|

PARTICULARS |

EXTENDED DUE DATE |

|

ITR for AY 2021-22 u/s 139(1) whose Due Date is 31.07.2021 |

31.12.2021 |

|

ITR for AY 2021-22 u/s 139(1) whose Due Date is 31.10.2021 |

15.02.2022 |

|

ITR for AY 2021-22 u/s 139(1) whose Due Date is 30.11.2021 |

28.02.2022 |

|

Report of Audit for PY 2020-21 |

15.01.2022 |

|

Report from an Accountant by persons entering into international transaction u/s 92E |

31.01.2022 |

|

Due Date for furnishing Belated / Revised Return for AY 2021-22 |

31.03.2022 |

A step by step guide on how to file ITR (Income Tax Return) on the New Income Tax Department Portal?

With Financial Year 2020-21 almost coming to an end, many taxpayers will be filing their ITR/Income Tax Return as it is mandatory to file the Income Tax Return as per the Income Tax Act 1961. Income Tax Return is a form prescribed by the Department of Income Tax to communicate the details of the Income earned by an assessee in any Financial Year and Tax paid on the same. The last date to file Income Tax Return for individuals, HUF, and other assesses whose books of accounts are not required to be audited is 30th September 2021, for assesses whose books of accounts are to be audited the last date to file Income Tax Return, is 30th November 2021.

A taxpayer can e-file his Income Tax Return on the Income Tax Department Portal. This article is a step by step guide that explains how to file e-file ITR(Income Tax Return):

|

Step-1 |

|

|

Step-2 |

|

|

Step-3 |

|

|

Step-4 |

Download the appropriate Income Tax Return Preparation Utility. |

|

Step-5 |

|

|

Step-6 |

|

|

Step-7 |

|

|

Step-8 |

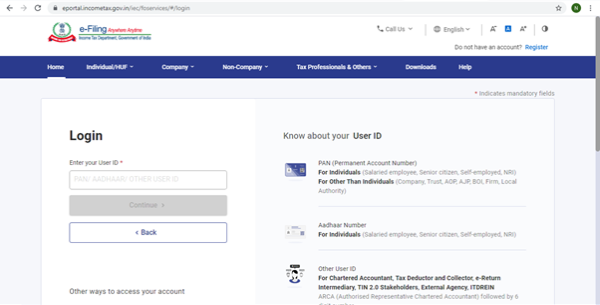

1. Login to the New Income tax e-filing portal

Taxpayers can e-file their Income Tax Return on the e-filing portal of the government https://www.incometax.gov.in. The login option is available on the right side of the home page of the website. The following details are to filled while logging in:

- User Id (PAN / Aadhaar / Other User ID)

- Check box the Secure Access Message

- Password

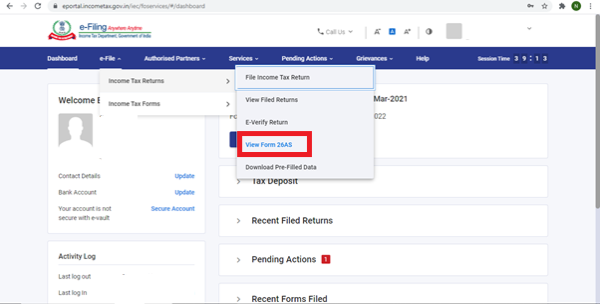

2. Check Form 26 AS

Form 26 AS is maintained by the Department of Income Tax that contains details of tax credited in the form of TDS, TCS, or Advance Tax which can be claimed as credit by the assessee in the Income Tax Return. Before filing the Income Tax Return the taxpayer must make sure that amount of TDS as reflected in Form 26 AS matches with the amount reflected in the TDS statement. If the amount of TDS reflected in Form 26AS is less than the amount shown in the TDS statement. The taxpayer will not be eligible to claim the actual TDS as a credit in his Income Tax Return without rectifying the discrepancies. Form 26AS can be viewed and downloaded from the Income Tax Portal. Check Form 26 AS

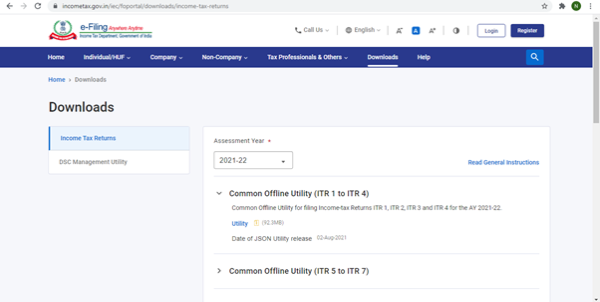

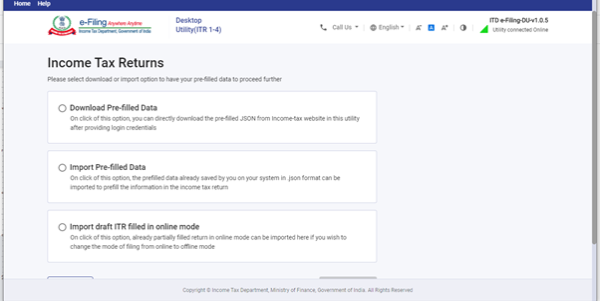

3. Choose the right mode to file Income Tax Return

The Income Tax Return can be e-filed either by offline mode or online mode by a taxpayer. Using the online mode the taxpayer can enter the data directly on the e-filing portal and submit the return. However, the online facility is available to file ITR-1 and ITR-4 only. The Income Tax Department recently notified changes in ITR-1 and ITR-4 for AY 2020-21. The offline mode can be used for filing all sorts of ITR. The user can download the Form applicable to him, fill the form offline, generate XML, and upload the generated XML on the portal.

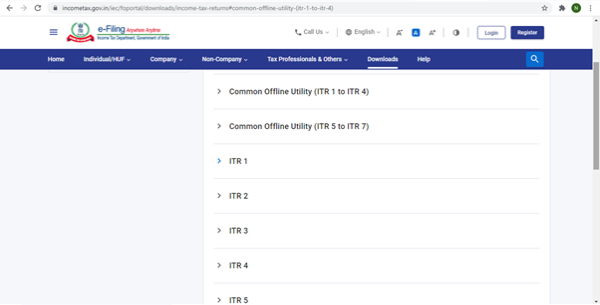

4. Download the appropriate Income Tax Return Preparation Utility

If you are filing the Income Tax Return using the JSON upload method, the user will have to download the appropriate ITR utility. Click on ITR Return Preparation software under Downloads on the home page and choose the right Assessment Year to download the appropriate utility.

System Requirements

- Utility: Windows OS

- Architecture: ia32, x36

Windows 7 or later are supported (ia64, x64systems binaries will run on ia32)

Please note, the ARM version of Windows is not supported.

The filing of the returns can be done in any of the three methods:

- Download the Pre-filled data

- Import Pre-filled Data i.e. already filed data in JSON Format

- Import draft data in Online Mode

5. Fill the details in the Income Tax Return Form and Calculate Tax

After downloading the appropriate Income Tax Return Preparation Utility, the taxpayer needs to fill the applicable mandatory details. The personal and other details that are readily available can be pre filled by importing the pre-filled JSON file. The taxpayer can then calculate the tax after validating all the tabs.

6. Generate the JSON File:

After validating the return, JSON File is to be generated. Save the JSON File.

7. Upload your income tax return

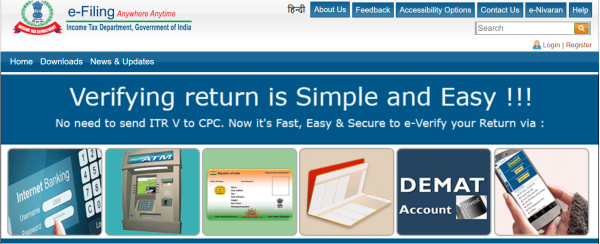

8. Verify Income Tax Return

Filing of Income Tax Return is not considered as complete unless the return is verified. The taxpayer had to choose any one of the following options to verify the Income Tax Return:

- Digital Signature Certificate (DSC).

- Aadhaar OTP.

- EVC using Prevalidated Bank Account Details.

- EVC using Prevalidated Demat Account Details.

- Already generated EVC through My Account Generate EVC Option or Bank ATM. -Validity of such EVC is 72 hours from the time of generation.

- I would like to e-Verify later. Please remind me.

- I don't want to e-verify this Income Tax Return and would like to send signed ITR-V through normal or speed post to "Centralized Processing Center, Income Tax Department, Bengaluru 560500"

CAclubindia

CAclubindia