What is TDS?

The concept of TDS was introduced in India with the aim of collecting tax at the source by enabling the payer to deduct tax due before paying the balance to the payee. The person from whom the tax has been deducted at source will be entitled to get a credit for the same on the basis of Form 26AS or TDS certificate issued by the deductor.

Table of Contents

What is TDS Refund?

The concept of TDS Refund arises when actual tax payable for the Financial Year (tax payable under all income heads) is less than taxes paid by way of TDS. Under these circumstances, the additional tax paid by way of TDS is refunded to the payee.

For example: While deducting TDS on Salary income, employers do not consider deductions. Suppose, an employee gave donations that are eligible for deductions u/s 80G, then automatically his Total Taxable Income will be less than the income calculated by the employer. In this case the difference between the two taxes will be refunded.

How to Claim TDS Refund?

Case 1: When your employer deducts more than the income tax payable as per your IT return filing

Step 1: Calculate your actual tax payable and file the Income Tax Return (ITR) and claim a refund.

Step 2: During the ITR filing process you will be asked to submit your bank account details so that excess tax can be refunded.

Note: In case you don’t have taxable income for the FY, you will be required to apply for a NIL TDS certificate. This can be done from your jurisdictional income tax officer who will ask you to fill Form 13 u/s 197. Then, you will be required to submit the NIL deduction order passed to the TDS Deductor.

Case 2: When your income is below the tax slab and the bank deducts tax on your FD Account

Option 1: You can declare that your total taxable income is below the tax slab while filing the ITR and the Income Tax Department will credit the excess tax to your bank account.

Option 2: You can fill Form 15G and submit it to your bank, hereby notifying them that your total taxable income is below the slab rate and thus, no tax should be levied on the interest income.

Case 3: When you are a senior citizen with an FD Account

As per the Income Tax Act, 1961 senior citizens are persons whose age is more than 60 years, and such citizens are exempted from tax deduction on interest income earned by them on fixed deposits, provided such interest income is up to 50,000 INR annually.

Option 1: You can declare that you are exempted from paying tax on interest income from FD while filing the ITR and the Income Tax Department will credit the excess tax to your bank account.

Option 2: You can fill Form 15H and submit it to your bank, hereby notifying them that you are a senior citizen and thus, tax cannot be deducted on interest income from fixed deposits.

How to claim TDS Refund online?

Step 1: Register yourself on the IT department’s website i.e. https://www.incometax.gov.in/iec/foportal/

Step 2: Download the relevant ITR Form and claim the TDS refund while filing the ITR

Step 3: Submit the return and download the acknowledgment that is generated

Step 4: E-verify the ITR acknowledgment by using a digital signature

How to check TDS Refund status?

Option 1: Using the acknowledgment and refund processing email from the IT Department

Option 2: Using your PAN Card number on the website: https://www.incometax.gov.in/iec/foportal/

Option: By calling CPC Bangalore at 1800-4250-0025

What is the TDS Refund period?

In normal circumstances, it takes anywhere between 3 to 6 months for the refund to be credited to your account. This period may be extended due to delay in e-verification.

In case you don’t receive your refund on time, you can:

- • Check if your employer has e-verified Form 16

- • Download and verify your Form 26AS with your TDS and income details

- • Contact your nearest Income Tax Office

- • Get in touch with Ombudsman – Income Tax Department

What is the interest on TDS Refund?

As per Section 244A of the Income Tax Act, 1961 the Income Tax Department is liable to pay you an interest of 6% p.a. in case of delay in payment of the TDS refund. This interest accrues from the first month of the Assessment Year in which the ITR is filed, till the date on which the refund is granted.

However, if the amount of refund is less than 10% of the income tax payable, this interest amount is not required to be paid. Moreover, if any interest is received then the same needs to be taxed under head "Income from Other Sources".

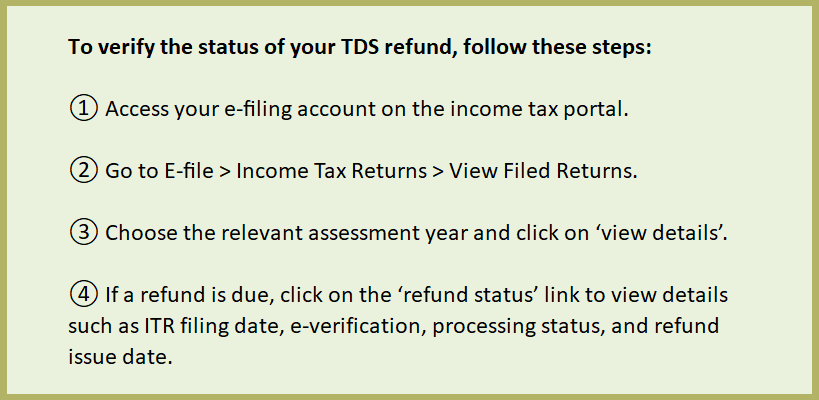

How to verify the status of TDS Refund?

Things to remember while claiming TDS Refund

You must ensure that the bank account details and address linked to your PAN in the ITR are correct, otherwise the refund may be transferred to another person or may result in delay/non-transfer of the refund.

In addition to that, the address must also be correct in case the bank account details are incorrect and payment is being sent through a cheque.

You may also change your contact details in the "Profile Settings" section on Income Tax e-filing portal. Herein, you can change your address, e-mail id and mobile number.

In case, the cheque issued to you is returned to the Income Tax Department, then you can raise a Refund Re-issue Request, which can be found on the "My Account" section of the e-filing portal. Herein, you can choose the mode of payment i.e. Electronic Clearance Service or cheque. You can also change your address and bank account details for claiming the refund. However, such request can only be issued if the cheque has been returned to the IT Department. In case, the same has been collected by any other individual, then the department will no longer be liable to pay you the refund on TDS.

CAclubindia

CAclubindia