COFI: “SAP Coffee & Management Accountants: An ERP Spurt.”-Indian Perspective

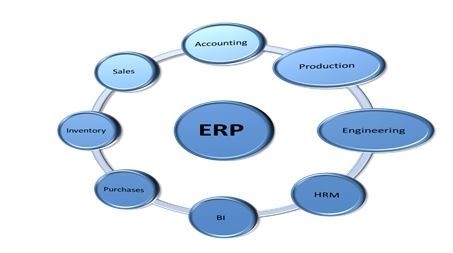

ERP and the role of Professionals in global scenario has been changed. In nowadays SAP (R3)-HANA is using by lots of prestigious company not in India but in World also. The main reason behind its integration features that every work done only at single time and use by other in real time basis. This article focuses on the CO-Controlling and FI-Finance in SAP that how this ERP can help to the best Cost and financial accounting practices for the business and able to decrease the time taken for Management Decision Making. Various types of Standard reports are available in SAP-ERP. FICO of COFI is two main modules to control the Cost and Financial Accounting. This module also known as FICO. Even latest amendments of Ministry of Corporate Affairs to maintain the cost record for manufacturing/Processing company those are mandatory under section 209(1) (d) of Company Act 1956 taken care by BI module and ABAP module of SAP.

CO stands for Controlling in SAP-ERP which includes the wide functionality of cost and management accounting practice. It includes the:

a. Cost Element Accounting

b. Cost Center Accounting

c. Internal Orders

d. Activity Based Costing

e. Product Cost Controlling

f. Profit Center Accounting

These above Sub-Module of Controlling through This main module integrate with the entire module like FI-Financial Accounting, Enterprise Controlling, Strategic Enterprise Controlling, Investment management, Project System, Real Estate Management MM-Material Management, PP-Production Planning, and PM-Plant Maintenance.

The working of SAP is based on path and Transaction Code (T-Code).E.g. for Creation of Primary and Secondary Cost Element.

Controlling>>Cost Element Accounting>>Master Data>>Cost Element>>Individual Processing>>Collective Processing.

T-Code- KA01- Create Primary Cost Element.

KA06- Create Secondary Cost Element.

Cost Element Accounting

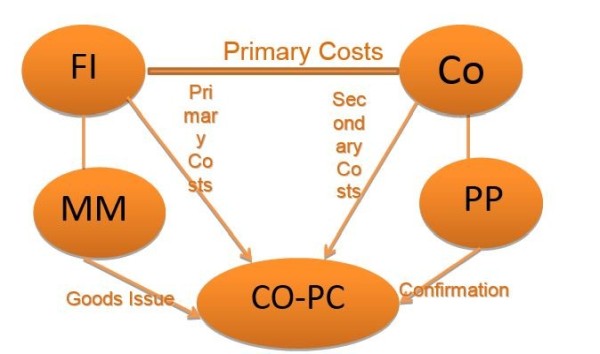

In Cost Element Accounting General ledger are divide into Primary & Secondary Cost element. Primary Cost Elements bring the data (financial postings) into SAP. As shown below, the Primary Cost Elements carry the values from FI into different modules depending on the category or classification assigned to the G/L account.

It is important to note that cost elements with a category of “01” are considered an expense and post to a cost center. The value will also appear in PCA because each cost center is tied to a profit center. PCA receives the posting because of that relationship and not directly from the cost element

Secondary Cost Elements move data around within CO and have NO impact on the General ledger. An example of this would be the allocation of electricity.

Cost Center Accounting

A cost center is used as a Collecting place for costs. The Cost of Operating the Cost Center is determined for the period and then Total Cost is applied to the costs units which have passed through the cost center. ”A Cost center a production or service location function activity or equipment for which cost are accumulated”. (CIMA official Terminology) the same concept is used through SAP also to measure and manage the Cost. A cost center is part of an organization that does not produce direct profit and adds to the cost of running a company. Examples of cost centers include research and development departments, marketing departments, help desks and customer service/contact centers.

For the creation of Cost Center in SAP it is essential to first create the Cost Center Group and Cost center Hierarchy. It depends upon the business requirement and differs from one business to other business organization.

Controlling >> Cost Center Accounting>>Cost Center>> Individual Processing>> Collective Processing.

Creation of Cost Center Group KSH1; Creation of Cost Center KS01

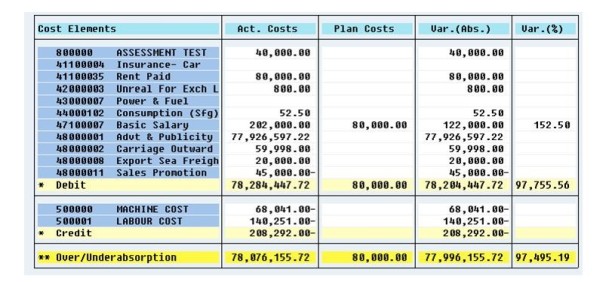

Cost Center Report Address: S_ALR_87013611 - Cost Centers: Actual/Plan/Variance

Internal Orders

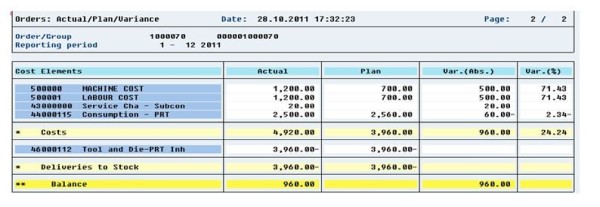

Internal orders are generally used to plan, collect, and settle the costs of internal jobs and tasks.

The SAP system enables you to monitor your internal orders throughout their entire life-cycle;

From initial creation, through the planning and posting of all the actual costs, to the final

Settlement and archiving. Internal Orders are of two types CAPEX & OPEX. CAPEX stands for the capital Expenditure in the organization this may be done through Asset under Construction (AUC). This may depend upon the Capital & Revenue Expenditure of the organization. Other one is the OPEX operating expenditure of the organization. These are the main tools in the hand of Controller/Cost & Management Accountant to make the Budgets and Budgetary Control. So MIS make easy which is always miserable part for the top management that the real time and reliable information is available in the system.

Controlling >> Cost Center Accounting>>Cost Center>> Individual Processing>> Collective Processing.

Creation of Cost Center Group KOH1; Creation of Cost Center KO01

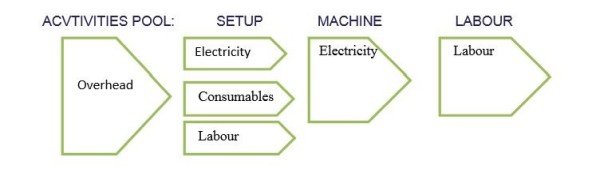

Activity-Based Costing

An approach to the costing and monitoring of activities which involves tracing resource consumption and costing final outputs. Resources are assigned to activities, and activities to cost objects based on consumption estimates. The latter utilise cost drivers to attach activity costs to outputs.’ CIMA Official Terminology, 2005

A development of the principles of activity based costing (ABC) is activity based management (ABM).In SAP for Product and Service Costing also follows the activities pool that whatever the resources consumed by the Product that will consider in the Cost sheet of Product under the CO-PC sub module.

There is the following way to make the pool for Activity Types:

Transaction Code: KP26

Product Cost Controlling

Product Costing functions to calculate the cost of goods manufactured (COGM) and cost of goods sold (COGS) for products such as materials tangible and services (intangible). The costs may then be analyzed and business decisions (such as "make or buy" decisions) made. This is very helpful to management accountant and management to take decision regarding the operating resources.

The cost of goods manufactured is composed of material and production costs, process costs and overhead (such as material and production overhead). The cost of goods sold consists of the cost of goods manufactured together with sales and administration overhead costs.

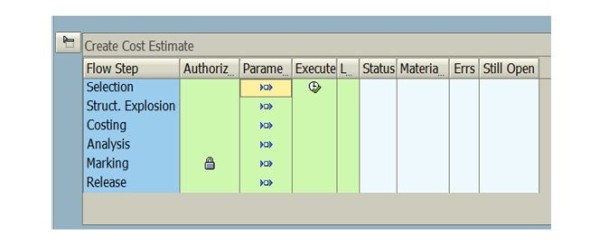

For calculation the COGM and COGS for materials, we can execute a material cost estimate (with or without quantity structure). For further information, see the following:

a. Material Cost Estimate with Quantity Structure

b. Material Cost Estimate Without Quantity Structure

Path: Accountingà Controlling Product Cost Controlling Product Cost Planning Material Costingà

Cost Estimate with Quantity Structure Transaction Code CK11N – Create

This option is for product cost of single Semi Finished Goods and Finished good level. But this same practice is very difficult to calculate the Product/Service Cost. For the plant wise Product Costing there are other ways as follows:

Path: Accounting ® Controlling ® Product Cost Controlling ® Product Cost Planning ® Material Costing ® CK40N - Edit Costing Run

Cost Estimate Transaction Code CK40N.

Profitability Analysis

Profitability Analysis in SAP also Known as (CO-PA) .Which enables to evaluate market segments, which can be classified according to products, customers, orders or any combination of these, or strategic business units, such as sales organizations or business areas, with respect to your company's profit or contribution margin. CVP Analysis is also possible through Profitability Analysis Sub module. Under this function we can calculate the profitability on various line items, Product wise, various segment and business area. Profit Center (discuss later) is must for calculate the Profits under various category.

The aim of the system is to provide your sales, marketing, product management and corporate planning departments with information to support internal accounting and decision-making.

Two forms of Profitability Analysis are supported: costing-based and account-based.

a. Costing-based Profitability Analysis is the form of profitability analysis that groups costs and revenues according to value fields and costing-based valuation approaches, both of which you can define yourself. It guarantees you access at all times to a complete, short-term profitability report.

b. Account-based Profitability Analysis is a form of profitability analysis organized in accounts and using an account-based valuation approach. The distinguishing characteristic of this form is its use of cost and revenue elements. It provides you with a profitability report that is permanently reconciled with financial accounting.

Path: Accounting ® Controlling ® Profitability Analysis ® Information System ® Execute Report ® KE30

For Profitability Analysis there is Various Transaction Code to get the Profit Statement but Normally the following Transaction Code:

· EPM - CO-PA Planning

· KE13N - Upload from Excel

· KE21N - CO-PA Line Item Entry

· KECM - CO-PA: Customizing Monitor

·KEDR - Maintain Derivation Strategy.

Profit Center Accounting

A profit center is a management-oriented organizational unit used for internal controlling Purposes. Dividing our Organization up into profit centers allows you to analyze areas of Responsibility and to delegate responsibility to decentralized units, thus treating them as “Companies within the company”.

The essential difference between a profit center and a business area is that profit Centers are used for internal control, while business areas are more geared toward an external viewpoint. The profit center differs from a cost center in that cost centers merely represent the Units in which capacity costs arise, whereas the person in charge of the profit center is responsible for its balance of costs and revenues

Profit Center Accounting (CO-PCA) lets you determine profits and losses by profit center using Either period accounting or the cost-of-sales approach. It also lets you analyze fixed capital and So-called “statistical key figures” (number of employees, square meters, and so on) by profit Center. Consequently, you can calculate the entire key figures commonly used in cost accounting (Return on investment, cash flow, sales per employee, and so on).

Conclusion: At present Scenario the for Professional Accountant it becomes more vital from initial stages (Project Preparation, Business Blueprint, Realization, Final Preparation, and Go Live & Support) while the implementation of any ERP and help to comply with the Cost Accounting Standards and requisite Cost Accounting Records under Section 209(1) (d) of Company act also.

From product Costing till the Profit margin analysis ERP helps a lot. This is technology savvy also and helps to the management take the correct decision at right time and fulfil the requirement of Sustainability Framework also.

CAclubindia

CAclubindia