Now moving ahead to find out the answer of our third question “How to manage the components of working capital” which will ultimately gives us the overview of Management of Working Capital.

For this firstly we need to know what the components of working capital and its sub-components also:-

1. Current Assets: Majorly Current assets consist

A. Debtors or Accounts Receivables

B. Inventory

C. Cash

2. Currents Liabilities : Majorly Current Liabilities consist

A. Creditors or Accounts payables

B. Accruals or Outstanding Expenses

We will discuss each component in-depth.

Debtor or Accounts Receivables Management

First of all lets understand the meaning of Receivables :

Per “Investopedia”

1. An asset designation applicable to all debts, unsettled transactions or other monetary obligations owed to a company by its debtors or customers

2. Receivables are recorded as an asset by the company because it expects to receive payment for the outstanding amounts soon. Long-term receivables, which do not come due for a significant length of time, are recorded as long-term assets on the balance sheet.

So in other words Accounts receivables arise as a result of credit sales or we can say they arise due to credit facilities provided to customers.

Lets understand the meaning of Credit period because of which “Accounts receivables arise”.

Credit Period:

Credit period means the period allowed to debtors for payment in the normal course of business.

It means if credit period is 60 days it means customer will repay the debts within 60 days.

Factors affecting credit period:

1. Funds available with the company.

2. Bad debt risk.

3. Quantum of sales : credit may not be allowed if small quantities are purchased.

4. Market practices and customs.

5. Customers credit worthiness

6. Production capacity of the organization

Now since receivables are directly connected with credit sales or credit facilities provided to customers we are here more concerned with why we need to give credit to customers.

What are its advantages and drawbacks?

Advantages:

1. Higher sales: Extended credit period helps organization to achieve growth in sales.

2. Increase in Profits: Increased sales further helps organization to achieve higher profits.

3. Reputation/Goodwill: Due to higher sales an organization can build its goodwill in market and thus can compete very well with competitors.

Drawbacks:

1. Interest Cost/Capital cost: Since higher sales result in higher Accounts receivables therefore there will be more blockage of funds.

Due to blockage of fund in receivables an organization has to look for other sources to procure further funds to meet out its other payments which will ultimately result in further cost.

2. Collection cost: An organization has to also incur additional cost in collecting the funds from its customer and further sometime some it also require to take some additional steps to recover funds from defaulting customers.

3. Administrative cost: i.e. Salary given to staff for maintaining the data related to accounts receivables, cost incurred in conducting investigation & credit worthiness etc.

4. Defaulting Costs: Sometime organizations have to also face a situation where they are not able to recover the debts from customers and then they become bad debts.

Now for the management of “Accounts Receivable” we need to understand what should be our credit period so that after considering our all costs mentioned above an organization can still earn profits.

An organization should allow such credit period to customers where increased sales pursuant to extended credit period can set off the costs mentioned above.

In other words if by extending credit period if an org can earn profits then it should grant that period to customers.

Profit = Sales – Interest cost – collection cost – bad debts – admin cost

After deciding the profitability (due to extended credit period) an org also consider its liquidity. Since due to higher credit period firms liquidity gets hindered and vice- versa. So, optimum credit policy is that where there is a “Trade-off between Liquidity and profitability”.

Now lets understand the factors which generally affects the credit period allowed to a customer.

Analyzing the Credit Applicant

Sources of information

Credit Analysis

Sequential Investigation Process

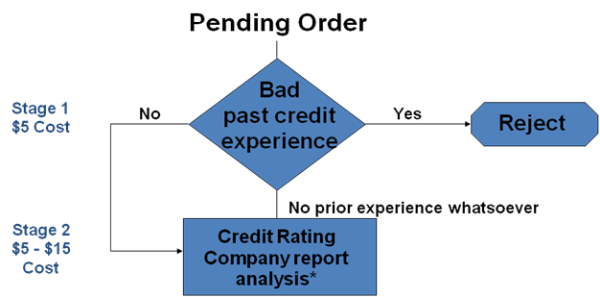

Sample Investigation Process Flow Chart (Part A)

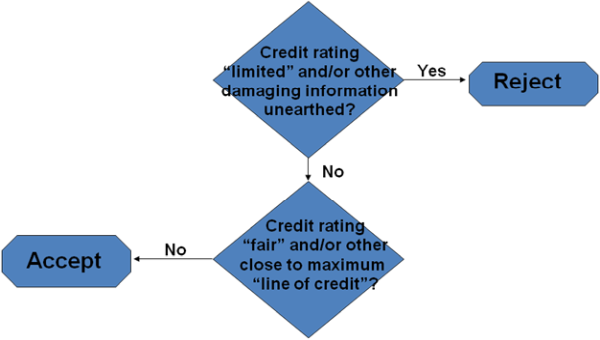

Sample Investigation Process Flow Chart (Part B)

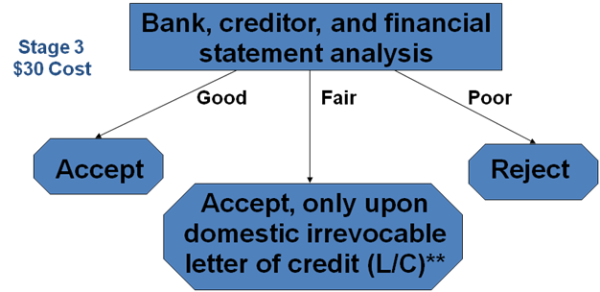

Sample Investigation Process Flow Chart (Part C)

The C part involves various ratios calculation also.

Now in the next article I will take the Inventory management part.

Note: The author is the member of ICAI. His area of interest is Finance. For any queries and suggestions he can be approached at email: arvindagarwall@yahoo.co.in

CAclubindia

CAclubindia