Once again I am very grateful for such a positive feedback on my Second Article "Section 9 of CGST Act, 2017: Levy and Collection"

Friends in my Second Article I have discussed first part of Section 9 "Levy & Collection" in case of Normal Charge. Today we will discuss Section 9: Levy & Collection" in case of Reverse Charge"

In this article we will cover second part i.e. Reverse Charge. Our last part "section 9 in case of ecommerce will be discussed in our upcoming articles.

THE CENTRAL GOODS AND SERVICES TAX ACT, 2017

CHAPTER III

LEVY & COLLECTION OF TAXES

Levy and Collection.

PART 1 - Section 9(1) and Section 9(2) already discussed in last article

PART 2 - Section 9(3) and 9(4) "Levy & Collection" in case of Reverse Charge

1. The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

2. The central tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

AUTHOR COMMENTS ON SECOND PART

1. Understanding of the words 'Reverse Charge'

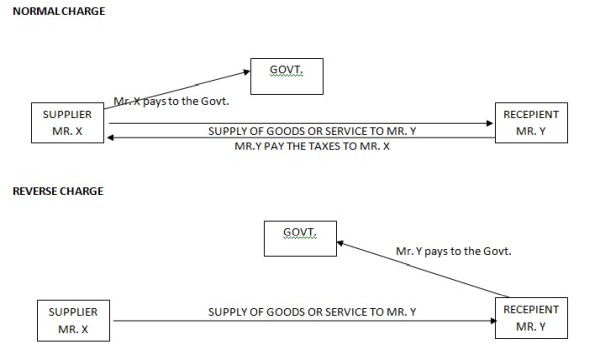

The basic fundamental of Indirect taxes is taxes are to be collected from the buyer or service recipient by the manufacturer, trader or service provider as the case may be, and deposit the same with concerned authority. Generally, supplier collects the taxes from the recipient and deposits the same after adjusting his output liability with input tax credits to the concerned authority.

Under the reverse charge mechanism liability to pay tax on a particular supply is on the recipient of the supply.

In India, the concept of REVERSE CHARGE under GST is being introduced which is already present in service tax law on certain services. Reverse charge under GST may be applicable for both service as well as goods. Currently, there is no reverse charge mechanism in supply of goods under existing laws.

Section 2(21) 'Central tax' means the central goods and services tax levied under section 9;

Section 2(98) 'reverse charge' means the liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or sub- section (4) of section 5 of the Integrated Goods and Services Tax Act;

2(93) 'Recipient' of supply of goods or services or both, means -

(a) where a consideration is payable for the supply of goods or services or both, the person who is liable to pay that consideration;

(b) where no consideration is payable for the supply of goods, the person to whom the goods are delivered or made available, or to whom possession or use of the goods is given or made available; and

(c) where no consideration is payable for the supply of a service, the person to whom the service is rendered.

and any reference to a person to whom a supply is made shall be construed as a reference to the recipient of the supply and shall include an agent acting as such on behalf of the recipient in relation to the goods or services or both supplied;

2(105) 'supplier' in relation to any goods or services or both, shall mean the person supplying the said goods or services or both and shall include an agent acting as such on behalf of such supplier in relation to the goods or services or both supplied;

2. Whether GST under Reverse Charge is applicable on all the supplies?

Reading of Section 9(3), its self made clear that only NOTIFIED SUPPLIES of Goods or Services or both will attract reverse charge provisions under section 9(3). So far as almost twelve (12) Supplies of Services are listed under Reverse Charge Mechanism and list of Supply of Goods under reverse charge is yet to be notified. Supplies of Goods or Service other than notified services will not be covered under section 9(3).

After Reading Section 9(4), It is clear that in case of Registered Person who receives the supply from a Unregistered Person would be liable to pay CGST under Reverse Charge Basis. But the supply should be a TAXABLE SUPPLY; no reverse charge shall be applicable in case of EXEMPT SUPPLY OR NON TAXABLE SUPPLY. If you will read the section 9(4) carefully you will see that is NO any words 'Supply of Goods or Services or both notified by the Govt' it means all the supply of goods or services or both will be covered under section 9(4), in other words we can say all the supply will be under reverse charge u/s 9(4). If a Registered person receives any supply from a unregistered person (whether notified by Govt. u/s 9(3) or not ) will subject to reverse charge u/s 9(4).

One more point is here to discuss with you, in case of taxable supply if you go through the provisions of supply i.e. Section 7 which says-

Section 7 (1) For the purposes of this Act, the expression 'supply' includes -

(a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;

Section 7(1)(a) says that supply should be 'IN THE COURSE OF BUSINESS OR FURTHERENCE OF BUSINESS' we can interpret that if a person sells his personal old jewellery to a jeweller, jeweller shall be not liable to pay tax under reverse charge basis because here the supply made by the unregistered person is not in the course or furtherance of business.

Friends, I will not cover the section 7 in detailed here only relevant portion is discussed here. We will discuss the section 7 in detailed in one of my article 'SCOPE OF SUPPLY'

3. Understanding of the words 'all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both'

Friends, we have discussed generally supplier is liable for the taxes in case of a supply and since he is the person liable to pay taxes and in case of any default he will be penalized with the provisions of the relevant acts. Since supply is made by supplier in case of reverse charge but recipient is liable to pay taxes and in case of any default the provisions of relevant act should be applicable to the recipient instead of the supplier. That’s why the words are used 'all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both'

CAclubindia

CAclubindia