Following points are to be discussed under this article

- TDS Interest

- Types of TDS interest along with example

- Late fees for delay in filling of TDS return and how to calculate?

- Penalty of Late filling of TDS return u/s 271 H and when it is not levied?

- Penalty in case of delay in issuing of TDS certificates

1) TDS Interest

Which section TDS interest is to be paid?

TDS Interest is to be paid under section 201of Income Tax Act, 1961

When it is to be paid?

When there is failure to deduct or pay TDS.

So there are TWO categories of Defaults:

(1) Deduction of tax at source

- FAILURE to deduct tax at source

- DELAY in the deduction of whole or part amount of tax

(2) Payment of tax deducted at source

- FAILURE to deposit the whole or part of TDS (non - deposit) within due date

- DELAY in the payment of whole or part amount of TDS (short deposit or late deposit) within due date

2) Types of TDS Interest

Two categories of TDS interest

- Interest for Late Deduction

- Interest for Late Deposits

Let's discuss these two categories one by one in details along with example

3) Interest For Late Deduction

- Interest for late deduction of TDS is applicable @ the rate of

1% per month

- It is applicable from the date on which tax was deductible to the date of actual deduction.

Difference between 2 Dates

Due Date of deduction Actual Date of deduction

Rate of interest = 1% per month

- The calculation of above interest is on per month basis NOT on number of DAYS basis e. PART of month to be considered as FULL month.

Let us take Example in order to understand above Concept better: -

Example

- Professional service: Rs50, 000 on which TDS is to be deducted u/s 194J of Rs.5000/-

- Invoice Date: 28th of Jan, 2021 and Date of Payment 10th of Feb, 2021

- Point of Deduction – Earlier of the above two dates that is 28th of Jan, 2021 but TDS is deducted on 10th of Feb, 2021

So, INTEREST FOR LATE DEDUCTION is calculated for 2months are as follows

= 5000*2months*1% = Rs.100 Interest Payable = Rs.100/-

Note: Interest is levied on TDS amount and NOT on Invoice amount and Part of Month is considered as FULL months.

Therefore in above case there is 2 Months i.e Jan and Feb months

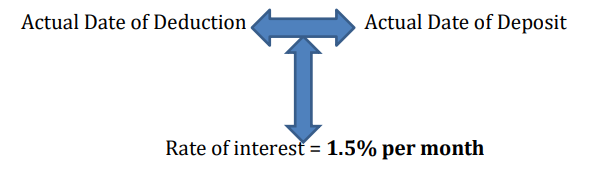

4) Interest for Late Deposit

- Interest for late deposit of TDS is applicable @ the rate of 5% per month.

- It is applicable from the date on which tax was deducted to the date of actual payment of TDS.

Difference Between 2 dates

The calculation of interest is on PER MONTH basis NOT on number of DAYS basis i.e. PART of month to be considered as FULL month.

Note: The Payment of interest should be from the Date on which TDS was deducted, NOT from the date on which TDS Challan is due.

Example:

Referring to above example- All points are same except Actual date of deposit: 16/04/2021 and Due date of deposit: 07/03/2021

So, INTEREST FOR LATE Deposits of TDS are as follows = 5000*2months*1.5% = Rs.150

Therefore Total TDS interest = Rs.250/-

5) TDS Late Fees -For delay in filing TDS Return

Failure to furnish or delay in furnishing the prescribed statements u/s 200(3) i.e. TDS Return

The provisions of quarterly statements of TDS have been introduced in the statute vide section 200(3) w.e.f. 01/04/2005.

Every person responsible for deducting tax is required to file Quarterly statements of TDS and DUE dates are as under –

|

Quarter |

Due Date |

|

April to June |

31st July |

|

July to September |

31st Oct |

|

October to December |

31st Jan |

|

January to March |

31st May |

Delay in filling of TDS quarterly return that is 24Q/26Q/27Q/27EQ then there is two possible consequence

- LATE FEES u/s 234E

- PENALITY u/s 271H

Now we discuss first, LATE FEES –

Any delay in return filing from the due date will result in a mandatory fee of Rs 200 per Day until the filling of the return.

Maximum CAP = TOTAL FEES should NOT exceed total amount of TDS deducted during that quarter

Therefore we can conclude that,

Rs. 200 per day or Maximum amount of TDS whichever is LOWER

6) Penalty for Late Filing of TDS Return U/S 271H

Assessing officer (AO) MAY direct a person who fails to file the statement of TDS within due date to pay

Penalty = MINIMUM of 10,000 which may be extended to 1,00,000. (Min 10K –Max 1Lakh)

The penalty under this section is in ADDITION to the penalty u/s 234E.

This section will also cover the cases of incorrect filing of TDS return.

7) Cases where Penalty u/s 271H = not levied?

There are total 3 cases where above penalty is not levied

- The tax deducted/collected at source is paid to the credit of the Government (TDS DEPOSITED)

- Late filing fees and interest (if any) is paid to the credit of the

- The TDS/TCS return is filed before the expiry of a period of ONE year from the due date specified in this behalf.

8) Penalty for Delay in Issue Of TDS Certificate U/S 272A

The Certificate u/s 203 shall be furnished within due dates as specified in Rule 31

Any delay in furnishing the TDS certificate will result in a MANDATORY fee of 100 per day until the issue of TDS Certificate.

Due date of issue of TDS Certificate u/s 203

|

Quarter |

Due Date (Other than Salary) |

Due Date Salary |

|

April to June |

15h August |

15th of June |

|

July to September |

15th November |

|

|

October to December |

15th February |

|

|

January to March |

15th June |

The author can also be reached at cajayprakashpandcompany@gmail.com

Disclaimer: The purpose of this is to share knowledge and it is for education purpose only. This does NOT constitute NOR does this form part of neither it is to be construed as, A LEGAL OPINION. The analysis is solely based on the reading abilities of the Author. They may be correct/incorrect as per you. No representation or warranty, express or implied, is made or given in respect of any information provided. UNDER NO circumstances should any recipient rely on this communication as a basis for any legal decision. The views expressed are of personal to the author. They do not reflect the views of any organization he may be directly/indirectly associated with. Neither author nor any of its affiliates accepts any legal liability, or responsibility, for, or provides any assurance or guarantee of accuracy, authenticity, completeness, correctness, dependability, reliability, suitability or timeliness of, any part of this article. The contents of this article are based only on the understanding of the Law, Rules, Notifications, etc. of the author and THEY ARE NOT BASIS FOR ANY LEGAL OPINION.

CAclubindia

CAclubindia