Good News for all those who want to trade online on Web portals like Flipkart, Snapdeal or Amazon then you should have a Delhi VAT Registration Number (TIN Number) and those who want to start their small-medium Businesses.

As The Department of Trade and Taxes has made certain relaxations in its rules of granting Registration like No Surety is required to apply for registration.

You can apply for registration by following these steps-

1. Who can obtain registration on DVAT Portal?

- Individual (Proprietorship Firm)

- People who want to trade online on eCommerce sites like Flipkart, Snapdeal, etc.

- Partnership Firm

- Private Ltd. Company

- Public Limited Company

- Government Company

- Government Deptt/Society/Club/Trust

- Hindu Undivided Family

- PSU

- Bank

2. How to Obtain Registration on DVAT?

Filing DVAT form online on http://dvat.gov.in/website/home.html

3. The fee charged by Government

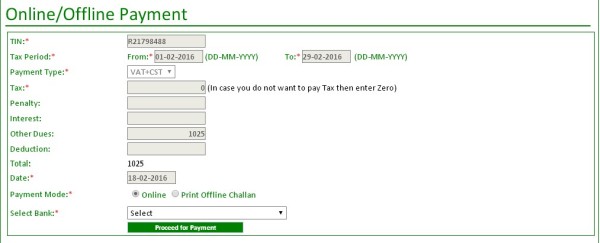

- For DVAT Registration : Rs.1,000

- For DVAT + CST registration : Rs.1,025

4. Penalty if the dealer fails to obtain DVAT registration

Where a person who is required to be registered under DVAT Act fails to apply for registration within one month from the day he is required to make an application, then he shall be liable to pay penalty equal to Rs.1,000 per day from the date of default subject to the maximum of Rs.1,00,000.

5.Types of Registration Schemes

Composition Scheme: Dealer is required to pay DVAT at flat rate of 1% without claim benefit of Input Taxes Paid.

Normal Scheme: Dealer is required to pay DVAT at rates prescribeD i.e. 1%, 5%,12.5 & Dealer can claim benefit of Input Taxes Paid.

6. Documents required for DVAT registration

|

Proprietorship |

Partnership Firm |

Company |

|

PAN of Proprietor |

PAN of Firm |

PAN of Company |

|

Identity Proof of Proprietor |

Identity Proof of all Partners |

Identity Proof of all Directors |

|

Address Proof of Proprietor |

Address Proof of all Partners |

Address Proof of all Directors |

|

Address Proof of Place of Business |

Address Proof of Place of Business |

Address Proof of Place of Business |

|

Photograph of Proprietor |

Photograph of all Partners |

Photograph of all Directors |

7. Online DVAT Registration Process:

STEP 1 - First of all visit website of DVAT Department using this URL. http://dvat.gov.in/website/home.html

Then go to New Registration Segment.

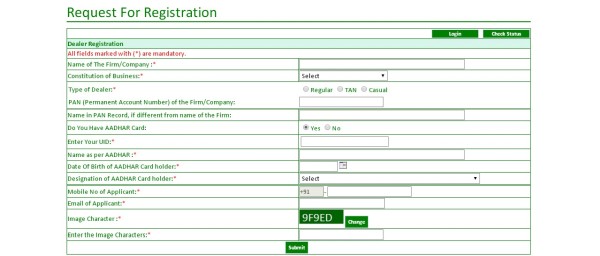

STEP2 - Fill this form very carefully as it is relevant for PAN verification by Department of Trade and Taxes.

Do Consider:

a. Change in name of Firm/Company is not possible until the registration certificate is sanctioned.

b. For those who want to apply for TIN on the name of One Person Company.; Select Others in the Constitution of Business Dropdown.

c. If you are requesting registration twice then temporary TIN will not be allotted to the dealer.

d. Once you have selected VAT registration, you cannot switch it to VAT+CST registration.

Once you fill this form, you receive an email from DVAT help desk.

STEP 3 - Your PAN verification may take 1 day and after which you will receive two emails from DVAT helpdesk.

First Mail gives you the status of PAN verification.

OR

Second Mail will give you Reference Number and Password.

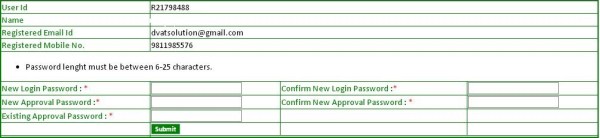

STEP 4 - Again visit the site using the first URL, go to Dealer login segment, and Change Password.

Use Reference no as User ID and Password that you have received in third mail as specified in Step 3.

Now it requires you to change your existing password to a new password and approval password.

Please Note - Now approval Password is used to change the Profile Password in the Future.

STEP 5 - Start filling the registration form

If you have selected VAT registration then you need to Fill only DVAT-04, but

If you have selected VAT+CST registration then you need to Fill DVAT-04 as well as CST-FormA.

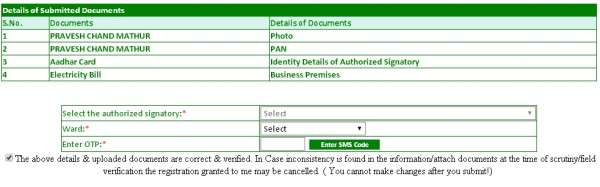

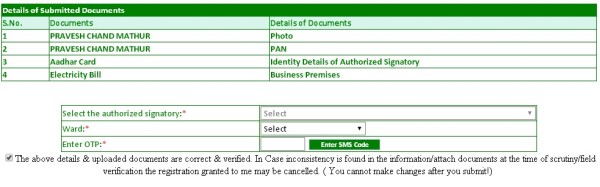

STEP 6 - Upload the scanned requisite documents in PDF Format.

STEP 7 - Now it is the time for you to make payment of Court Fee either through online mode or offline mode.

STEP 8 - Go to Approval -- Submit section and submit it.

Points that one should consider before starting filling online application.

i. Never try to submit forms in multiple attempts as it may block your access.

ii. If OTP does not come in 5-10 minutes, then never try too many attempts otherwise Server may fail to accept all OTP’s.

iii, Review form twice before submission, because once form is submitted further changes not possible until verification process completed by VAT Inspector.

iv. No surety is required to apply for DVAT registration which was required earlier.

v. In case the dealer already has a TIN allotted with the same PAN or he has TIN anytime in the past, then Temporary TIN will not be allotted to him immediately.

vi. Rather it will be allotted only after verification by VAT Inspector

vii. Banquet Halls can apply for registration by filing form BE-2.

viii. With Effect from 26.06.2015 E-Commerce Portals like Flipkart, Snapdeal, Amazon, etc are required to get themselves registered under DVAT Act through form EC-1

[No.F.3(515)/Policy/VAT/2015/330-41].

Once your registration completes it's not over, now you need to file DVAT Return on a quarterly basis along with all its annexures even if you had not carried any transaction during the said quarter.

Non Filing may attract penalties of Rs.400 per day and the Registration Certificate might be cancelled by VAT Officer.

In case of annexure 2A & 2B filed by the dealer is mismatched in the department’s record then it may result in payment of Penalty of higher of Rs.10,000 or DVAT amount.

Please note that the Department of Trade and Taxes has recently issued a new annexure 1E on 29.12.2015 which every dealer who trade in goods using E-Commerce Portals like Flipkart, Snapdeal, etc is required to file at the time of furnishing his DVAT return.

Non Filing may attract a penalty of Rs.50,000.

The author also blogs at www.emunshe.com and can be reached at ankit@emunshe.com

CAclubindia

CAclubindia