1. Transactions covered: Any benefit or perquisite, whether convertible into money or not

2. Rate of TDS: 10%

3. Threshold for deduction: Value of benefit/perquisite should be more than Rs. 20,000

4. Payee: Only resident payees are covered u/s 194R.

5. Who are liable to deduct tax: Persons liable for tax audit in the preceding previous year

6. When to deduct tax: At the time, when the benefit/perquisite is provided

7. Intent behind the introduction of the provision

As per section 28(iv) of the Income-tax Act, the value of any benefit or perquisite, whether convertible into money or not, arising from business or exercise of profession is to be charged as business income in the hands of the recipient of such benefit or perquisite. However, in many cases, such recipient does not report the receipt of benefits in their return of income, leading to furnishing of incorrect particulars of income

It has been noticed that as a business promotion strategy, there is a tendency on businesses to pass on benefits to their agents. Such benefits are taxable in the hands of the agents. In order to track such transactions, I propose to provide for tax deduction by the person giving benefits, if the aggregate value of such benefits exceeds Rs. 20,000 during the financial year.

(Para 138 of FM's speech, Budget 2022-23)

8. Circular 12/2022- Guidelines for implementation of Section 194R

a. Deductor is under no obligation to check to whether the benefit provided is taxable as business income for the recipient or not.

b. TDS shall be deducted even on benefits/perquisites provided in the nature of cash.

c. TDS shall be deducted even on capital assets provided as benefit/perquisite.

d. TDS need not be deducted on sales discount, cash discount and rebates.

e. TDS shall be deducted on free samples.

f. Value of benefit/perquisites

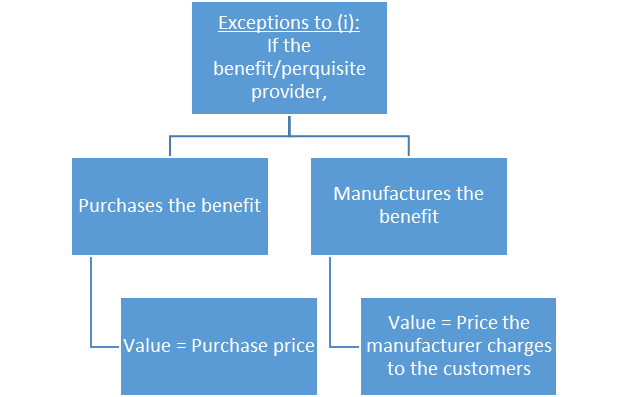

i. Generally, value would be Fair market value of the perquisite

ii. The value of the perquisite shall exclude the GST component

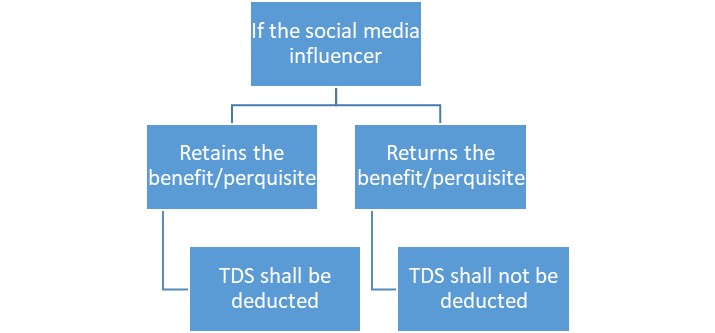

g. Benefit/Perquisite given to social media influencers for product promotion

h. Reimbursement of out-of-pocket expenses incurred by service provider

- Let's say, A provides consultancy service to B. A incurs travel expense in the course of business. If this travel expense is invoiced in the name of B and B reimburses the travel expense to A, B is liable deduct TDS u/s 194R

i. Expenditure incurred on dealers conference to educate dealers

i. TDS shall not be deducted if:

Conference is not in the nature of incentives/benefits to select dealers/customers who have achieved particular targets

ii. TDS shall be deducted if:

1. Expenditure incurred in the nature of leisure trip or leisure component, even if it is incidental to the dealer/business conference

2. Expenditure incurred for family members accompanying the person attending dealer/business conference

3. Expenditure on participants of dealer/business conference for days which are on account of prior stay or overstay beyond the dates of such conference

j. How shall tax be deducted in case the benefit/perquisite is in kind?

i. Recipient shall pay tax through advance tax challan.

ii. Deductor shall obtain a declaration along with a copy of advance tax challan.

iii. In the TDS return, the same shall be reported along with challan number

iv. Form 26Q would carry the provisions for the same starting from this year

Alternatively,

i. The benefit provider may pay the tax on behalf the benefit recipient.

ii. The benefit provided shall include the tax paid and tax shall be deducted accordingly. i.e., Grossing-up provisions shall apply.

k. For the calculation of liability as to whether the threshold limit of Rs. 20,000/- has been exceeded during the year or not, benefits provided since 01.04.2022 shall be taken into account.

CAclubindia

CAclubindia