Due to the disruption caused by the COVID-19 pandemic, there has been a continuous demand for an extension in due dates of various compliance. While on 30th December 2020, the government extended the due date for filing ITR and GST returns, no such extension was given for the Companies Fresh Start Scheme, 2020 (CFSS 2020). As of late, an outpour of demands requesting the government to extend the due date for CFSS is being seen on social media. Consequently, hashtags such as #Extend_CFSS and #CFSSExtension have been trending on Twitter.

What is the Companies Fresh Start Scheme?

As per the Companies Act, 2013, all companies operating in the country are liable to follow statutory compliances annually. These include filing annual returns, financial statements, documents, filing fees for such returns, statements, etc. In the event of non-compliance, the company is deemed to have defaulted, and hefty fines and penalties are imposed. In an attempt to ease matters for companies, the Ministry of Corporate Affairs came up with the Companies Fresh Start Scheme. Effective from 1st April 2020, the scheme offers a one-time opportunity to the defaulting companies to file the pending documents and make good filing-related defaults without paying any higher additional fees. The due date under CFSS was 31st December 2020.

Why are professionals demanding an extension?

1. Crashing of MCA website

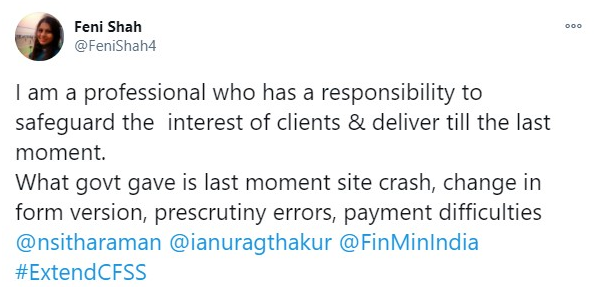

As cited by numerous professionals on Twitter, the Ministry of Corporate Affairs' website crashed on the due date, i.e., on December 31, 2020. Many users also reported that they were unable to generate challan. Others said that they faced login errors, auto-logouts, and payment failures on the last date.

2. Changes in e-Form MGT-7

MGT-7 is an e-form provided to all corporates to fill the annual return as prescribed under section 92 of the Companies Act, 2013. Professionals said that the MCA revised the MGT-7 and provided it on the portal on the last day of CFSS 2020, i.e., on 31st December 2020. This complicated the process as the professionals had already spent time and resources on the earlier form and were left with little time to re-work on the updated form.

3. Short duration of the scheme

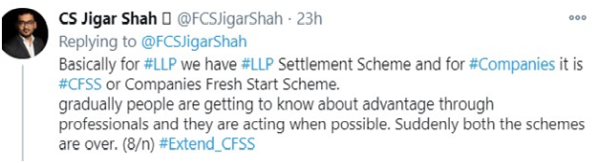

As stated earlier, the Companies Fresh Start Scheme came into effect on 1st April 2020. The scheme was initially supposed to be valid till September 30, 2020. However, it was extended to 31st December 2020. Taxpayers and professionals have complained that the window for availing the benefits of the scheme is very short.

In light of the above issues, numerous organizations have also come forward and requested Finance Minister Smt. Nirmala Sitharaman for an extension of various due date compliances.

The Institute of Company Secretaries of India, on 24th December 2020, wrote a representation letter to the Ministry of Corporate Affairs, asking it to extend the last date under the Companies Fresh Start Scheme to 31st March 2021. ICSI also requested MCA to extend the due date for LLP Settlement Scheme 2020 to 31st March 2021. You can go through the entire letter here.

The Merchants Chamber of Uttar Pradesh has also written to Union Minister of State for Finance & Corporate Affairs, Mr. Anurag Thakur, regarding the extension of CFSS-2020 to June 30, 2021.

In a letter dated 2nd January 2021, the Karnataka State Chartered Accountants Association has requested Finance Minister Smt. Nirmala Sitharaman to extend the validity of CFSS to 31st March 2020.

However, news of an extension is yet to come.

Do you think such an extension is required? Let us know in the comments section below.

CAclubindia

CAclubindia