Start Up: The common man understands the word start up that when he starts any business. And the same is exactly true. But this word “START UP” is the word of every mouth since January 16, 2016. Because our Prime Minister Narendra Modi has unveiled a policy for the start ups and gave this word the name “START UP INDIA” and has promised to give a no. of benefits for the industries/ people/ Professionals/ youngsters who come under the scheme of START UP INDIA and not START UPs. hahahahaha. Very confusing. General Public takes these two words “START UP” and “START UP INDIA” as same. And The answer is Probably YES But exactly NO.

Lets First discuss the benefits being provided to the START UP, then we shall differentiate between START UP and START UP INDIA

Key announcements made during the Startup India Standup India action plan:

1. Start-ups will be exempted from paying income tax on their income for the first 3 years

2. 80% rebate on filing a patent application.

3. Fast track mechanism for patent applications

4. Exemption of tax on capital gain. When person invests its own wealth, then they will get exemption from capital gains tax.

5. Mobile app will be launched on April 01, 2016 which will enable start-ups to get registered within a day. The app will have a small application form for registration.

6. Web portal will be launched on April 01, 2016 for clearances, approvals, and registrations

7. Compliance regime based on self-certification

8. No inspection for 3 years of start-up businesses in respect of labour, environment law compliance post self-certification

9. Easier norms for start-ups to exit within 90 days. Bill will be introduced in the parliament.

10. Relaxed norms of public procurement for start-ups. There would be no requirement of turnover or experience.

11. Government will setup a fund with an initial corpus of Rs. 2, 500 crore and total corpus of Rs. 10, 000 crore over a period of 4 years

12. A hub for startup India will be started with single point of contact.

The above benefits are the reasons that Many entrepreneurs were excited by the announcements made by Prime Minister Narendra Modi as part of the Startup India Action Plan. Hence, the entrepreneurs and many other people are happy that they can now get the tax and other benefits as discussed above after starting a new enterprise/ business. But the question is are all the startups really eligible for the benefits that were announced?

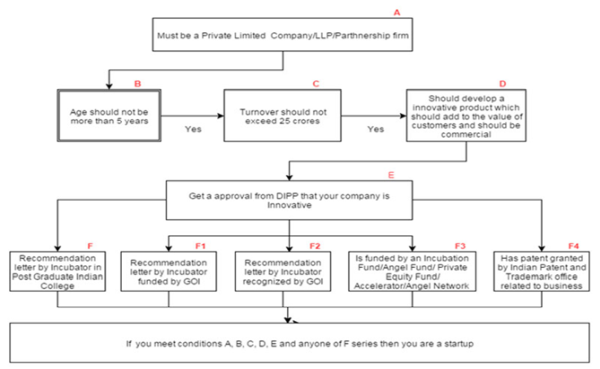

Here’s a quick analysis of the eligibility criteria (please note that the following flow chart is specifically applicable for startups seeking tax exemption):

CONDITIONS FOR START UPS:

1. It must be an entity registered/incorporated as a:

a. Private Limited Company under the Companies Act, 2013; or

b. Registered Partnership firm under the Indian Partnership Act, 1932; or

c. Limited Liability Partnership under the Limited Liability Partnership Act, 2008.

2. Five years must not have elapsed from the date of incorporation/registration.

3. Annual turnover (as defined in the Companies Act, 2013) in any preceding financial year must not exceed Rs. 25 crore.

4. Startup must be working towards innovation, development, deployment or commercialization of new products, processes or services driven by technology or intellectual property.

5. The Startup must aim to develop and commercialise:

a) a new product or service or process; or

b) a significantly improved existing product or service or process that will create or add value for customers or workflow.

6. The Startup must not merely be engaged in:

A. developing products or services or processes which do not have potential for commercialisation; or

b. undifferentiated products or services or processes; or

c. products or services or processes with no or limited incremental value for customers or workflow

7. The Startup must not be formed by splitting up, or reconstruction, of a business already in existence.

8. The Startup has obtained certification from the Inter-Ministerial Board, setup by DIPP to validate the innovative nature of the business, and

Moreover Various Approval are also required from Government Authorities to get registered under Start Up India initiative. These are mainly:

a. be supported by a recommendation (with regard to innovative nature of business), in a format specified by DIPP, from an incubator established in a post-graduate college in India; or

b. be supported by an incubator which is funded (in relation to the project) from GOI as part of any specified scheme to promote innovation; or

c. be supported by a recommendation (with regard to innovative nature of business), in a format specified by DIPP, from an incubator recognized by GOI; or

d. be funded by an Incubation Fund/Angel Fund/Private Equity Fund/Accelerator/Angel Network duly registered with SEBI* that endorses innovative nature of the business; or

e. be funded by the Government of India as part of any specified scheme to promote innovation; or

f. have a patent granted by the Indian Patent and Trademark Office in areas affiliated with the nature of business being promoted.

NOTE: DIPP may publish a ‘negative’ list of funds which are not eligible for this initiative.

CONCLUSION: DIFFERENCE OF START UP AND START UP INDIA

START UP means when a business is being started. Like a person opens up a garments shop, general store, music company, television show, manufacture products, give normal and usual services etc which are uncommon and being already done by the people of India.

START UP INDIA initiative talk only about the new start ups which must be working towards innovation, development, deployment or commercialization of new products, processes or services driven by technology or intellectual property. AND

The Startup must aim to develop and commercialize:

A new product or service or process; or a significantly improved existing product or service or process that will create or add value for customers or workflow.

Let’s take the example of startups who are engaged in creating and developing online marketplaces like Flipkart and Amazon. So a new startup engaged in the same field may not be eligible unless its product is significantly improved than what existing players provide.

Another eligibility criteria states that the startup should get a recommendation letter from the recognized incubator cell or be recognized by the GOI or should be funded by recognized funds. Going by these criteria, roughly 60% of existing startups could be rendered ineligible for the Startup India plan.

The author can also be reached at csmohitsaluja@gmail.com

CAclubindia

CAclubindia