The below are some of the key highlights of 31st GST council meeting held on 22nd December 2018.

1. Due date for filing of annual returns in forms GSTR-9, GSTR-9A and audit in form GSTR-9C to be extended to 31.07.2018 for the financial year 2017-18.

2. Physical visit to GST office for submission of documents for refund will be dispensed with. Provisions to upload documents electronically will be enabled shortly

3. Refund for excess payment of tax, if any, can be obtained through Form GST RFD-01A

4. Returns filing to be modified and new return format to be introduced shortly which will be mandatory from 1.7.2019

5. ITC in relation to invoices issued by the supplier during FY 2017-18 may be availed by therecipient till the due date for furnishing of FORM GSTR-3B for the month of March, 2019, subject to specified conditions (conditions are yet to be notified).

6. Security services provided by a registered person (except to Government) and who has registration under TDS and also entities registered under composition scheme will be put under RCM

7. Amendment of section 50 of the CGST Act to provide that interest should be charged only on the net tax liability of the taxpayer, after taking into account the admissible input tax credit, i.e. interest would be leviable only on the amount payable through the electronic cash ledger.

Reduction (Changes) in Rates of goods

A. 28% to 18%

- Pulleys, transmission shafts and cranks, gear boxes etc., falling under HS Code 8483

- Monitors and TVs of upto screen size of 32 inches

- Re-treaded or used pneumatic tyres of rubber;

- Power banks of lithium ion batteries. Lithium ion batteries are already at 18%. This will bring parity in GST rate of power bank and lithium ion battery.

- Digital cameras and video camera recorders

- Video game consoles and other games and sports requisites falling under HS code 9504.

B. 28% to 5%

- Parts and accessories for the carriages for disabled persons

II. GST rate reduction on other goods,-

A.18% to 12%

- Cork roughly squared or debagged

- Articles of natural cork

- Agglomerated cork

B. 18% to 5%

Marble rubble

C. 12% to 5%

- Natural cork

- Walking Stick

- Fly ash Blocks

12% to Nil:

Music Books

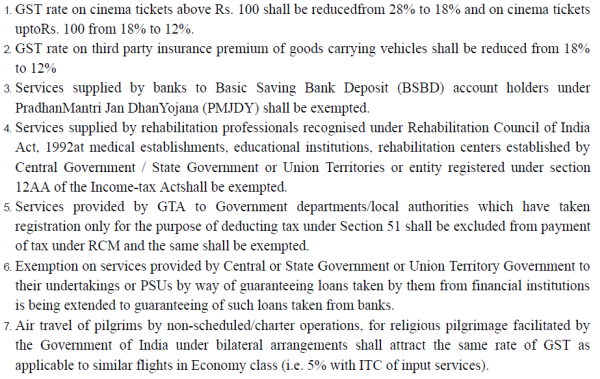

Reduction / Changes in rates of services

CAclubindia

CAclubindia