THE FACELESS APPEAL SCHEME, 2020 (Under Income Tax Act,1961)

Notified vide Notification No. 76/2020 Central Board of Direct Taxes dated 25th September 2020 Effective from 25.9.2020. For such territorial area or persons or class of persons or incomes or class of incomes or cases or class of cases, as may be specified by the Board.

Salient Features

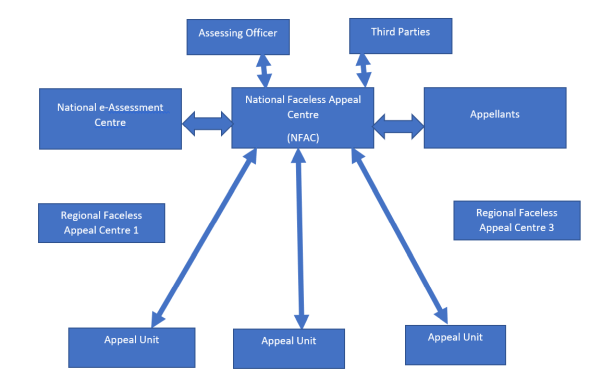

- Board will set up National Faceless Appeal Centre, Regional Faceless Appeal Centre, and Appeal Units.

- All the communication with Appellants, National e-Assessment Centre, Assessing Officer, or any other person will be through Nation Faceless Appeal Centre.

- All the communication will be through electronic mode only.

- Personal hearings as approved will be through a specified electronic video conferencing system only.

- There will not be any need for the appellants or their authorized representatives to appear physically.

STRUCTURE OF FACELESS APPEAL SCHEME,2020

The procedure under FACELESS APPEAL SCHEME,2020

Appeal Assignment

- NFAC will assign the appeal to any Appeal Center through an automated system

- If an appeal is filed late, then the appeal unit may admit the appeal if it satisfied with the reasons for delay otherwise the appeal will be rejected.

- Appeal Unit will communicate the action to NFAC who will inform the appellant.

Appeal Procedure

- After the appeal admission Appeal Unit may communicate to NFAC to obtain further information or documents which it may require from the appellants.

- NFAC will give notice to Appellants to submit information as required by the Appeal Unit within the time specified in the notice.

- Appeal Unit may also inform NFAC to ask for Ground of Appeal, documents, evidence filed by the appellant, or any further information or records from the National e-assessment Centre or the Assessing Officer as the case may be.

- NFAC will give notice to E-Assessment Centre or Assessing officer to submit the required documents within a specified time.

- The appellants, National e-Assessment Centre, or the Assessing Officer will submit the prescribed documents within time or extended time.

- NFAC will forward the above information/documents to the Appeal Unit

Additional Grounds

- The appellants may file the additional grounds of appeal along with reasons for not filing the additional ground when the original appeal was filed.

- NFAC will forward the additional grounds to National e-Assessment Centre or Assessing Officer for their comments within a specified time, and also to the appeal unit.

- NFAC will also forward the comments of the National e-Assessment Centre and the Assessing Officer to the Appeal Unit or if no comments are received then also inform the Appeal Unit accordingly.

- If the Appeal Unit is satisfied with the reason for filing additional grounds it will admit the appeal and otherwise reject the appeal. The same will be communicated to NFAC who shall in turn inform the appellants.

Additional Evidence

- The appellants may file the additional evidence along with reasons for not filing the additional evidence as to how their case is covered under exceptional circumstances specified in rule 46(1)

- NFAC will forward the additional evidence to National e-Assessment Centre or Assessing Officer for submitting their report within a specified time.

- NFAC will also forward the report of the National e-Assessment Centre and the Assessing Officer and additional evidence to the Appeal Unit.

- If the Appeal Unit, after considering the additional evidence, is satisfied with the reason for filing additional evidence then it will admit the additional evidence or otherwise reject the additional evidence.

- The same will be communicated to NFAC who shall in turn inform the appellants, National e-Assessment Centre, or Assessing Officer.

Appeal proceedings:

- Where the Appeal Unit intends to enhance the assessment or penalty or reduce the refund, then it shall prepare the SCN and send the same to NFAC to shall send it to appellants to file a response/reply within the time specified in the SCN.

- Appellants shall file the reply to NFAC who will send the same to the Appeal Unit or inform the Appeal Unit if no reply is received from Appellants.

- Appeal Unit, after considering all the above shall prepare a draft order and send it to the NFAC along with details for penalty proceedings.

- NFAC may finalize the draft order or send it to another Appeal Unit for review, in accordance with the risk management strategy, The Appeal Unit may concur with the draft order or suggest variation in the order and inform NAFC accordingly.

- If a variation is suggested then NFAC shall send the draft order along with suggestions to another Appeal Unit to prepare the final order and forward it to NFAC.

- NFAC will send the Appeal Order to the Appellants, National e-Assessment Centre, Assessing Officer, and RNFAC.

Penalty proceedings:

- Appeal unit may, in the course of appeal proceedings, for non-compliance of any notice, direction, or order issued under this Scheme on the part of the appellant or any other person, recommendation for initiation of any penalty proceedings to the NFAC.

- NFAC will send the notice to appellants or any other person to file the reply.

- Appellants or any other person shall file the response with NFAC within a specified time.

- NFAC will send the notice and the reply to another Appeal Unit through an automated allocation system.

- The Appeal Unit may prepare a draft order or drop the penalty proceedings and inform the NFAC.

- NFAC shall send the final penalty order or communicate the dropping of proceedings to the Appellants, National e-Assessment Centre, or the Assessing Officer.

Rectification Proceedings:

- An application for rectification of mistake may be filed with NFAC by appellant or any other person, appeal unit preparing or reviewing or revising the draft order; or the National e-Assessment Centre other Assessing Officer,

- NFAC shall assign such an application to a specific appeal through an automated allocation system.

- The appeal unit shall examine the application and prepare a notice for granting an opportunity to the other parties as stated above and send the notice to NFAC.

- NFAC shall send the notice of granting an opportunity to all the other parties as above as to why rectification of mistake should not be carried out.

- All the other parties shall file their response with NFAC.

- NFAC shall send the notice and the response to appeal unit who shall prepare the draft rectification order or reject the application citing reasons. The same will be communicated to NFAC.

- NFAC shall send the rectified order or intimation of rejection of the application to an Applicant and all other parties.

CAclubindia

CAclubindia