Rules shall not apply to that LLP and Mr.X is not required to give Form BEN-1.

Situation No. 6: Death of Mr.X

If Mr.X died, then he ceased to be as SBO and there is no requirement to give declaration in Form BEN-1 by the descendants of Mr. X in such case.

Source: http://www.mca.gov.in/Ministry/pdf/CompaniesOwnersAmendmentRules_08020219.pdf

Also Read:

The authors can also be reached at kumarbraj7@gmail.com and rahuldas151292@gmail.com

DISCLAIMER: The information given in this document has been made on the basis of the provisions of the Companies Act, 2013 and Rules made thereunder. It is based on the analysis and interpretation of applicable laws as on date. The information in this document is for general informational purposes only and is not a legal advice or a legal opinion. You should seek the advice of legal counsel of your choice before acting upon any of the information in this document. Under no circumstances whatsoever, we are not responsible for any loss, claim, liability, damage(s) resulting from the use, omission, or inability to use the information provided in the document.

CAclubindia

CAclubindia