The tiresome and troublesome process of navigating and uploading a TDS return on the TRACES portal has been simplified by the Income Tax Department. Now the IT dept has provided its own website/portal for uploading the return effortlessly. We are further trying to bolster the ease to an extent that a few clicks and your work is done and so we are presenting a step by step guidance.

Prerequisites for uploading TDS returns:

Before you actually begin with the procedure of uploading the return, make sure you have the following:

-

Valid TAN which is registered for e-filing

-

TDS statements which is prepared and validated via Return Preparation Utility (RPU) and File Validation Utility (FVU) respectively

-

Valid DSC registered for e-filing (If you want to upload using DSC)

-

The principal contact's bank account / Demat account details

-

Or The principal contact's PAN linked with Aadhaar (If you wish to upload using EVC)

Procedure to upload TDS statements on Income Tax Portal

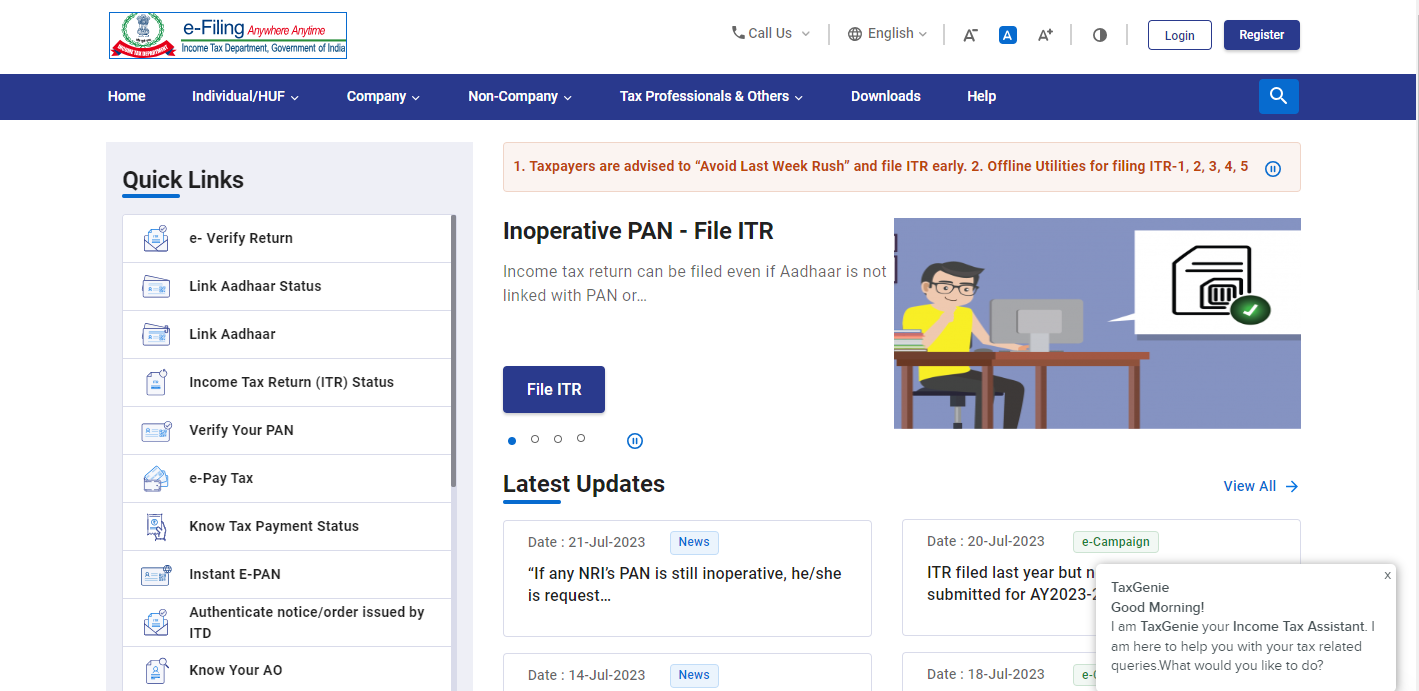

Step 1: Go to http://incometaxindiaefiling.gov.in/

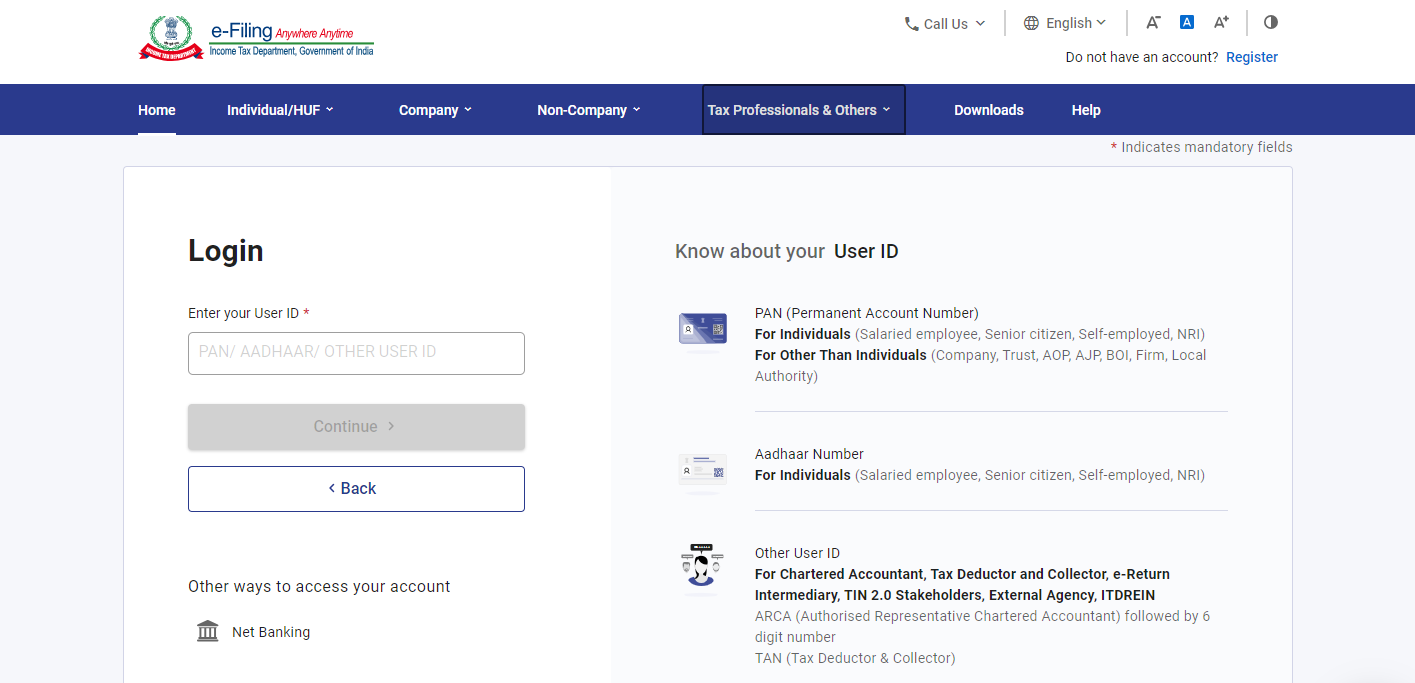

Step 2: Log in using your Tax Deduction and Collection Account Number (TAN) details.

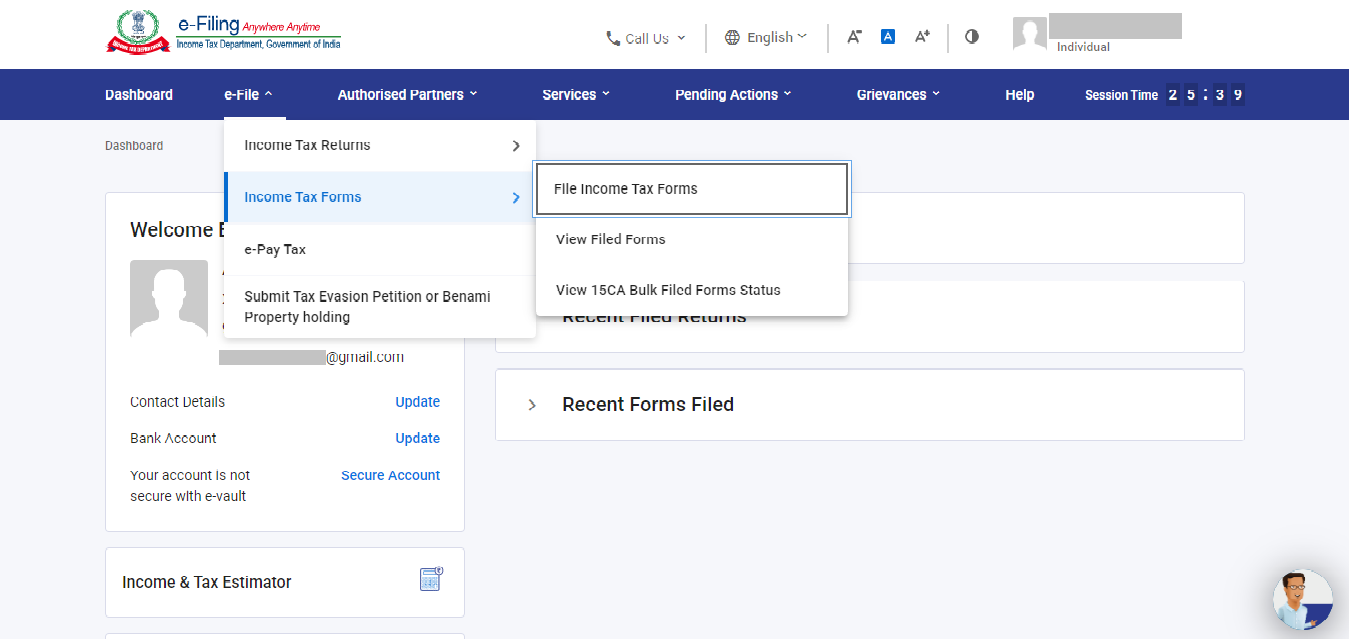

Step 3: On the dashboard, click on 'e-File,' then 'Income Tax Forms,' and select 'File Income Tax Forms.'

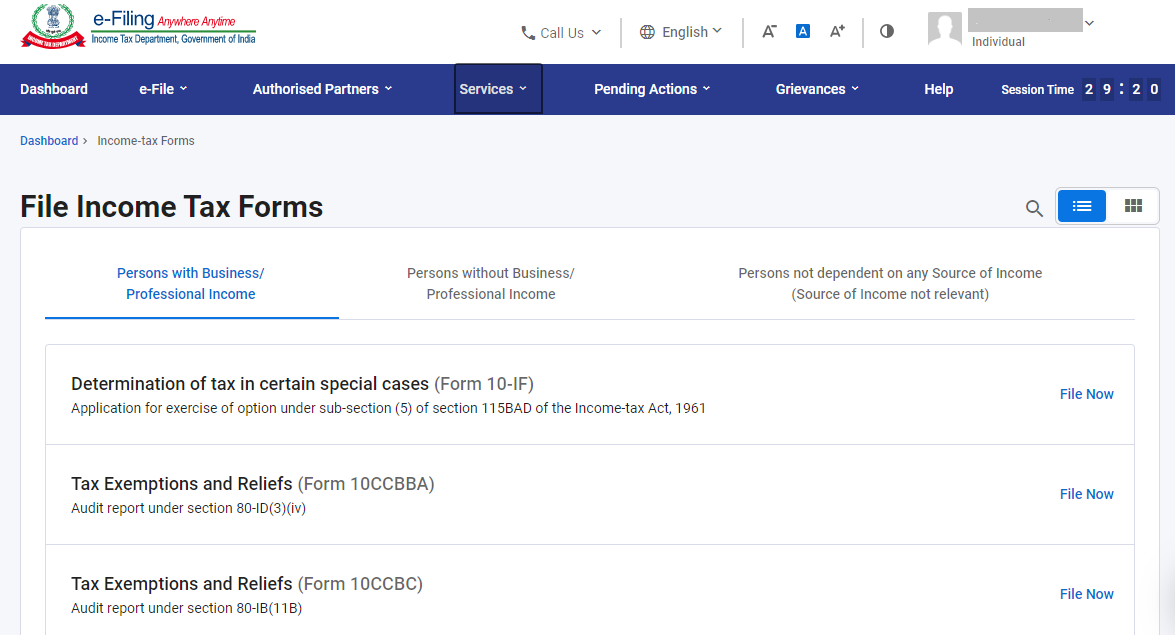

Step 4: Choose the appropriate form that you need to file.

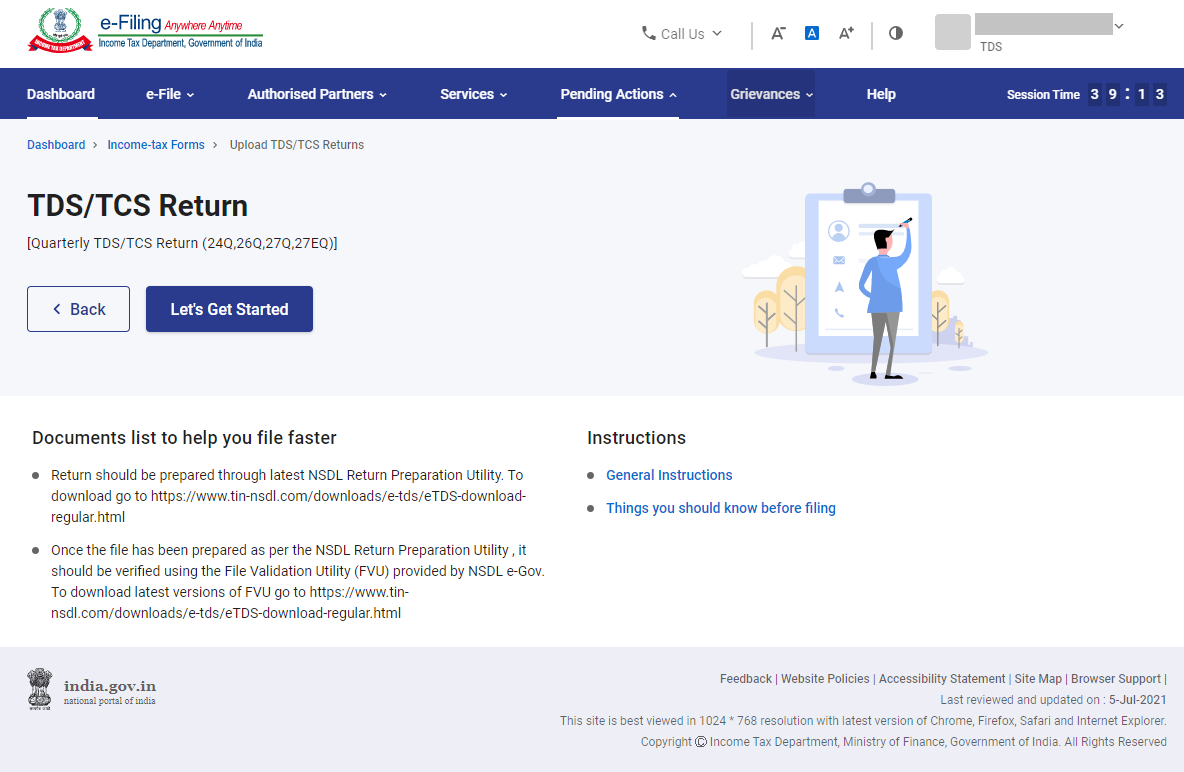

Step 5: Proceed to 'Upload TDS Form' and click on the 'Let's Get Started' option.

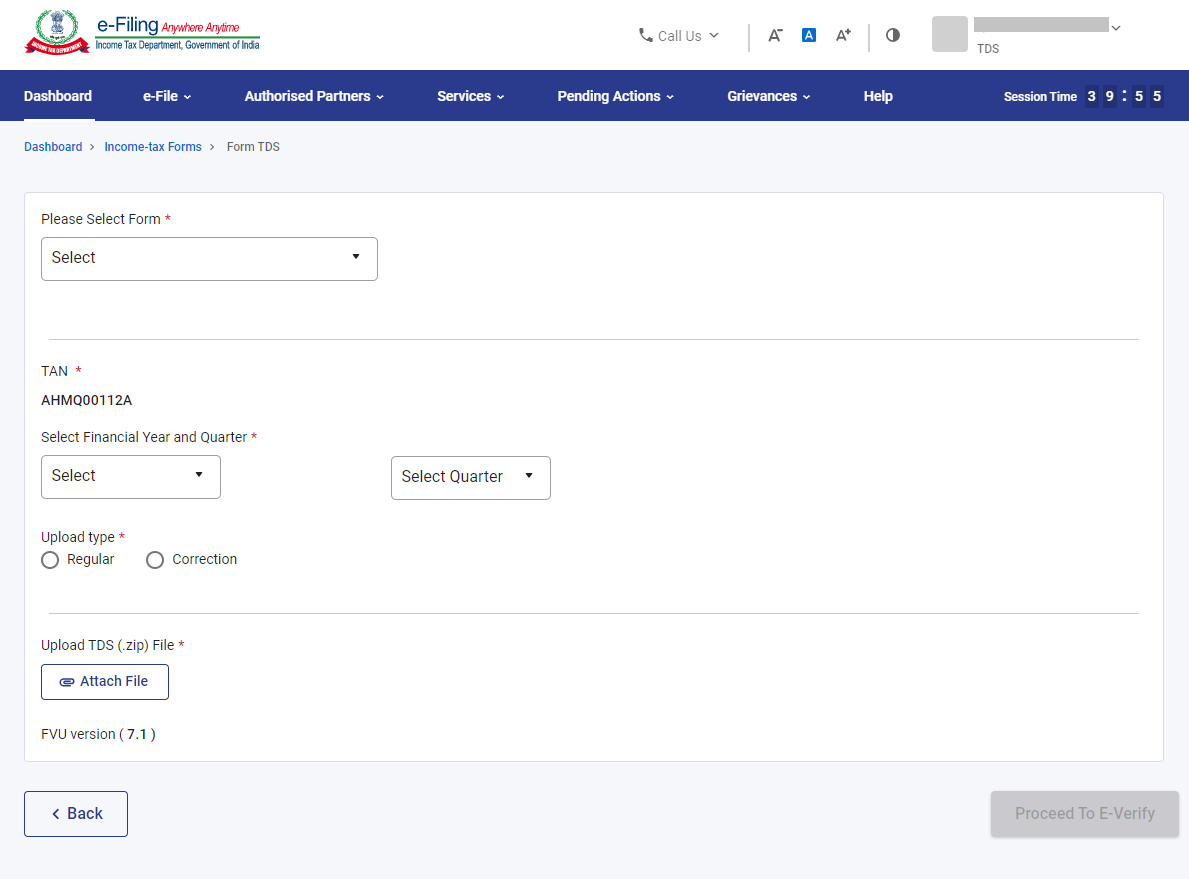

Step 6: Enter the necessary details related to the TDS form. Click on 'Proceed to e-Verify' to complete the process.

Step 7: An OTP will be sent to the registered mobile number. Use this OTP to validate the return. After successful validation, you will receive a success message.

If you haven't generated your Digital Signature Certificate (DSC), you can use the Electronic Verification Code (EVC) to validate the TDS statements.

CAclubindia

CAclubindia