Amendments in Tax Audit Report

Purpose of Rule 6G: This rule tells about the name of the forms applicable in the case of 44AB Audit and from 1st April 2021 sub-rule (3) is inserted.

Rule 6G

(1) The report of audit of the accounts of a person required to be furnished under section 44AB shall,-

(a) In the case of a person who carries on business or profession and who is required by or under any other law to get his accounts audited, be in Form No. 3CA;

(b) In the case of a person who carries on business or profession, but not being a person referred to in clause (a), be in Form No. 3CB.

(2) The particulars which are required to be furnished under section 44AB shall be in Form No. 3CD.

(3) The report of audit furnished under this rule may be revised by the person by getting revised report of audit from an accountant, duly signed and verified by such accountant, and furnish it before the end of the relevant assessment year for which the report pertains, if there is payment by such person after furnishing of report under sub-rule (1) and (2) which necessitates recalculation of disallowance under section 40 or section 43B.

Crux of Amendment

The purpose of Amendment is that there is time difference of one month in due dates of ITR and Tax Audits. Therefore in some cases 43B payments are done after the tax audits are completed but before filing of return of income & TDS deducted before tax audit completed and deposit after Tax audit completed but before filling of returns. Therefore new sub-rule (3) is inserted.

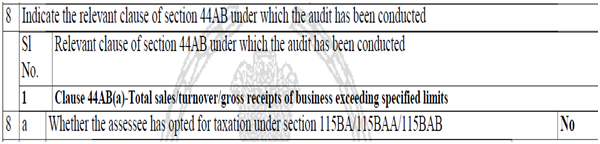

Clause 8(a) Part A of Form 3CD

Before Amendment

After Amendment

Whether the assesse has opted for taxation under section 115BA/115BAA/115BAB/115BAC/115BAD.

Crux of Amendment

Section 115BAC (New Regime): Tax on Individuals and HUF

The new regime is applicable from AY 2021-22 therefore before amendment no such section are there in Clause 8A.

Section 115BAD (New Regime): Tax on certain resident Co-operative societies

The new regime is applicable from AY 2021-22 therefore before amendment no such section are there in clause 8A.

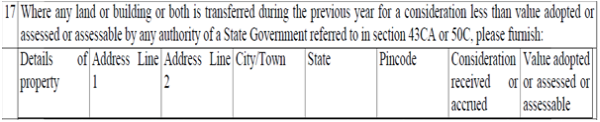

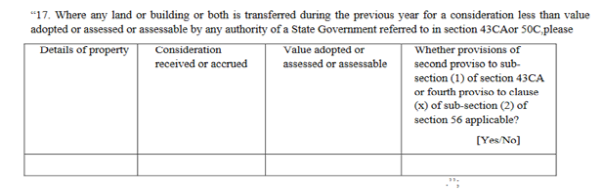

Clause 17 Part B of Form 3CD

Before Amendment

After Amendment

Second Proviso to sub-section (1) of section 43CA

‘Provided further that in case of transfer of an asset, being a residential unit, the provisions of this proviso shall have the effect as if for the words "one hundred and ten percent.", the words "one hundred and twenty percent." had been substituted, if the following conditions are satisfied, namely:

(i) the transfer of such residential unit takes place during the period beginning from the 12th day of November, 2020 and ending on the 30th day of June, 2021 ;

(ii) such transfer is by way of first time allotment of the residential unit to any person; and

(iii) the consideration received or accruing as a result of such transfer does not exceed two crore rupees.

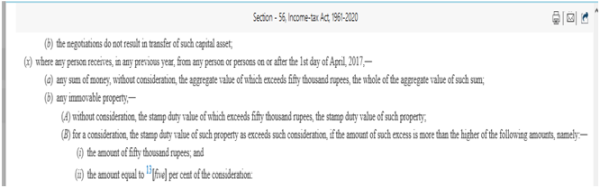

Fourth proviso to clause (x) of sub-section (2) of section 56

Provided also that in case of property being referred to in the second proviso to sub-section (1) of section 43CA, the provisions of sub-item (ii) of item (B) shall have effect as if for the words "ten percent.", the words "twenty percent." had been substituted.

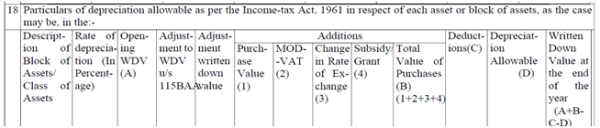

Clause 18

Before Amendment

After Amendment

In clause 18, for sub-clauses (ca) and (cb), the following sub-clauses, shall be substituted namely:

(ca) Adjustment made to the written down value under section 115BAC/115BAD (for assessment year 2021-2022 only).

(cb) Adjustment made to written down value of Intangible asset due to excluding valueof goodwill of a business or profession.

(cc) Adjusted written down value.

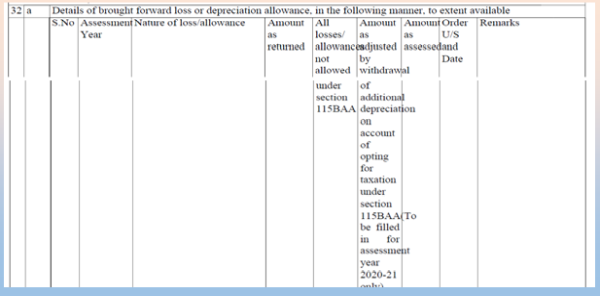

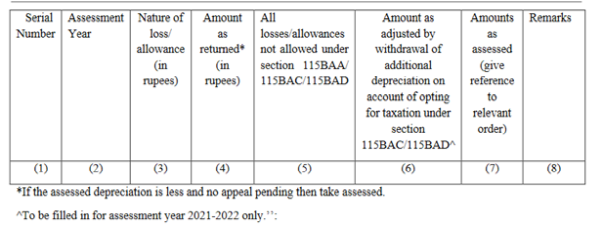

Clause 32 (a)

Before Amendment

After Amendment

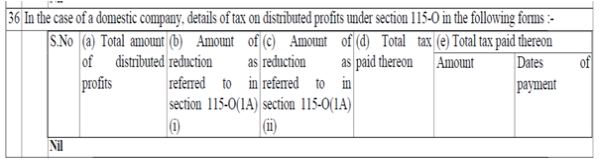

Clause 36

Before Amendment

After Amendment

Clause 36 omitted

CAclubindia

CAclubindia