Whether you run a small or large business, securing a ₹20 Lakh business loan can help you invest in new equipment, expand operations, or manage working capital. However, before you understand how to apply for a business loan, it is crucial to assess your repayment capacity. This is where a business loan EMI calculator proves useful. Let's explore how a business loan EMI calculator works and how you can manage your ₹20 Lakh loan repayments effectively.

What is a Business Loan EMI Calculator

A business loan EMI calculator helps you estimate your monthly repayment amount based on the loan principal, tenure, and interest rate. This tool allows you to plan your finances effectively, ensuring that your loan remains within your budget before proceeding with the application.

How to Calculate ₹20 Lakh Business Loan EMI Manually

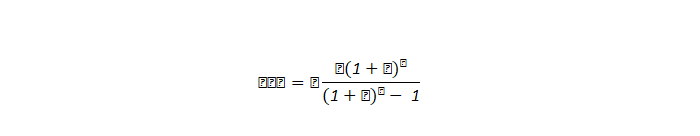

To calculate your EMI for a ₹20 Lakh loan, you can use the following formula:

Here,

- 'P' refers to the amount you have borrowed

- 'r' means interest rate (monthly)

- 'n' refers to the repayment tenure in months

Suppose the lender has approved a ₹20 Lakh loan at a 12% annual interest rate (1% monthly) for three years or 36 months.

Then, EMI = 2000000 × 0.01 × (1+0.01)³⁶ / [(1+0.01)³⁶−1]

Here is the step-by-step calculation:

Step 1: Calculate (1 + r)n

(1+0.01)³⁶ = (1.01)³⁶

= 1.440909

Step 2: Calculate (1 + r)n - 1

(1.01)³⁶ - 1 = 0.440909

Step 3: Calculate EMI

EMI= 2000000 × 0.01 × 1.440909/0.440909

= 2000000 × 0.014409/0.440909

= 28818.18/0.440909

= ₹65335.28

As per the calculation, the EMI for a ₹20 Lakh business loan approved at a 12% annual interest rate for 36 months is approximately ₹65,335.28.

Step-by-step Guide to Calculating Business Loan EMI

Manual calculations are not only tedious but also prone to errors. To avoid this, you can use an EMI calculator. Here are the steps involved in using the Bajaj Finserv EMI calculator.

- Step 1: Go to your lender's website.

- Step 2: Search for the EMI calculator on the home screen and choose the Business Loan EMI calculator.

- Step 3: Use the slider or manually input ₹20 Lakh under the loan amount section.

- Step 4: Enter the minimum interest rate offered by your preferred lender to get an idea.

- Step 5: Finally, enter the desired repayment tenure. The calculator will display your monthly obligation.

Interpreting The Amortisation Schedule for a ₹20 Lakh Business Loan

After inputting all the details into the ₹20 Lakhs business loan EMI calculator, you can click and check the repayment schedule, also known as the amortisation schedule. An amortisation table details each loan payment over time, breaking it down into principal and interest components. This table helps track the portion of your monthly EMI allocated to principal and interest payments.

Here is the amortisation schedule for a ₹20 Lakh loan approved at an 18% per annum interest rate for 36 months.

|

Months |

Principal Component |

Interest Component |

Balance |

|

1st Month |

₹42,305 |

₹30,000 |

₹19,57,695 |

|

2nd Month |

₹42,939 |

₹29,365 |

₹19,14,756 |

|

3rd Month |

₹43,585 |

₹28,721 |

₹18,71,172 |

|

4th Month |

₹44,237 |

₹28,068 |

₹18,26,935 |

|

5th Month |

₹44,901 |

₹27,404 |

₹17,82,034 |

|

6th Month |

₹45,574 |

₹26,731 |

₹17,36,460 |

|

7th Month |

₹46,258 |

₹26,047 |

₹16,90,202 |

|

8th Month |

₹46,952 |

₹25,353 |

₹16,43,251 |

|

9th Month |

₹47,656 |

₹24,649 |

₹15,95,594 |

|

10th Month |

₹48,371 |

₹23,934 |

₹15,47,224 |

|

11th Month |

₹49,096 |

₹23,208 |

₹14,98,127 |

|

12th Month |

₹49,833 |

₹22,472 |

₹14,48,294 |

|

13th Month |

₹50,585 |

₹21,724 |

₹13,97,714 |

|

14th Month |

₹51,339 |

₹20,966 |

₹13,46,375 |

|

15th Month |

₹52,109 |

₹20,196 |

₹12,94,266 |

|

16th Month |

₹52,891 |

₹19,414 |

₹12,41,375 |

|

17th Month |

₹53,684 |

₹18,621 |

₹11,87,691 |

|

18th Month |

₹54,489 |

₹17,815 |

₹11,33,201 |

|

19th Month |

₹55,307 |

₹16,998 |

₹10,77,894 |

|

20th Month |

₹56,136 |

₹16,168 |

₹10,21,758 |

|

21st Month |

₹56,978 |

₹15,326 |

₹9,64,780 |

|

22nd Month |

₹57,833 |

₹14,472 |

₹9,06,947 |

|

23rd Month |

₹58,701 |

₹13,604 |

₹8,48,246 |

|

24th Month |

₹59,581 |

₹12,724 |

₹7,88,665 |

|

25th Month |

₹60,475 |

₹11,830 |

₹7,28,190 |

|

26th Month |

₹61,382 |

₹10,923 |

₹6,66,808 |

|

27th Month |

₹62,303 |

₹10,002 |

₹6,04,505 |

|

28th Month |

₹63,237 |

₹9,068 |

₹5,41,268 |

|

29th Month |

₹64,186 |

₹8,119 |

₹4,77,082 |

|

30th Month |

₹65,149 |

₹7,156 |

₹4,11,934 |

|

31st Month |

₹66,126 |

₹6,179 |

₹3,45,808 |

|

32nd Month |

₹67,118 |

₹5,187 |

₹2,78,690 |

|

33rd Month |

₹68,124 |

₹4,180 |

₹2,10,566 |

|

34th Month |

₹69,146 |

₹3,158 |

₹1,41,420 |

|

35th Month |

₹70,183 |

₹2,121 |

₹71,236 |

|

36th Month |

₹71,236 |

₹1,069 |

₹0 |

Disclaimer: The above table is for illustrative purposes only and represents an estimated loan repayment schedule based on assumed interest rates and terms. Actual repayment amounts may vary depending on changes in interest rates, loan terms, and other factors.

As shown in the table above, the interest payable is higher during the initial months of your loan. However, over time, it gradually decreases while the principal repayment increases.

How Does EMI Affect Interest Payments on ₹20 Lakh Business Loan

When using a loan EMI calculator, always check how the repayment tenure affects the interest payable and total repayment amount.

For example, suppose you get a loan of ₹20 Lakh at an 18% annual interest rate. The impact of different loan tenures on your budget is shown in the table below:

|

Parameters |

Repayment Tenure |

||||

|

12 Months |

24 Months |

36 Months |

48 Months |

60 Months |

|

|

Loan Amount |

₹20,00,000 |

₹20,00,000 |

₹20,00,000 |

₹20,00,000 |

₹20,00,000 |

|

Interest Rate |

18% |

18% |

18% |

18% |

18% |

|

EMI |

₹1,83,360 |

₹99,848 |

₹72,305 |

₹58,750 |

₹50,787 |

|

Interest Payable |

₹2,00,320 |

₹3,96,357 |

₹6,02,972 |

₹8,20,000 |

₹10,47,211 |

|

Total Payable |

₹22,00,320 |

₹23,96,357 |

₹26,02,972 |

₹28,20,000 |

₹30,47,211 |

Disclaimer: The values mentioned in the above table are subject to change according to the lender's discretion. Please confirm the business loan terms with your lender before processing.

A longer tenure reduces the EMI but increases the total interest paid, while a shorter tenure results in higher EMIs but lowers overall interest costs. Choosing the right tenure depends on your budget and cash flow, ensuring you can comfortably manage your business's operational needs.

Key Takeaways

An EMI calculator is the best tool for estimating costs, comparing options, and planning finances. You can ensure your loan remains manageable by evaluating tenure, interest rates, prepayment options, and additional charges.

CAclubindia

CAclubindia