Books of Accounts u/s 209

�

U/s 209, company must maintain proper books of account at its registered office:

�

a)��Receipts/payments

b)�Sales and Purchases

c)�Assets and Liabilities

d)��If company engaged in production, processing, manufacturing or mining activities , Cost records (utilisation of material or labour etc) prescribed by CG for that class of company

�

Board of Directors may decide to keep at some other place but must pass Board Resolution and give notice to RoC within 7 days

�

Must maintain proper books of account relating to transactions effected at the branch office; also arrange to obtain from the branch proper summarized returns, at intervals of not more than three months, for being kept at the registered office.

�

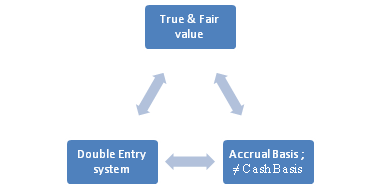

Proper books of Accounts u/s 209(3)

�

�

Period u/s 209(4A)

�

Not less than eight years immediately preceding the current year

�

Annual Accounts u/s 210 and 211

�

Board shall lay Balance Sheet and P&L before the company at every AGM

�

|

First AGM |

Date of incorporation of the company till a date max 9 month preceding the AGM |

|

Others |

Last AGM till a date max 6 month preceding the AGM |

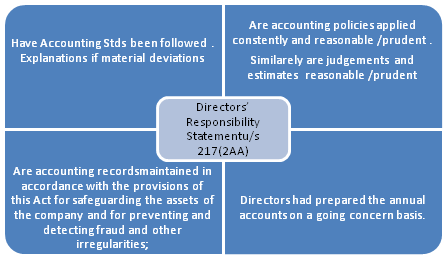

Every profit and loss account and balance sheet must comply with Accounting Standards (Sec 211 and 217)

�

In case of non-compliance

�

� the deviation from the accounting standards;

� the reasons for such deviation; and

� the financial effect, if any arising due to such deviation

�

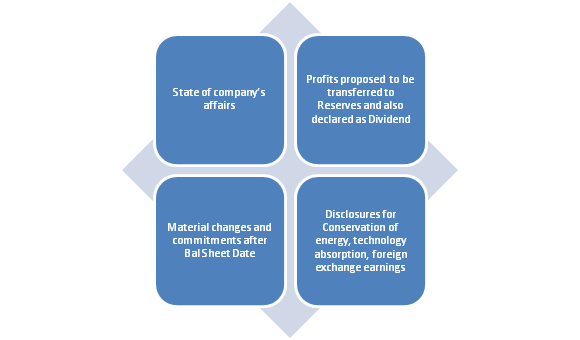

Board�s report u/s 217(1)

�

�

Changes which have occurred during the financial year�

�

a)�in nature of the company�s business;

b)�in company�s subsidiaries

c)�in the nature of the business carried on by them; and

d)�Generally in the classes of business in which the as an interest.

�

Also details of employees getting more than prescribed salaries

�

Reasons for the failure, if any, to complete the buy back within the time specified in sub-section (4) of section 77A.

�

Information and explanations on every reservation, qualification or adverse remark contained in the auditors� report

�

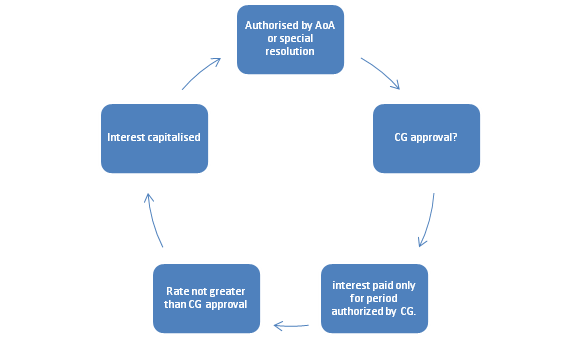

Payment of Interest out of Capital during Construction

�

�

Until capitalised, it must be shown as a separate item in the Balance Sheet under the head �Miscellaneous Expenditure�.

Special Requirement of Company Audit

�

�

AUDIT OF SHARE CAPITAL

�

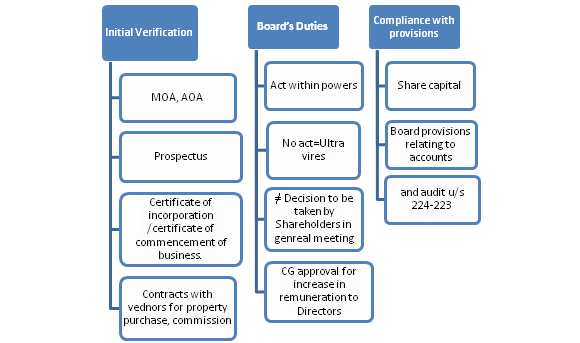

General Programme for Verification of Share Capital

�

1)�Authorized capital

�

��Verified w.r.t. amount shown in the Memorandum of Association

� Previous year audited balance sheet may also be seen

2)�Issued capital

�

��Verify the amount of issued capital w.r.t last year audited balance sheet.

��Has Central Government issued any notification for conversion of debenture or loan into equity share under section 94A?

3) Further issue of capital

�

a)��Compliance with conditions of issue contained in MOA and AOA, Prospectus or Statement in lieu of Prospectus, shelf prospectus, red-herring prospectus and information memorandum etc

�

b)��First allotment made only when minimum subscription stated in the Prospectus had been subscribed and until then the amount received was kept deposited in a Scheduled bank as required by Section 69 of the Act.

�

c)��Brokerage and underwriting commission @ Rates authorized by the Prospectus or AOA

�

d)�Compliance with section 81 (dealing with right shares)

�

e)��Preliminary contracts, if any, entered into for purchase of a property or business, for creating an organisation for management of the company, etc. as per terms stated in the Prospectus.

�

f)��Application for listing to one or more recognised stock exchanges before the expiry of ten weeks from the date of the closing of the subscription list.

�

g) SEBI guidelines followed? Check Compliance reports submitted by lead managers and reports submitted to SEBI

�

h)��Internal check on receipt of amounts along with the application

�

i)�Verify compliance with legal provision relating to issue of shares at premium� (section 78), issue of shares at discount (section 79), and issue of sweat equity shares (section 79A)

�

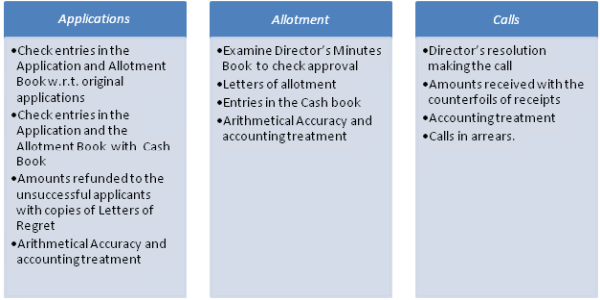

Verification of Shares issued for Cash

�

�

Shares issued for consideration other than cash

�

a. Contract under which issue made! How many shares? What value? Consideration in cash/in kind?

�

Board approval of decision to issue shares for a consideration other than cash and the actual allotment? Check minutes of Board Meeting

b. Prospectus � check the substance of the contract and terms of issue including how payment of purchase consideration was made to vendor in case of amalgamation / how underwriting commission preliminary expenses was paid

Accounting entry =correct? Adjustment for premium or discount made?

c. Filing of the copy of the contract with the Registrar of Companies within 30 days of contract!

Classification issues: Whether for cash / otherwise

E.g.� Allotment of shares in adjustment of a Bonafide debt owed by company = considered as allotment against cash

Even if amount paid later = considered as allotment against cash

Consider this while inquiring into matters stated in section 227(1A)

�

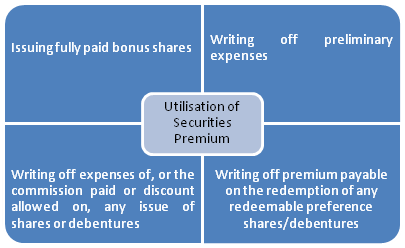

Shares issued at a Premium

�

No authorisation in Articles required

No conditions for issue

�

�

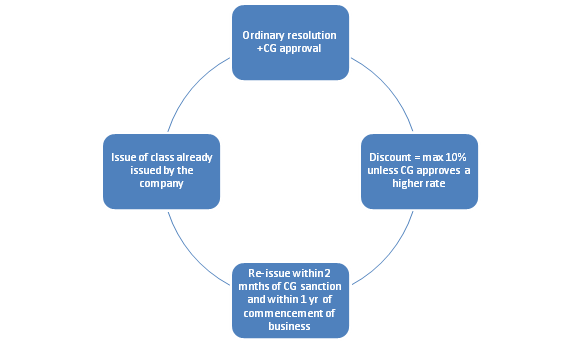

Shares issued at a Discount (N�09)

�

�

Issue of Sweat Equity Shares (M�00, M�02, M�03)

�

Section 79A inserted via Companies (Amendment) Act, 1999

Sweat equity= issued to employees/directors at a discount or for consideration other than cash

For providing knowhow/intellectual property rights / value addition

�

Conditions

=same class as already issued

Special resolution in General Meeting; it should state how many shares, to whom, at what price/consideration

1yr after commencement of business

If equity shares = listed on any recognised stock exchange, follow SEBI guidelines

If equity shares ≠ listed on any recognized stock exchange, follow prescribed guidelines

�

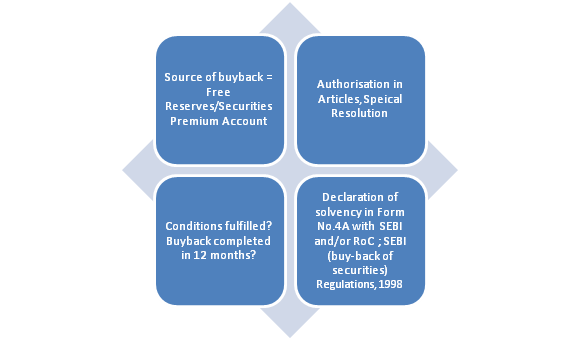

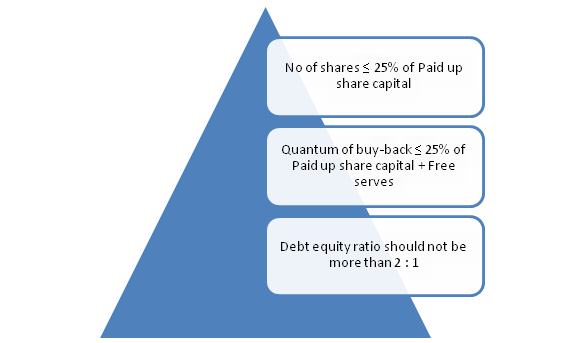

Power of Company to Purchase its Own Securities/Buyback of shares by the company (N�00, N�02)

�

�

Calls Paid in Advance

�

Does the company have the power to accept calls in advance as per AoA?

If Articles permit, may pay pidend on calls in advance

Interest on calls in advance can be paid out of capital even when profits are not available

No voting rights until the same becomes presently payable

�

Calls-in-Arrear

�

Verify amounts due from shareholders w.r.t. calls in arrears from the Share register

Show separately if any calls are due from Directors

If Articles permit, interest may be charged on �Calls in Arrears�

�

By: CA Anurag Singal

CAclubindia

CAclubindia