As easier as it has become to avail credit from banks/lenders, the assessment process of an individual's creditworthiness has become more stringent. With every loan or credit card application, certain parameters are assessed against the borrower to check their creditworthiness. This not only decides the repayment terms of the credit applied for, it can also lead to the rejection of the application.

One of the primary parameters considered by banks while assessing the credit application is credit score. 5 years ago, the concept of credit score was still novel, since then credit score has indeed come a long way and become an integral part of everyone's financial life.

Credit score is a 3-digit number that starts from 300 and goes up to 900, with the higher value deeming one more creditworthy. Ideally, your credit score should by above 750.

You can check your creditworthiness score for free on CreditMantri.

Credit score is provided by the 4 credit bureaus, i.e. Equifax, CIBILTM, Experian, and CRIF Highmark. Banks report to each of these bureaus about the activities of their borrowers and the bureaus assign credit scores based on those activities.

Factors Affecting Credit Score

As important as credit score is, it itself depends on multiple factors. Each bureau gives different weight to each of the factors, but the factors used to calculate remain the same. Banks/lenders take into account the bureau score when assessing one's application for a credit product like a loan or credit card.

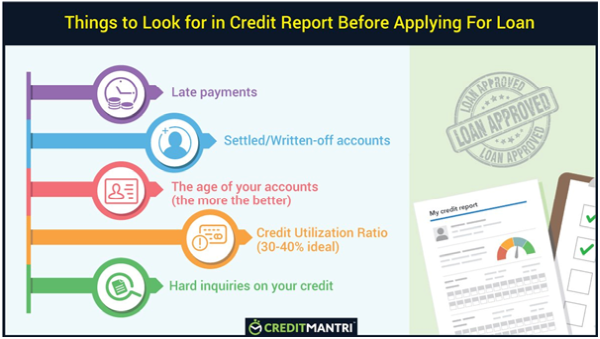

Following are the factors that have an effect on your credit score,

Repayment History

Your repayment history is one of the most important factors that bank/lenders look for while assessing your creditworthiness. Your repayment history entails all the EMI's and credit card bills that you have paid for all your credit accounts.

Having a good repayment history, i.e. repaying all your dues on time, indicates a responsible behaviour towards credit. If you have consistently defaulted on your repayments, banks/lenders will have certain concerns while granting you loan as they would deem you as irresponsible towards credit because of your past defaults.

If you have repaid your past dues on time, lenders would trust you more with their money and could even give you loans at a lower interest rate. Hence, having a good repayment history is always recommended and even a single missed payment can lead to a drop in your credit score.

Portfolio Age

The average age of your credit accounts also has an effect on your credit score. It is better to have a long credit history. If you open too many new accounts at a time or close old credit card accounts for which you have consistently been making repayments, it could impact your credit score.

If you have your existing credit card accounts open with your current lenders for a long time (of course with consistent repayment), your prospective lender would consider this as a healthy sign of your experience and responsibility with credit.

That being said, your repayments and number of accounts have more weight on your credit score than your account portfolio age. Hence, it is recommended to clean close the account when needed by paying full outstanding amount.

Number Of Hard Enquiries

Every time you apply for credit with a bank/lender and they have to get your credit score from the bureau, it is counted as a hard enquiry. The more the number of hard enquiries in a period, the more is the chance of lenders deeming you as a credit hungry person.

So, it is always recommended that you should not be lured by any loan or credit card offer you see and check your credit score first to find out your eligibility chances for your preferred credit. You can also check out the best loans/credit cards suitable for your credit score online on the fintech firms like CreditMantri.

Borrowings Mix

There are two types of credit- secured credit (home loan, auto loan) and unsecured credit (personal loan, credit card). As the name suggests, secured credit requires you to pledge collateral to avail the credit, whereas you can avail the unsecured credit without pledging any collateral.

Ideally, your credit portfolio should have a balance both secured and unsecured credit. Having too much unsecured credit could deem you as a credit hungry person and bring your credit score down.

Credit Utilization Ratio

Your credit utilization ratio is defined as the proportion of your usage of each of your credit card to the total limit of that credit card. Ideally, your credit card utilization ratio should not exceed 30-40%.

If you are consistently using more than 40% of your limit, you would be deemed as a credit hungry person, which will bring your credit score down.

How Can You Improve Your Credit Score?

By now, we understand the importance of credit score to avail a credit. But, even if you have a low credit score, you needn't worry. You can always improve your credit score.

Just follow the following steps to get back on track with a good credit score,

- Identify your negative accounts

- Resolve every negative account by paying the outstanding amount

- Make sure your credit score is updated

- Consistently repay your existing credit amount

If coordinating with the lender and bureau seems like a big task, you can always take the help of a professional organization like CreditMantri. These organizations will get you the best repayment terms favourable for your income and help you clean close your negative accounts.

About Us

CreditMantri makes Credit Possible. It helps consumers take charge of their credit health and help them make better borrowing decisions. Users can discover loans, credit cards best matched to the credit profile, resolve issues on existing borrowings, and reduce current borrowing costs.

CAclubindia

CAclubindia