Aadhaar is a 12-digit unique identification number issued by the Indian government to its citizens, while Permanent Account Number (PAN) is a 10-digit alphanumeric number issued by the Income Tax department to individuals and entities for tax purposes.

The Indian government has mandated that all PAN holders must link their Aadhaar number to their PAN card. The deadline to link Aadhaar with PAN has been extended several times in the past, and the latest deadline is 30th June, 2023.

If an individual fails to link their Aadhaar with their PAN by the deadline, their PAN card will become inoperative from 1st July, 2023. This means that the individual will not be able to use their PAN card for any financial transactions that require it, such as opening a bank account, filing income tax returns, or making investments.

Last date and fee for linking PAN-Aadhaar

Here are some key points to keep in mind regarding the deadline to link PAN with Aadhaar and the associated fee:

- The original deadline to link PAN with Aadhaar was 31st March 2022.

- The Central Board of Direct Taxes (CBDT) extended this deadline to 30th June, 2023.

- This means that individuals have until 30th June, 2023 to link their PAN with Aadhaar.

- However, to initiate the linking process, individuals are required to pay a fee of Rs 1,000.

- This fee is applicable only if the linking is done after the original deadline of 31st March 2022.

- If the linking is done before the original deadline, there is no fee charged.

How to pay fee to Link PAN with Aadhaar

To pay the fee to link PAN with Aadhaar, you can follow these steps:

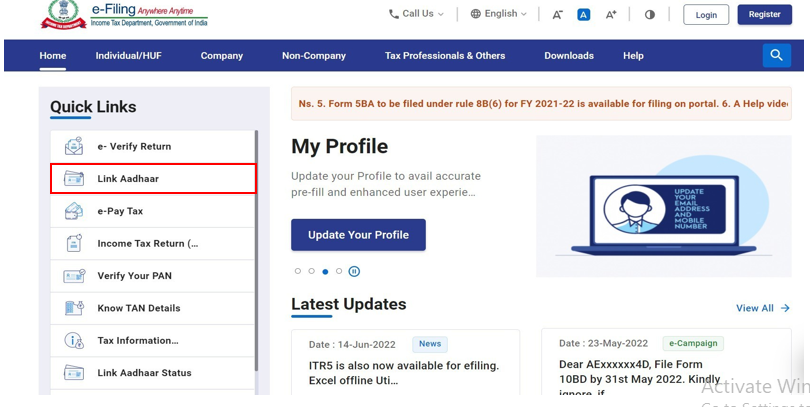

- Visit the official website of the Income Tax Department.

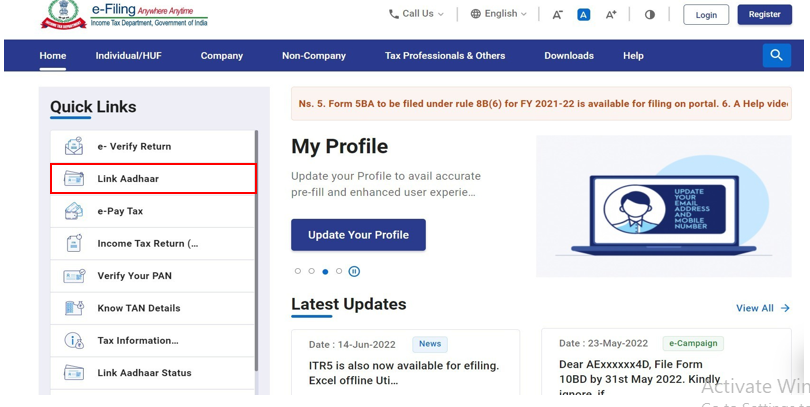

- Click on the 'Link Aadhaar' option under the 'Quick Links' section.

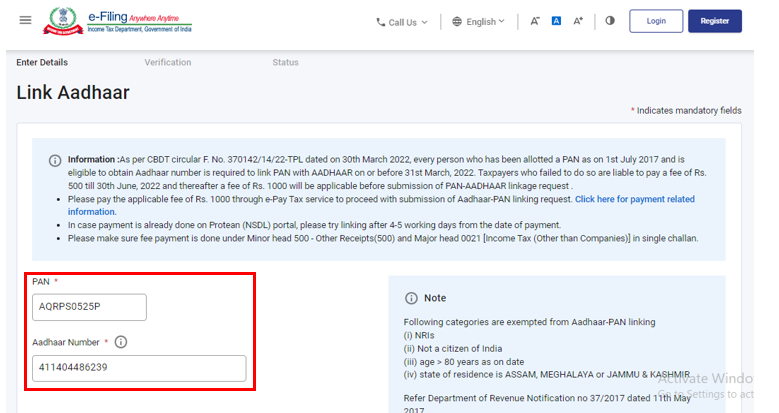

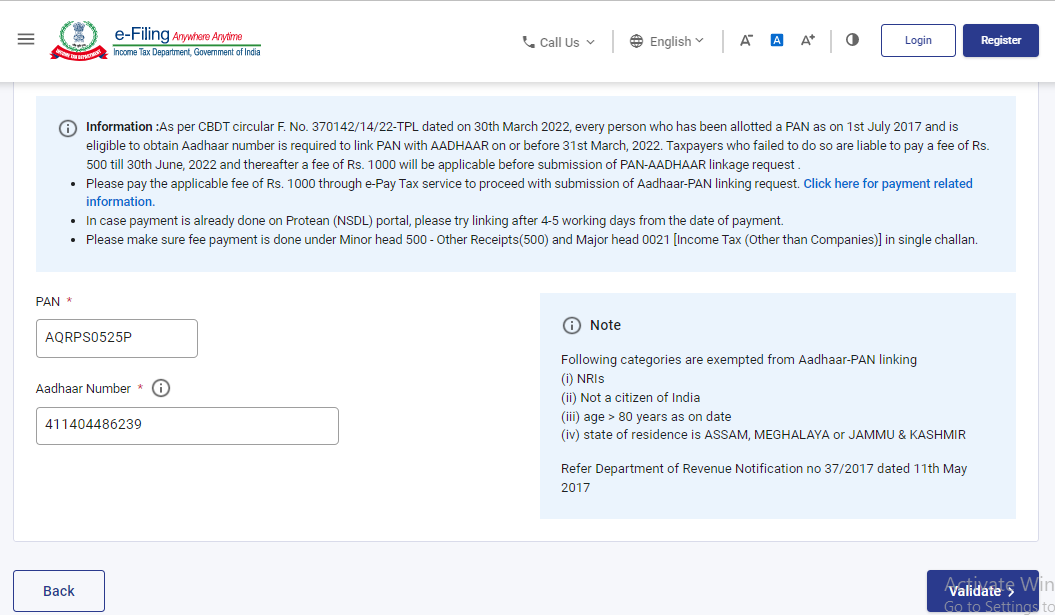

- Enter your PAN and Aadhaar details in the respective fields.

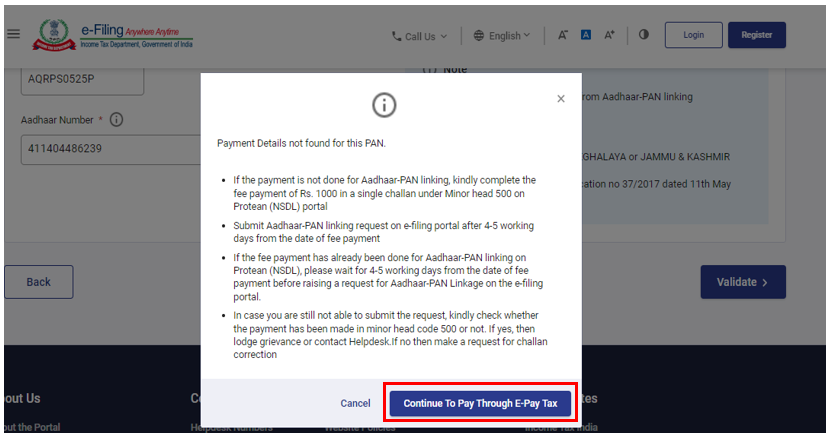

- Select the option to 'Continue To Pay Through E-Pay Tax.

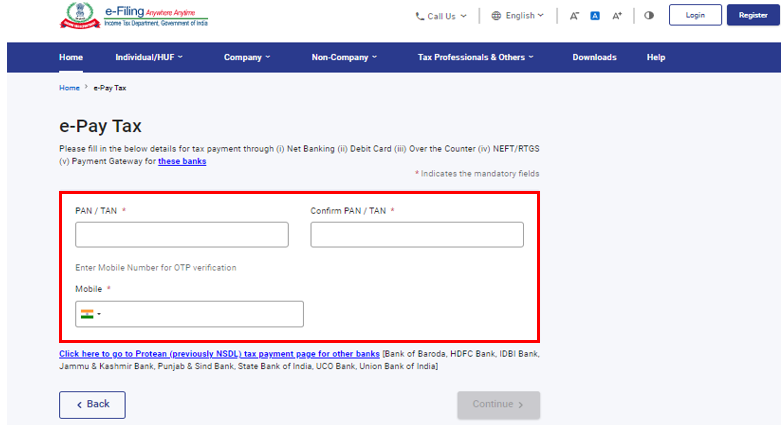

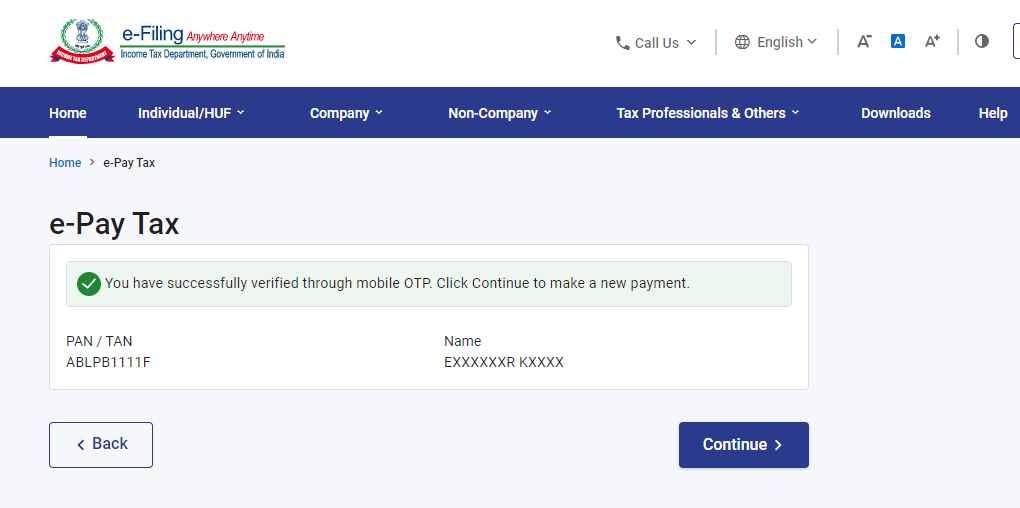

- Enter PAN and mobile number to verify through OTP.

- Once verified click continue to make payment.

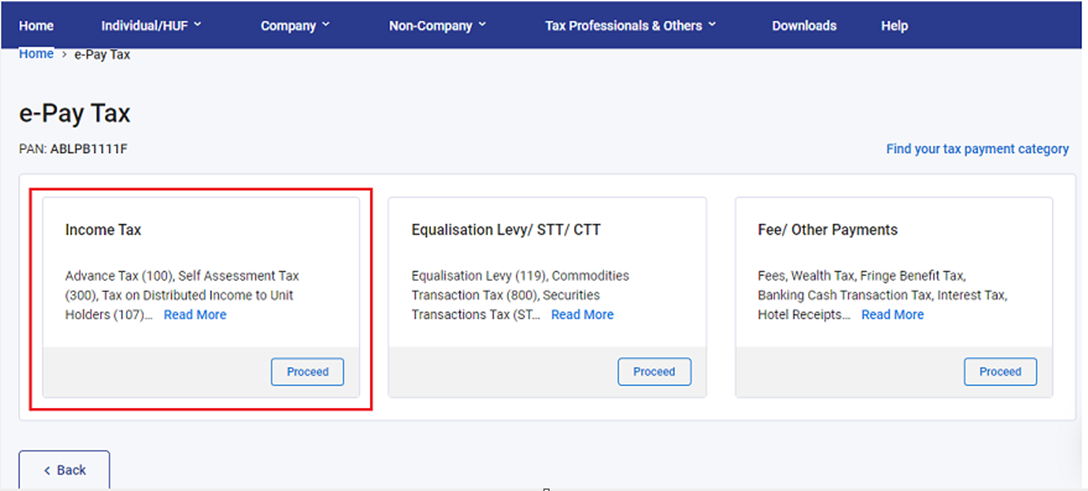

- Select 'income tax' head and proceed

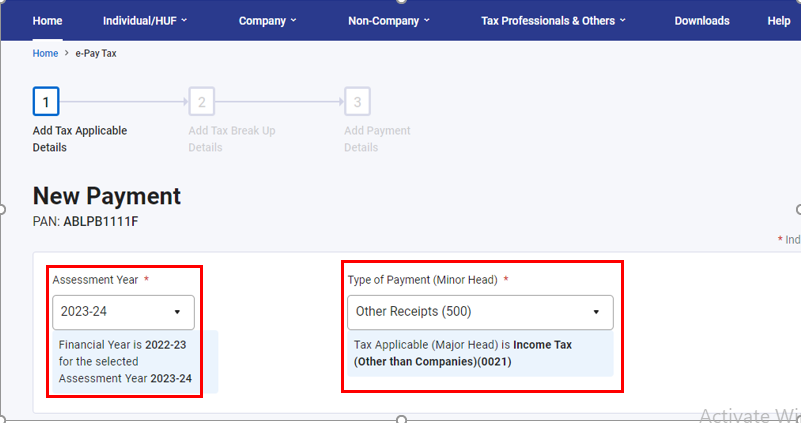

- Select AY 2023-24, Type of Payment (Minor Head) - Other Receipts (500)

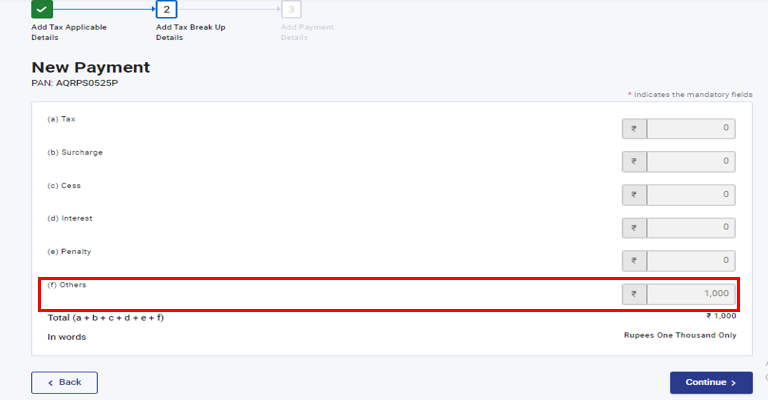

- If your linking is being done after the original deadline of 31st March 2022, you will be redirected to a page to make the payment of Rs 1,000.

Now, challan will be generated. On the next screen you have to select the mode of payment after selecting the mode of payment you will be re-directed to the Bank website where you can make the payment.

- Submit the Aadhaar PAN link request on e-Filling Portal immediately if payment is made through e-Pay Tax service.

- Enter PAN and Aadhaar Number and then click on validate

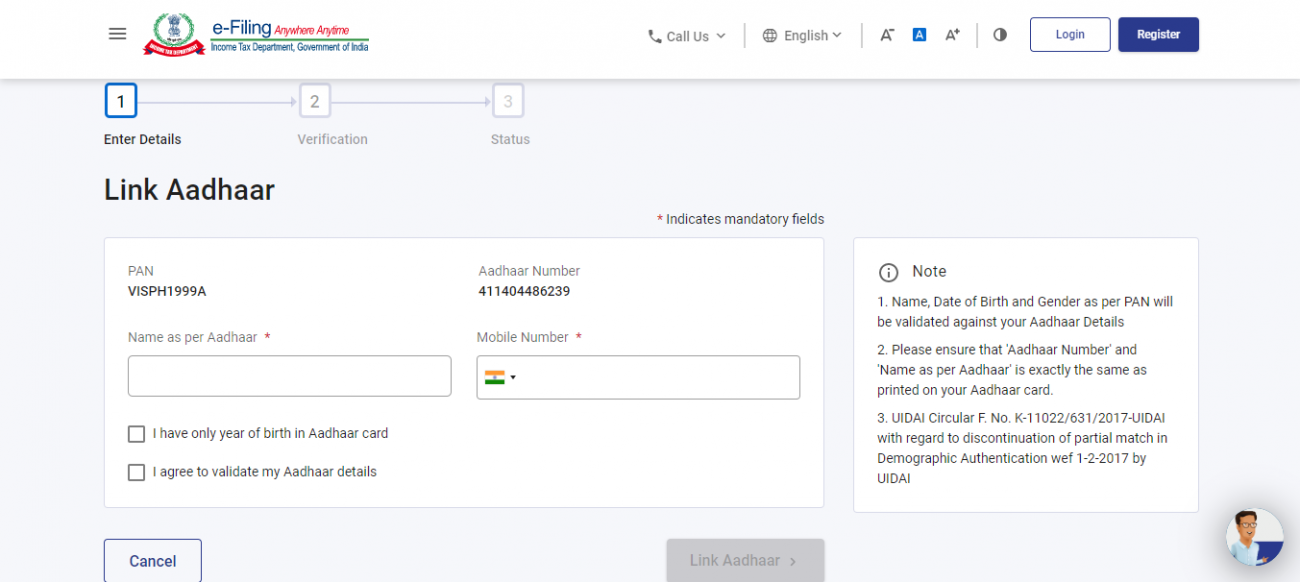

- Click on Link Aadhaar button once entered Name and Mobile Number.

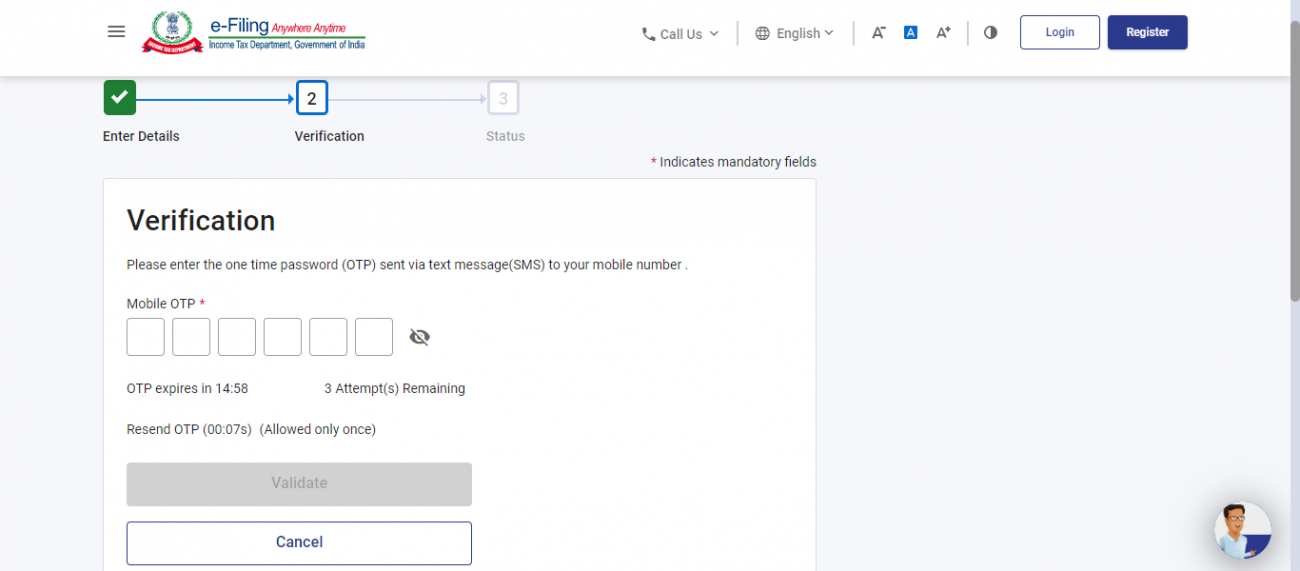

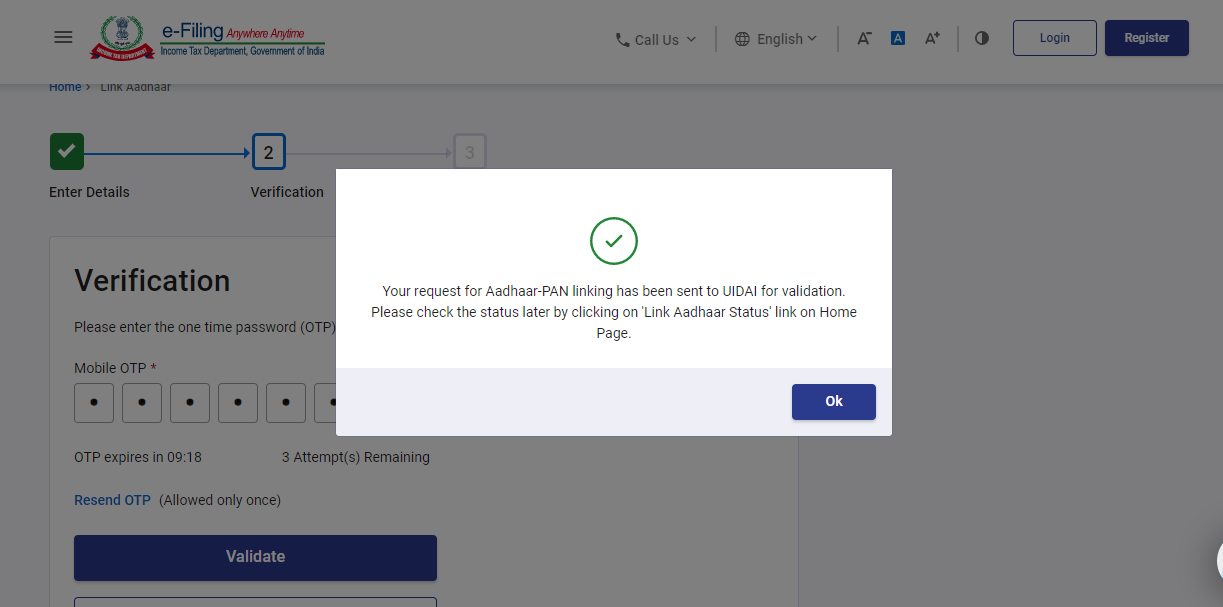

- You will receive an OTP for verification.

- On successful Validation, a message will be displayed regarding your Link Aadhaar Status.

CAclubindia

CAclubindia