1. GENERAL OVERVIEW:

- Input Tax Credit is the backbone of the GST regime. GST is nothing but a value added tax on goods & services combined. It is these provisions of Input Tax Credit that make GST a value added tax i.e., collection of tax at all points after allowing credit for the inputs.

- GST, which is also known as value added tax in other countries is a tax on final consumption of goods and services. Unlike the present sales tax system, which is a single stage tax, the GST is a multi stage tax. Payment of tax is made in stages by the intermediaries in the production and distribution process. Although the tax would be paid throughout the production and distribution chain, it is ultimately passed to the final consumer. Therefore, the tax itself is not a cost to the intermediaries and does not appear as an expense item in their financial statements.

2. MANNER OF TAKING INPUT TAX CREDIT:

- Any registered person shall be entitled to take credit of admissible tax.

- Electronic credit ledger shall be maintained for each taxable person in the manner as may be prescribed in this behalf.

- ITC on inputs held in stock and contained in semi-finished and finished goods held in stock:

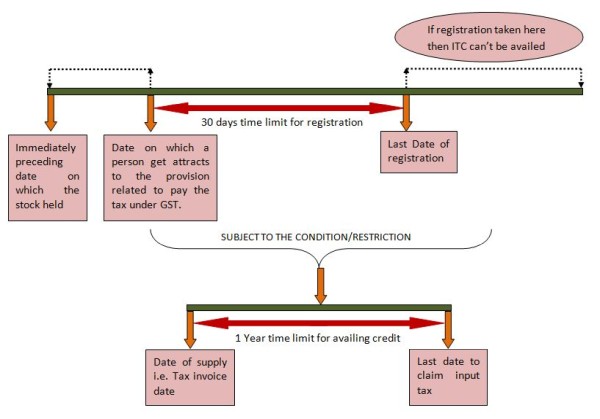

Case I - Where a person becomes liable to pay tax under GST provisions

Such person have to applied for registration within 30 days from the date of liability to pay tax register and registered, shall be entitled to get input credit held in the stock and held in finished/Semi finished stock as on the day immediately preceding the date from which he becomes liable to pay tax subject to the condition that cannot avail credit of goods and / or services after 1 year from tax invoice date. It is explained in the following manner:

Example: ABC Ltd. (a manufacturer company of Rajasthan state) has crossed the proposed threshold limit of turnover of Rs.20 lacs on 20/11/2016 and has obtained registration on 04/12/2016 (i.e. within the limit of 30 days). Hence the company is eligible for ITC on inputs held in stock as on 19/11/2016 (i.e. immediately preceding date of attracting the provision to pay the tax under

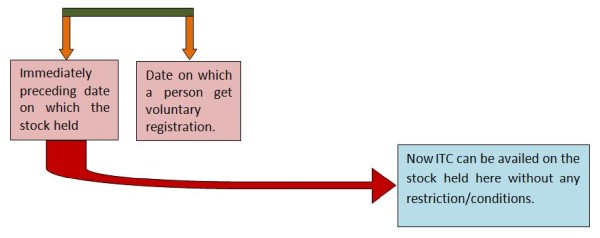

Case II - Where a person voluntary applies to GST provisions

A Person who is not required to register, but obtains voluntary registration shall be entitled to get input credit held in the stock and held in finished/Semi finished stock as on the day immediately preceding the date of registration without any conditions. It is explained in the following manner:

Example: ABC Ltd. (a manufacturer company of Rajasthan state) is not liable to get registration under GST as it hasn't crossed the proposed threshold limit of Rs.20 lacs and but voluntary obtained registration 20/11/2016. Hence the company is eligible for ITC on inputs held in stock as on 19/11/2016.

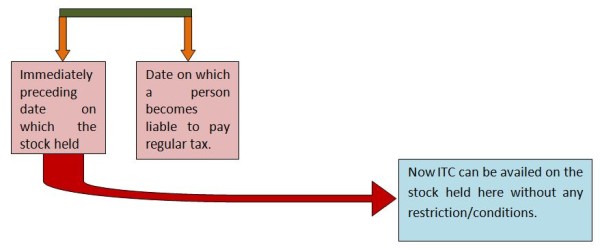

Case III - Where a person shift from Composition to Normal Scheme

A Person who has opt for composition scheme shall be entitled to get input credit held in the stock and held in finished/Semi finished stock as on the day immediately preceding the date from which he becomes liable to pay tax under the regular scheme without any conditions. It is explained in the following manner:

Example: ABC Ltd. (a manufacturer company of Rajasthan state) was paying tax registration under composition scheme on that upto 30/11/2016. However w.e.f. 01/12/2016 the company crossed the proposed threshold limit of Rs. 50 lacs to enjoy the composition scheme and become liable to pay tax in regular scheme with effect from that date. Hence it is eligible for ITC on inputs held in stock as on 30/11/2016.

3. PROPORTIONATE CREDIT:

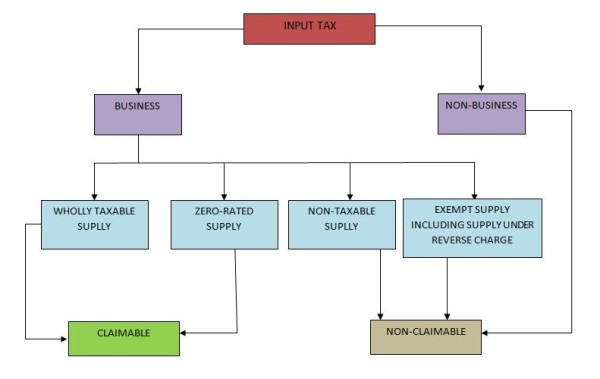

The goods and/or services are used by a registered taxable person partly for business and partly for non-business; he is eligible to input tax credit of goods and/or services attributable to the purposes of business. Similarly when the goods and/or services are used partly for effecting taxable supplies (plus zero-rated supplies) and partly for effecting non-taxable supplies (plus exempt supplies); he is eligible for credit attributable to the taxable supplies including zero-rated supplies. Same has explained in the following chart:

4. ITC PROVISIONS FOR BANK/FINANCIAL INSTITUTION/NBFC:

A banking company or a financial institution including a non-banking financial company, engaged in supplying services by way of accepting deposits, extending loans or advances shall have the option to either comply with the provisions of sub-section (2), or avail of, every month, an amount equal to fifty per cent of the eligible input tax credit on inputs, capital goods and input services in that month.

Explanation- The option once exercised shall not be withdrawn during the remaining part of the financial year.

Example: ABC Ltd an NBFC has partly used telephone services for its business activities and also extends telephone services free of cost to its management (which can be considered to be non business activity). Here ABC Ltd has option to either avail proportionate credit method in which business services/activity are only eligible for claiming ITC or avail fifty per cent of the ITC on business services/activity.

5.INELIGIBLE CREDIT:

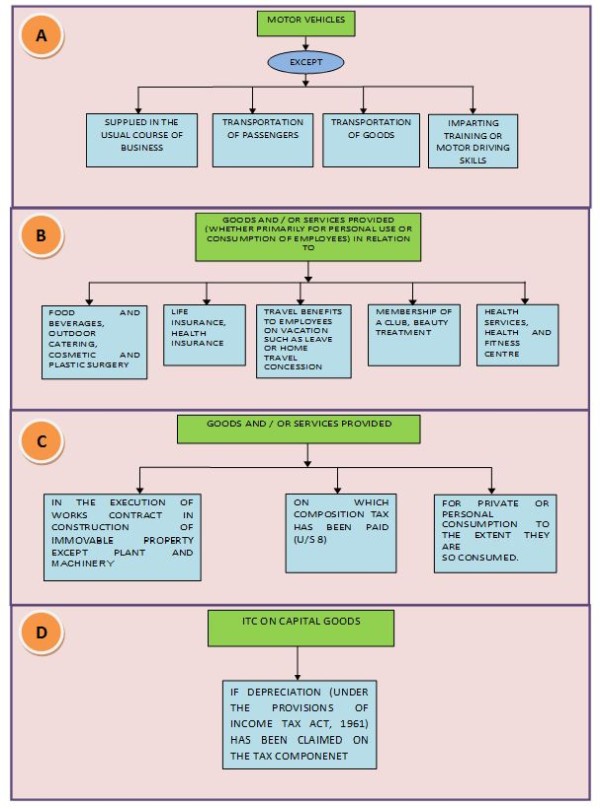

There are some ineligible credits under GST which are explained in the following diagram:

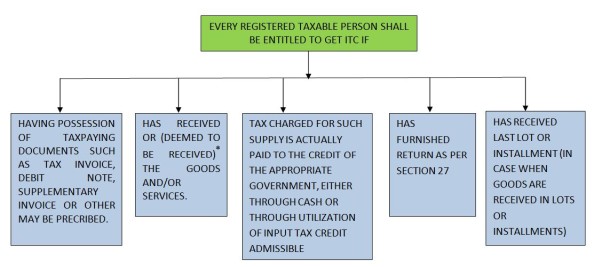

6. CONDITIONS FOR AVAILING INPUT TAX CREDIT: It is explained as below:

* * when goods are delivered by supplier to recipient or other person as per the direction of taxable person or his agent by way of transfer of documents of title of goods or otherwise.

7. TAKING INPUT TAX CREDIT IN RESPECT OF INPUTS/CAPITAL GOODS SENT FOR JOB WORK:

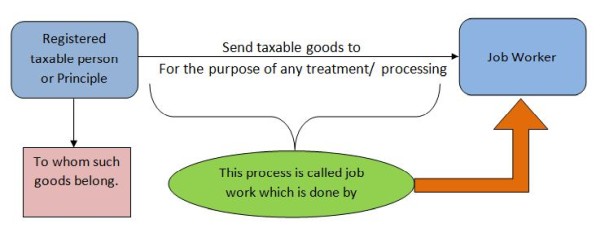

A. The Chain under Job work: It is explained as above:

B. Entitlement of credit under job work: The Principle can avail credit of input tax on goods sent to job-worker for job work subject to such conditions and restrictions as may be prescribed. However, under GST scenario, the norms relating to input tax credit on inputs or capital goods sent for job work are discussed as below:

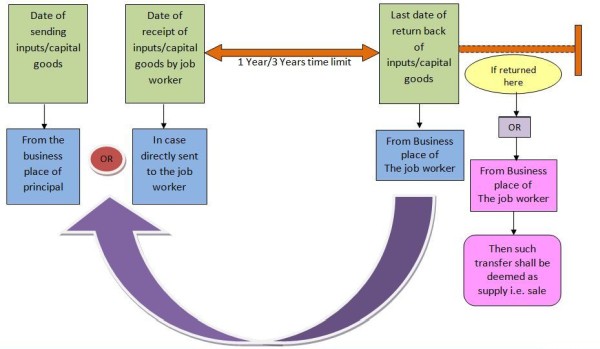

The "principal" shall be entitled to take credit of input tax on inputs/capital goods even if the inputs are directly sent to a job worker for job-work without their being first brought to his place of business subject to following conditions:

- Inputs/capital goods are returned back within a period of one year / three years respectively of their being sent out (In case Inputs/capital goods are directly sent to a job worker, the period of one year/three years shall be counted from the date of receipt of inputs by the job worker) after completion of job-work or otherwise.

- Inputs/capital goods are returned back from the place of business of the job worker.

Note: If any of above two conditions as discussed above are not satisfied (i.e. both the conditions must be fulfilled for claiming the supply as Job work and not sale), then such transfer or supply of goods shall be treated as sale.

It can be easily understood by the diagram as presented below:

CAclubindia

CAclubindia