CAclubindia News

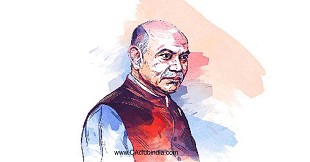

Shri P.C. Mody, Chairman, CBDT inaugurates the Phase II - Mid-Career Training Programme of IRS Officers

02 March 2021 at 05:29Shri P.C. Mody, Chairman, CBDT inaugurates the Phase II - Mid-Career Training Programme of Indian Revenue Service Officers today.

45th Civil Accounts Day Celebration addressed by FM

01 March 2021 at 20:03Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman lauds contribution of Controller General of Accounts during COVID-19 pandemic.

DGGI Gurugram officials arrest man for defrauding exchequer in excess of Rs. 13.76 crore

01 March 2021 at 19:17The Gurugram Zonal Unit of Directorate General of GST Intelligence has arrested a person, namely Mr. Pradeep Jain, resident of Muzaffarnagar, UP who is Director of M/s PSR Metals Pvt Ltd, Muzaffarnagar.

Rs. 1,13,143 crore gross GST revenue collected in February 2021

01 March 2021 at 18:47The gross GST revenue collected in the month of February 2021 is ₹ 1,13,143 crore of which CGST is ₹ 21,092 crore, SGST is ₹ 27,273 crore, IGST is ₹ 55,253 crore and Cess is ₹ 9,525 crore.

GST compensation shortfall released to States reaches Rs. 1.04 Lakh crore

01 March 2021 at 18:00The Ministry of Finance, Department of Expenditure has on Friday, released the 18th weekly instalment of Rs. 4,000 crore to the States to meet the GST compensation shortfall. 94% of the estimated shortfall released.

Empanelment of Members to act as Observers at the Examination Centres for the CA Exams May 2021

01 March 2021 at 17:31It is proposed to empanel members to act as observers for the forthcoming May 2021 CA Exams. The schedule and eligibility of such an empanelment is listed here.

Timeline Extended by MCA for Submitting Research Proposals latest by 5th March 2021

01 March 2021 at 05:15MCA is pleased to invite research proposals under the scheme "Funding Research and Studies, Workshops and Conferences etc." The proposals can be submitted latest by 5th March 2021.

CBIC extends due date for filing GSTR-9 and GSTR-9C for FY 2019-20 to 31st March 2021

28 February 2021 at 18:31In view of the difficulties expressed by the taxpayers in filing GSTR-9 and GSTR-9C, the Government has decided to further extend the due date for furnishing the same for the financial year 2019-20 to 31.03.2021.

ICAI further extends last date for waiving off condonation fees for CA students to 31st March 2021

28 February 2021 at 11:28Considering the difficulties being faced by Students/Articled Assistants, it has been further decided to extend the last date of waiving-off Condonation Fees from 28th February 2021 to 31st March 2021.

CGST Commissionerate Delhi officials arrest man for ITC fraud of Rs 50.03 crore

28 February 2021 at 11:21The officers of CGST Commissionerate, Delhi East have unearthed a network of fictitious firms used by their operator to generate and pass on fake Input Tax Credit (ITC) of Goods and Services Tax (GST).

Popular News

- ICAI Introduces UDIN Ceiling & Field-Level Validation for Section 44AB Tax Audits from 1st April 2026

- Provident Fund Contributions Above Threshold? Here's How Rule 277 Taxes Interest

- Draft Form 124 Proposes Mandatory Disclosure of Relationship With Landlord for HRA Claims

- ICAI: UDIN Validation Now Based on Five Parameters Including PAN

- MCA Launches Companies Compliance Facilitation Scheme 2026 with Major Relief on Late Filing Fees

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia