Transfer pricing:

• Selection criteria for TP audits - Aggregate value of international transactions is INR 15 Crores or more

• Cases with international transactions amounting to lower than this threshold are picked up on the basis of judgment of the Indian Revenue Authorities (‘IRA’)

• TP cases handled by specialised officers designated as TPO’s as against AO who handle Corporate tax matters

International transactions consists of Goods, services, Loans and intangibles

What is Transfer Pricing

• Transfer pricing refers to the pricing of cross-border transactions between two associated entities

• When two related entities enter into any cross-border transaction, the price at which they undertake the transaction is ‘transfer price’

• Due to the special relationship between related companies, the transfer price may be different than the price that would have been agreed between unrelated companies

• Price between unrelated parties in uncontrolled conditions is known as the “arm’s length” price (ALP)

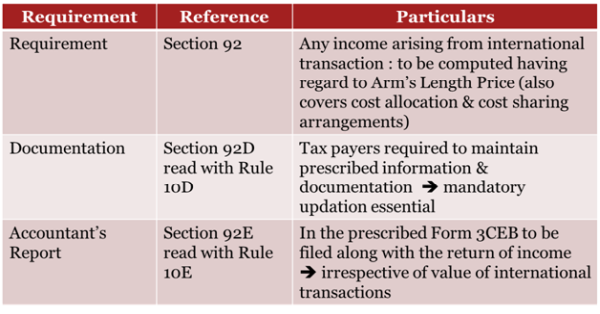

Compliance requirements

​

​

Relevant provisions

• 92: Computation of income from international transaction as per ALP

• 92(2A): Domestic TP: allowance for expenditure, interest, cost or expense or income in relation to SDT to be computed having regard to ALP

• 92A: Meaning of associated enterprise

• 92B: Meaning of international transaction èAmended by Finance Act 2014 to apply TP rules to transactions with a domestic unrelated party under specified conditions

• 92BA: Meaning of Specified Domestic Transaction

• 92C: Computation of arm’s length price

• 92CA: Reference to Transfer Pricing Officer

• 92CB: Power to make Safe Harbor Rules

• 92CC: Advance Pricing Agreement (APA) èAmended by Finance Act 2014 to include roll back provisions

• 92CD: Effect to Advance Pricing Agreement

• 92D: Maintenance of information & documents

• 92E: Accountant’s report

• 92F: Definition section

RULES

• 10A: Meaning of expressions used in computation of arm’s length price

• 10AB: Other method for determination of arm’s length price

• 10B: Determination of arm’s length price u/s 92C

• 10C: Most appropriate method

• 10D: information and documents to be kept and maintained u/s 92D

• 10E: Report from an accountant to be furnished u/s 92E

• 10F to 10T: APA Rules

• 10TA to 10TG: Safe Harbour rules

Others

• Base erosion is the important principle for attraction of TP provisions

• Provisions not to apply where ALP computation has effect of reducing income chargeable to tax or increasing loss

• No deduction available for TP adjustments after scrutiny by the AO under Sec. 10A, 10AA, 10B or Chapter VI-A as per proviso to Section 92CA(4)

CAclubindia

CAclubindia