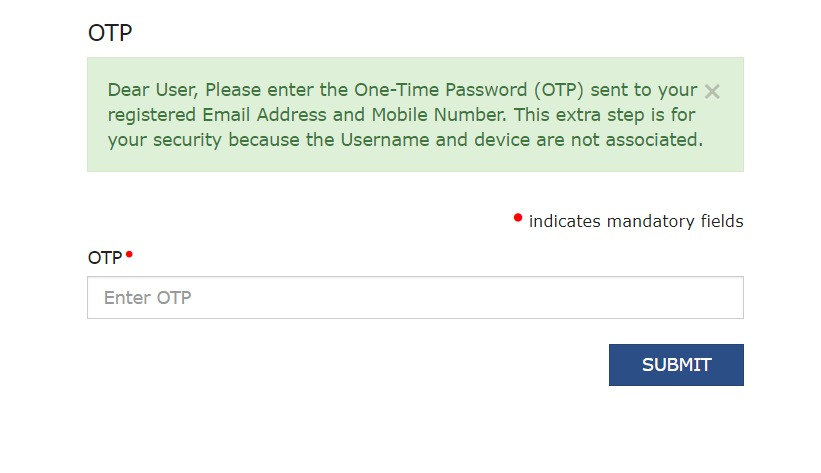

GSTN is implementing two-factor authentication (2FA) for taxpayers in a phased rollout, starting with Haryana and progressing to Punjab, Chandigarh, Uttarakhand, Rajasthan, and Delhi in the first phase. The 2FA, requiring a one-time password (OTP) for login security, aims to enhance GST portal security and will be implemented nationwide in the second phase from December 1, 2023.

Implications of implementing two-factor authentication (2FA) for taxpayers on the GST portal in points

1. Enhanced Security

- The primary goal of implementing 2FA is to enhance the overall security of the GST portal

- With the addition of a one-time password (OTP) requirement, unauthorized access to taxpayer accounts becomes more challenging, providing an extra layer of protection

2. Reduced Unauthorized Access

- 2FA significantly reduces the risk of unauthorized access, as even if login credentials are compromised, an additional authentication step is required through the OTP

- This helps in safeguarding sensitive taxpayer information and preventing fraudulent activities

3. Phased Rollout Strategy

- The phased rollout, starting with specific states like Haryana and progressing to Punjab, Chandigarh, Uttarakhand, Rajasthan, and Delhi, allows for a controlled implementation and testing of the new security measures.

- It enables authorities to address any potential issues or challenges before a nationwide implementation.

4. Regional Implementation Challenges

- Different regions may have varying levels of digital literacy and technology infrastructure. The phased rollout considers these regional variations and allows for adjustments based on the specific needs and challenges of each area.

5. User Education and Awareness

- The introduction of 2FA necessitates educating taxpayers about the new authentication process.

- Awareness campaigns and training sessions may be required to ensure users understand the importance of 2FA and how to effectively use OTPs for secure logins.

6. Compliance and Adoption

- Taxpayers and businesses need to ensure compliance with the new security measures.

- The successful adoption of 2FA relies on the cooperation of taxpayers, businesses, and other stakeholders, requiring a smooth transition to the new authentication process.

7. Potential Initial Disruptions

- As with any major system update, there might be initial disruptions or challenges as users adapt to the new authentication method.

- The GSTN and related authorities needs to be prepared to address any temporary issues and provide support during the transition period.

8. National Implementation Deadline

- The second phase of nationwide implementation from December 1, 2023, sets a deadline for all taxpayers across the country to adapt to the 2FA requirements.

- This timeframe emphasizes the urgency and importance of securing taxpayer data.

9. Continuous Monitoring and Updates

- Continuous monitoring of the system's performance and feedback from users is crucial for identifying and addressing any emerging security concerns.

- Regular updates and improvements to the 2FA system may be necessary to stay ahead of evolving cybersecurity threats.

10. Long-Term Impact on Cybersecurity Resilience

- The implementation of 2FA reflects a broader commitment to strengthening cybersecurity resilience in financial systems.

- This long-term impact can contribute to building trust among taxpayers and businesses in the security measures adopted by tax authorities.

Conclusion

It's true that it may set a major impact on tax return preparers including Chartered Accountants, but this step was necessary to safeguard personal data of taxpayers

CAclubindia

CAclubindia